VANCOUVER, BC / ACCESSWIRE / December 20, 2023 / CMC Metals Ltd. (TSXV:CMB)(Frankfurt:ZM5P)(CMCXF:OTCQB) (“CMC” or the “Company”) is pleased to announce that the Sailfish Royalty Corp. (“Sailfish”) has entered into a share purchase option agreement (the “Agreement“) with the Company that grants the option (the “Option“) to acquire all of the issued and outstanding shares of Swordfish Silver Corp. (“Swordfish“). Swordfish, through Sailfish de Mexico S.A. de C.V., holds the mineral rights of the Gavilanes silver exploration property (the “Property“) located in the Municipality of San Dimas, State of Durango, Mexico. Upon entering into the Agreement, CMC reimbursed Sailfish for certain fees incurred by Sailfish with respect to the Property in the 2023 calendar year in the amount of US$27,383.

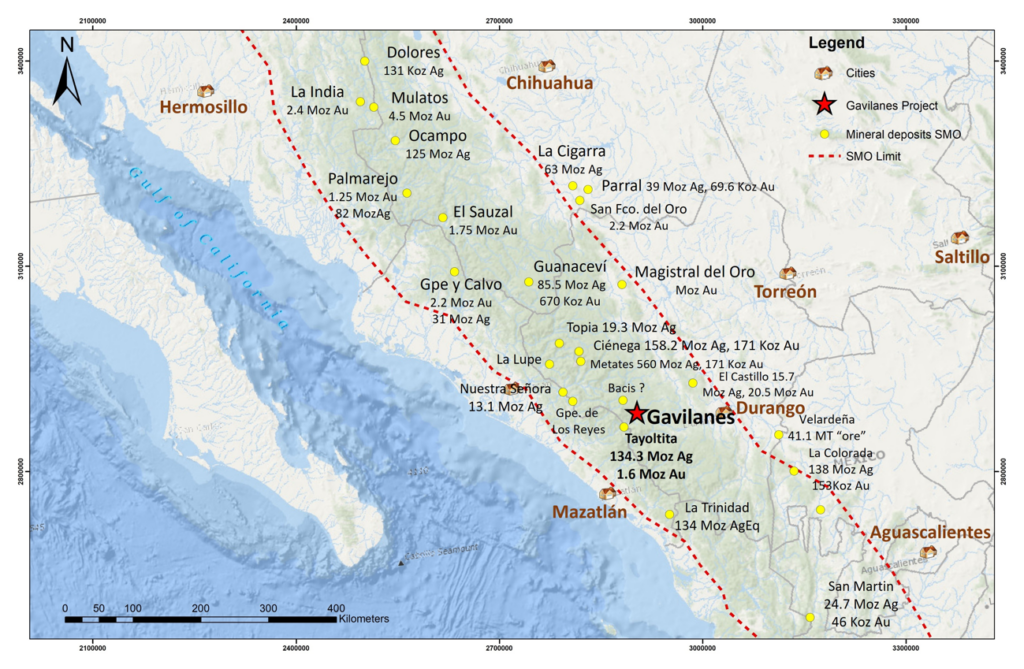

Gavilanes comprises of eleven concessions (13,594.5 hectares) located in the Sierra Madre Occidental Province in southwestern Durango. The Property has a current NI 43-101 Inferred Resource of 18,174,000 contained silver-equivalent (“Ag-Eq”) ounces at an average grade of 320.3 g/t Ag-Eq within 1,765,000 tonnes (Mine Development Associates/Respec Resource Gesociences Inc., 2021). The metal prices assumed in the resource estimate were $19.00 USD/oz silver, $1,600 USD/oz gold, $3.50 USD/lb copper, and $1.00 USD/lb for lead and zinc.

Gavilanes is a low to intermediate sulfidation epithermal deposit. Limited drilling at the site has been completed over 0.2 square kilometers of veins. Recent mapping efforts by Sailfish identified more than 20 veins covering an area in excess of 15 square kilometers. It is highly probable that the identified volume of mineralized veins will be increased by drilling the dip and strike extensions of the partly drill tested Gavilanes Zone, and early stage detailed mapping of the Central and Western Zones. Gavilanes is located 23 km northeast of the San Dimas/Tayoltita mine operated by First Majestic Silver Corp and shares many geological and mineralogical similarities with the mine deposit. Previous exploration on the Property includes a total of 61 diamond drill holes (13,011.25 meters). A majority of the drill core exists in storage at the site and is in superb condition. These factors, along with many others, highlight the significant exploration potential of the property. Descriptions of the property potential are included within various technical reports and recent studies which will be placed on the Company website (www.cmcmetals.ca).

The project has a drill permit from SEMARNAT to complete up to 4,650 meters of drilling. Plans are underway to complete 3,000 meters of step-out drilling from the identified resource as recommended by the 2021 NI 43-101 study. Phase 2 of the project envisions an additional 15,000 meters of diamond drill core definition in all three mineralized zones on the property, including the Gavilanes, Central and Western Zones.

Surface rights in the core area are held by the Ejido Los Gavilanes, a communal agrarian cooperative who have established exploration agreements with previous operators. The Company is meeting with the Ejido in the coming days to initiate negotiations for an exploration agreement.

Pursuant to the terms of the Agreement, in order to exercise the Option and maintain the Option in good standing, CMC shall make a series of cash payments, issue common shares in the capital of CMC (“CMC Shares“) and incur certain exploration expenditures on the Property (collectively, “Option Payments“), as follows:

- CMC shall pay to Sailfish cash payments totaling US$3,500,000 in accordance with the following schedule:

a. US$500,000 on or before March 31, 2024;

b. US$500,000 on or before March 31, 2025;

c. US$500,000 on or before March 31, 2026; and

d. US$2,000,000 on or before March 31, 2027; - CMC shall issue CMC Shares in accordance with the following schedule:

a. 1,000,000 CMC Shares upon acceptance by the TSX Venture Exchange (the “TSXV“) of the Agreement;

b. $700,000 in CMC Shares on or before March 31, 2024 calculated based on the greater of (i) $0.05 per CMC Share; and (ii) the 10-day volume weighted average price of the CMC Shares immediately prior to issuance; and

c. $500,000 in CMC Shares on or before March 31, 2025 calculated based on the greater of (i) $0.05 per CMC Share; and (ii) the 10-day volume weighted average price of the CMC Shares immediately prior to issuance; - CMC shall incur and pay for total exploration expenditures of C$5,000,000 in respect of the Property (including

10,000 meters of new drilling) in accordance with the following schedule:

a. C$1,000,000 on or before March 31, 2025;

b. C$1,500,000 on or before March 31, 2026; and

c. C$2,500,000 on or before March 31, 2027.

On or before exercise of the Option, CMC and Sailfish will enter into a net smelter returns royalty agreement with respect to the Property which grants Sailfish:

a. a 1.5% net smelter returns royalty on unencumbered grounds with an option for CMC to buy-back 1.0% of the net smelter returns royalty for $3,000,000; and

b. a 0.5% net smelter returns royalty on encumbered grounds.

CMC may, in lieu of making further Option Payments, immediately exercise the Option by: (a) paying to Sailfish US$4,000,000 in cash on or before the first anniversary of TSXV acceptance of the Agreement; or (b) paying to Sailfish US$3,500,000 in cash after the first anniversary of TSXV acceptance of the Agreement. CMC will act as operator during the option period and will be responsible for all rates, taxes, duties, royalties, assessments and fees levied after the date of the Agreement with respect to the Property or CMC’s operations thereon. The Agreement and proposed issuances of CMC Shares remain subject to acceptance by the TSXV. The Company paid a finders’ fees in connection with the Agreement.

Mr. John Bossio, Chairman of the Board of Directors of the Company notes “This acquisition is the culmination of a detailed due diligence effort involving the completion of independent exploration appraisals, reviews of numerous legal documents, and a geo-political evaluation of the San Dimas region. The entire Board has been heavily involved in examining the potential of this acquisition and I would like to thank them for their efforts. Our Board is highly confident that the Gavilanes project will provide significant value generation to our shareholders who have supported us through the years.”

Mr. Kevin Brewer, President and CEO notes “Gavilanes is a super growth opportunity for CMC. Assets like this with a solid resource base, huge exploration upside potential, and a drill permit are very difficult to find and acquire. Gavilanes, along with our Rancheria Silver properties, now provides CMC with a year-round ability to explore and drill high quality silver polymetallic projects in North America. I also wish to extend my sincere thanks to Sailfish who have worked diligently with us to make this project a reality.”

Qualified Person

Qualified Person Kevin Brewer, a registered professional geoscientist, is the Company’s President and CEO, and Qualified Person (as defined by National Instrument 43-101). He has given his approval of the technical information pertaining reported herein. The Company is committed to meeting the highest standards of integrity, transparency and consistency in reporting technical content, including geological reporting, geophysical investigations, environmental and baseline studies, engineering studies, metallurgical testing, assaying and all other technical data.

About CMC Metals Ltd.

CMC Metals Ltd. is a growth stage exploration company focused on opportunities for high grade polymetallic deposits in Mexico, Yukon, British Columbia and Newfoundland. Our new flagship project is the Gavilanes Silver-Gold Project, San Dimas, Durango, Mexico. Our polymetallic silver-lead-zinc CRD prospects in the Rancheria Silver District include the Silverknife and Amy projects (British Columbia) and the Silver Hart Deposit and Blue Heaven claims (Yukon). Our polymetallic projects with potential for copper-silver-gold and other metals include Bridal Veil (Newfoundland) and Logjam (Yukon).

On behalf of the Board:

“John Bossio”

John Bossio, Chairman,

Board of Directors

CMC METALS LTD.

For Further Information and Investor Inquiries:

Kevin Brewer, P. Geo., MBA, B.Sc.(Hons), Dip. Mine Eng.

President, CEO and Director

Tel: (+52) 669 198 8503

[email protected]

Suite 1000-409 Granville St., Vancouver, BC, V6C 1T2

To be added to CMC’s news distribution list, please send an email to [email protected] or contact Mr. Kevin Brewer directly.

References

Mine Development Associates/Respec and Resource Geosciences Incorporated, 2021. CSA NI 43-101 Technical Report and Estimate of Mineral Resources, Gavilanes Silver Project, San Dimas Municipality, Durango, Mexico, Authors: Dr. Matthew D. Gray and Derrick Unger. 128pp.

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

“This news release may contain certain statements that constitute “forward-looking information” within the meaning of applicable securities law, including without limitation, statements that address the timing and content of upcoming work programs, geological interpretations, receipt of property titles and exploitation activities and developments. In this release disclosure regarding the potential to undertake future exploration work comprise forward looking statements. Forward-looking statements address future events and conditions and are necessarily based upon a number of estimates and assumptions. While such estimates and assumptions are considered reasonable by the management of the Company, they are inherently subject to significant business, economic, competitive and regulatory uncertainties and risks, including the ability of the Company to raise the funds necessary to fund its projects, to carry out the work and, accordingly, may not occur as described herein or at all. Actual results may differ materially from those currently anticipated in such statements. Factors that could cause actual results to differ materially from those in forward looking statements include market prices, exploitation and exploration successes, the timing and receipt of government and regulatory approvals, the impact of the constantly evolving COVID-19 pandemic crisis and continued availability of capital and financing and general economic, market or business conditions. Readers are referred to the Company’s filings with the Canadian securities regulators for information on these and other risk factors, available at www.sedar.com. Investors are cautioned that forward-looking statements are not guarantees of future performance or events and, accordingly are cautioned not to put undue reliance on forward-looking statements due to the inherent uncertainty of such statements. The forward-looking statements included in this news release are made as of the date hereof and the Company disclaims any intention or obligation to update or revise any forward-looking statements, whether as a result of new information, future events or otherwise, except as expressly required by applicable securities legislation.”

SOURCE: CMC Metals Ltd.