All amounts in US$ unless otherwise indicated

VANCOUVER, British Columbia–(BUSINESS WIRE)–Capstone Copper Corp. (“Capstone” or the “Company”) (TSX: CS) today reported financial results for the nine months and quarter ended September 30, 2023 (“Q3 2023”). Copper production in Q3 totaled 40.3 thousand tonnes at C1 cash costs1 of $2.88 per payable pound of copper produced. Link HERE for Capstone’s Q3 2023 webcast presentation.

John MacKenzie, CEO of Capstone, commented, “I am encouraged by the progress we made during the third quarter in executing on our plan to improve operational reliability and expand margins across our portfolio. As construction at our flagship Mantoverde Development Project (“MVDP”) approaches completion by year-end, we look forward to a transformational year in 2024. Our excitement follows many years of dedicated effort by our mine build team in Chile. MVDP will drive a significant reduction in our consolidated unit costs and provide a pathway to record operating cash flow generation for Capstone Copper.”

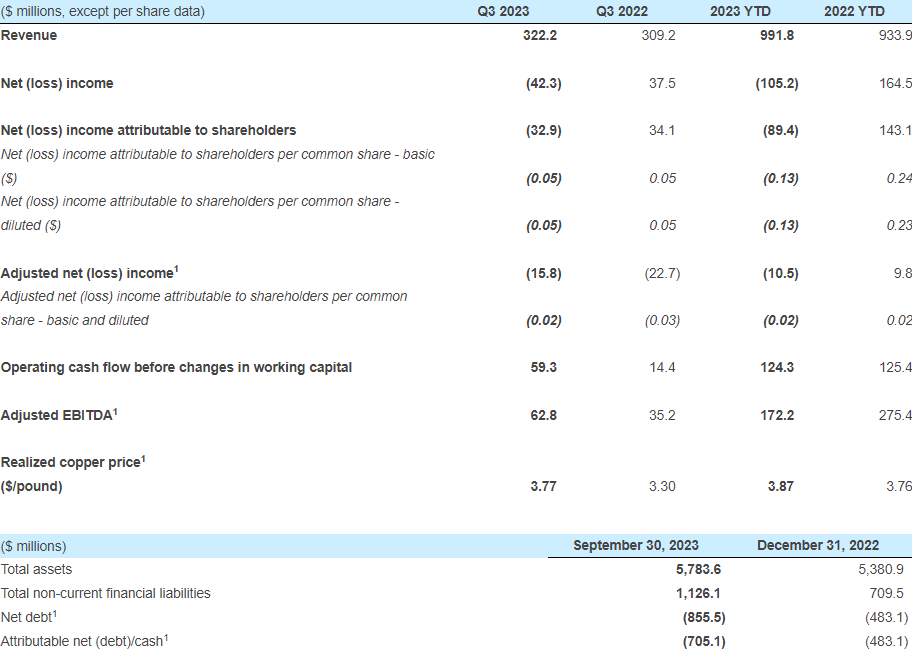

Q3 2023 OPERATIONAL AND FINANCIAL HIGHLIGHTS

- Net loss of $42.3 million, or $(0.05) per share for Q3 2023 compared to net income of $37.5 million, or $0.05 per share for Q3 2022.

- Adjusted net loss attributable to shareholders1 of $15.8 million, or $(0.02) per share for Q3 2023. Q3 2023 adjusted net loss attributable to shareholders1 is lower than Q3 2022 adjusted net loss attributable to shareholders1 of $22.7 million due to higher copper prices.

- Adjusted EBITDA1 of $62.8 million for Q3 2023 compared to $35.2 million for Q3 2022. The increase in Adjusted EBITDA1 is driven by a higher copper price of $3.75/lb compared to $3.18/lb (prior to unrealized provisional pricing adjustments), partially offset by lower copper sold (38.7 thousand tonnes in Q3 2023 versus 44.2 thousand tonnes in Q3 2022).

- Operating cash flow before changes in working capital of $59.3 million in Q3 2023 compared to $14.4 million in Q3 2022.

- Consolidated copper production for Q3 2023 of 40.3 thousand tonnes at C1 cash costs1 of $2.88/lb. Copper production in the third quarter was impacted by an unplanned eight days of cumulative downtime at Pinto Valley related to the secondary crusher jack shaft replacement and counter shaft repairs, plus planned maintenance downtime at Mantos Blancos. Lower production levels and maintenance expenses were the key drivers related to higher consolidated cash costs in the quarter.

- The Company reaffirms its H2 copper production guidance of 83kt to 93kt. C1 cash costs1 are trending towards the upper end of the H2 guidance range of $2.55/lb to $2.75/lb due to additional unplanned maintenance expenditures noted in Q3.

- Mantoverde Development Project (“MVDP”) overall progress at 93% and remains on schedule. Construction is progressing well on all key areas of the project. Total project spend since inception was $763 million at the end of September 2023, compared to $706 million at June 2023. The project is on track for construction completion by year end 2023. As the project nears completion, the updated total project cost is estimated at $870 million which is a 5% increase and includes approximately $20 million in project improvements.

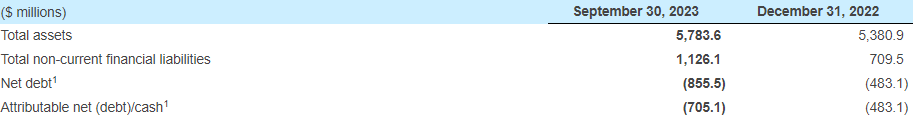

- Total available liquidity1 of $424.5 million as at September 30, 2023, composed of $129.5 million of cash and short-term investments, and $295.0 million of undrawn amounts on the corporate revolving credit facility.

1 These are alternative performance measures. Refer to the section entitled “Alternative Performance Measures” in the Cautionary Notes

OPERATIONAL OVERVIEW

Refer to Capstone’s Q3 2023 MD&A and Financial Statements for detailed operating results.

| Q3 2023 | Q3 2022 | 2023 YTD | 2022 YTD | |

| Copper production (000s tonnes) | ||||

| Sulphide business | ||||

| Pinto Valley | 13.7 | 14.1 | 39.2 | 41.8 |

| Cozamin | 5.9 | 6.4 | 17.8 | 18.7 |

| Mantos Blancos | 9.1 | 9.6 | 28.3 | 19.0 |

| Total sulphides | 28.7 | 30.1 | 85.3 | 79.5 |

| Cathode business | ||||

| Mantos Blancos | 3.0 | 4.0 | 9.6 | 8.0 |

| Mantoverde2 | 8.6 | 11.6 | 25.4 | 25.8 |

| Total cathodes | 11.6 | 15.6 | 35.0 | 33.8 |

| Consolidated | 40.3 | 45.7 | 120.3 | 113.3 |

| Copper sales | ||||

| Copper sold (000s tonnes) | 38.7 | 44.2 | 116.9 | 115.2 |

| Realized copper price1 ($/pound) | 3.77 | 3.30 | 3.87 | 3.76 |

| C1 cash costs1 ($/pound) produced | ||||

| Sulphides business | ||||

| Pinto Valley | 2.83 | 2.60 | 2.96 | 2.67 |

| Cozamin | 1.85 | 1.20 | 1.73 | 1.19 |

| Mantos Blancos | 2.85 | 2.17 | 2.80 | 2.34 |

| Total sulphides | 2.63 | 2.17 | 2.65 | 2.25 |

| Cathode business | ||||

| Mantos Blancos | 2.75 | 3.87 | 3.07 | 3.80 |

| Mantoverde | 3.74 | 3.87 | 3.89 | 3.62 |

| Total cathodes | 3.48 | 3.87 | 3.67 | 3.66 |

| Consolidated | 2.88 | 2.76 | 2.96 | 2.68 |

2 Mantoverde production shown on a 100% basis.

Consolidated Production

Q3 2023 copper production of 40.3 thousand tonnes was 12% lower than Q3 2022 primarily as a result of expected lower oxide production at Mantoverde on lower ore grade related to the mining sequence as we are transitioning to sulphide ore for MVDP. Moreover, Pinto Valley had lower mill throughput due to unplanned maintenance downtime related to secondary crusher jack shaft replacement and counter shaft repairs resulting in approximately eight days of downtime.

Q3 2023 C1 cash costs1 of $2.88/lb were 4% higher than $2.76/lb Q3 2022 mainly impacted by 12% lower production, partially offset by higher capitalized stripping at Mantoverde and higher gold by-product credits at Pinto Valley.

2023 YTD copper production of 120.3 thousand tonnes of copper is higher than the 113.3 thousand tonnes in 2022 YTD, primarily as a result of full quarter of production in Q1 2023 versus nine day production in Q1 2022 at Mantos Blancos and Mantoverde.

2023 YTD C1 cash costs1 of $2.96/lb were 10% higher than $2.68/lb 2022 YTD mainly on higher operational costs, partially offset by higher capitalized stripping and by-product credits.

Cathode production is from copper oxide ore that requires sulphuric acid leaching, solvent extraction and electrowinning (SX-EW) to produce copper cathodes which are a finished copper product for the market. Sulphide production requires a mill that utilizes a grinding and flotation process to recover sulphide minerals in a copper concentrate saleable as an intermediate product to smelters and refiners.

Pinto Valley Mine

Copper production of 13.6 thousand tonnes in Q3 2023 was 3% lower than in Q3 2022 mainly on lower mill throughput during the quarter (Q3 2023 – 47,426 tonnes per day (“tpd”) versus Q3 2022 – 48,143 tpd), resulting from unplanned eight-day downtime related to the secondary crusher jack shaft replacement and counter shaft repairs. Grade was consistent quarter over quarter (Q3 2023 – 0.34% versus Q3 2022 – 0.34%). Recoveries were lower compared to the same period last year (Q3 2023 – 87.4% versus Q3 2022 – 89.1%).

2023 YTD production was 6% lower than 2022 YTD mainly due to lower mill throughput (47,972 tpd in 2023 YTD versus 51,088 tpd in 2022 YTD) driven by heavy rainfall, including flooding, which resulted in plugged chutes and screens in Q1, conveyor belt replacement/structural support rebuild, and unplanned maintenance on the secondary crusher and associated conveyors which caused the equivalent of twenty days of downtime during Q2 and Q3. Recoveries were higher than 2022 YTD (87.4% 2023 YTD versus 86.3% 2022 YTD). The mill feed grade was consistent with the same period last year (0.32% in 2023 YTD versus 0.33% in 2022 YTD).

Q3 2023 C1 cash costs1 of $2.83/lb were 9% higher than Q3 2022 of $2.60/lb primarily due to increases in operating costs driven by higher contractor spend and mechanical parts costs ($0.32/lb) and lower production ($0.11/lb), partially offset by higher gold by-product credits and lower treatment and refining costs (-$0.21/lb).

2023 YTD C1 cash costs1 of $2.96/lb were 11% higher compared to the same period last year of $2.67/lb primarily due to increased mining costs due to inflationary pressures on explosives, and higher spend on rental equipment, mining equipment tools and maintenance contractors ($0.23/lb), lower production ($0.18/lb), and lower capitalized stripping ($0.05/lb), partially offset by higher gold and molybdenum by-product credits and lower treatment costs (-$0.15/lb). The cash costs are expected to trend down in Q4 as result of higher production.

Mantos Blancos Mine

Q3 2023 production was 12.2 thousand tonnes, comprised of 9.1 thousand tonnes from sulphide operations and 3.0 thousand tonnes of cathode from oxide operations, 11% lower than the 13.6 thousand tonnes produced in Q3 2022. The lower production was driven primarily by lower dump throughput, grade and recoveries impacting cathode production. The mill throughput of 14,176 tpd in Q3 2023 was impacted by mill downtime caused by planned repair and maintenance of the concentrator plant that lasted six days (liners and major components change). Recoveries were lower in Q3 2023 compared to the same period last year (76.3% in Q3 2023 versus 79.3% in Q3 2022), mainly driven by ore characteristics in the upper areas of the mine. A plan to address the plant stability during the second half of 2023 is underway that includes improved maintenance and optimization of the concentrator and the tailings system.

2023 YTD production of 37.9 thousand tonnes, composed of 28.3 thousand tonnes from sulphide operations and 9.6 thousand tonnes of cathode from oxide operations, was higher than the same period last year due to full operational Q1 2023 compared to a nine-day stub period in Q1 2022.

Combined Q3 2023 C1 cash costs1 were $2.82/lb ($2.85/lb sulphides and $2.75/lb cathodes) compared to combined C1 cash costs1 of $2.68/lb in Q3 2022, 5% higher than the same period last year mainly due to lower production ($0.11/lb), an increase in contracted services and labour cost mainly driven by unfavourable foreign exchange rate and inflation impact ($0.34/lb), plant maintenance and spare parts spend ($0.03/lb), partially offset by lower key consumable prices (-$0.34/lb) (realized acid prices averaged $141/t in Q3 2023 versus $273/t in Q3 2022 and diesel price averaged $0.76/l in Q3 2023 versus $0.97/l in Q3 2022).

Combined 2023 YTD C1 cash costs1 of $2.87/lb ($2.80/lb sulphides and $3.07/lb cathodes) were 3% higher compared to $2.78/lb in 2022 YTD. For the last quarter of 2023, we expect a reduction in combined C1 cash costs1 as the production mix is expected to have a higher ratio of concentrates to cathodes and lower acid prices (average 2023 YTD $171/t and estimated remaining $164/t).

Mantoverde Mine

Q3 2023 copper production of 8.6 thousand tonnes was 26% lower compared to 11.6 thousand tonnes in Q3 2022. Heap operations grade was lower as a result of mine sequence (0.32% in Q3 2023 versus 0.45% in Q3 2022), and recoveries were lower (66.5% in Q3 2023 versus 86.7% in Q3 2022) due to lower solubility ratio of the processed mineral and lower grades, all of which was partially offset by higher heap throughput (2.7 million tonnes in Q3 2023 versus 2.5 million tonnes in Q3 2022). Throughput from dump operations was lower compared with the same period last year due to a temporary sulphuric acid supply shortfall in September, and grades were consistent with the same period last year.

2023 YTD production of 25.4 thousand tonnes was lower than the same period last year, despite of full operational Q1 2023 compared to nine-day stub period in Q1 2022 due to lower heap grades as a result of mine sequence (0.31% YTD 2023 versus 0.48% YTD 2022) and lower recoveries due to lower solubility ratio of the processed mineral and lower grades. Production for the remainder of the year should be positively impacted by higher expected grades.

Q3 2023 C1 cash costs1 were $3.74/lb, 3% lower than $3.87/lb in Q3 2022 due to lower sulphuric acid prices ($156/t in Q3 2023 versus $285/t in Q3 2022) and lower mine costs mainly driven by lower diesel prices ($0.76/l in Q3 2023 versus $1.03/l in Q3 2022), partially offset by lower production.

2023 YTD C1 cash costs1 were $3.89/lb, 7% higher than $3.62/lb in 2022 YTD. For the last quarter of 2023, we expect a reduction in C1 cash costs1 due to lower energy prices (average YTD $0.22/kWh and estimated remaining $0.16/kWh) and higher production.

Cozamin Mine

Q3 2023 copper production of 5.9 thousand tonnes was lower than the same period prior year mainly on lower mill throughput (3,567 tpd in Q3 2023 versus 3,829 tpd in Q3 2022). Recoveries and grades were consistent quarter over quarter.

2023 YTD production was 5% lower than 2022 YTD due to lower throughput as a result of change in mining method (cut-and-fill) (3,590 tpd in 2023 YTD versus 3,803 tpd in 2022 YTD). Recoveries and grades were consistent with the same period last year.

Q3 2023 C1 cash costs1 were 54% higher than the same period last year mainly due to inflationary price increases on the main consumables, unfavourable foreign exchange rate, start of paste plant operations, which resulted in an increase in labour, contractor and cement costs, changes in mining method and additional bolting requirements as part of strengthening ground support ($0.61/lb) and lower copper production ($0.08/lb), partially offset by stockpile buildup (-$0.07/lb).

2023 YTD C1 cash costs1 were 45% higher than the same period last year primarily due to the change in mining method which resulted in an increase in contractor utilization and higher spend on bolting, and unfavourable foreign exchange rate ($0.42/lb). In addition, cash costs were impacted by lower production ($0.06/lb) and lower zinc by-product credits due to planned lower zinc production ($0.03/lb).

Mantoverde Development Project

Construction of the MVDP located at the existing Mantoverde (oxide) operation continues to progress well. The MVDP is expected to enable the mine to process 231 million tonnes of copper sulphide reserves over a 20-year expected mine life, in addition to existing oxide reserves. The MVDP involves the addition of a sulphide concentrator (32,000 tonnes per day) and tailings storage facility, and the expansion of the existing desalination plant.

The MVDP is progressing under a lump-sum turn-key engineering, procurement, and construction (EPC) contract with Ausenco Limited, a multi-national EPC management company, with broad international experience in the design and construction of copper concentrator projects of this scale in the international market. The execution plan includes a Capstone Copper owner’s team working with the contractors during the execution phase.

The MVDP is progressing well at approximately 93% complete as at September 30, 2023 and remains on track for construction completion by year-end followed by an expected six-month ramp-up to nameplate production levels in 2024.

Key areas of work completed during Q3 2023 were:

- Stockpiled approximately 5.0 million tonnes of sulphide ore

- Commenced commissioning of the primary crusher

- Grinding area: lubrication and cooling system installed. Laying completion of medium-voltage conductors to the Ball/SAG mill. Rotation of SAG/Ball Mills performed

- Flotation area: All cells installed and water test started

- Filtering area: Filter installed, air blower and tank mounted

- Tailings Thickener: Rake glide test done, underflow control valves and metallurgical sampler assembly completed

- Sand Plant: Thickener rake assembly in progress

- Tailings Storage Facilities: Mass excavation completed; Starting Wall and Cut-off Trench nearing completion

As of September 30, 2023, the MVDP to date costs total $763 million. Our total capital cost for the MVDP is estimated to be 5% higher at approximately $870 million. The increase from the prior estimate of $825 million relates to the following main areas (1) Inflation ($20 million) – impacting the fourth electric shovel, the diesel price on pre-stripping, and the cost per unit on tailings infrastructure construction, (2) Project improvements ($20 million) – additional rotainers for added flexibility in concentrate transport and storage, water reservoir and additional camp and warehouse space, and (3) Ramp up / commissioning costs ($5 million).

A virtual tour of the project can be viewed at https://vrify.com/decks/12698-mantoverde-development-project

Mantos Blancos

Mantos Blancos is currently focused on reliably achieving the installed capacity of 20,000 tonnes per day. We are executing on a plan to address plant stability that includes improved maintenance and optimization of the concentrator and tailings system. During the third quarter we addressed several bottlenecks in the crushing and grinding area of the operation. Moving forward, certain components in the tailings dewatering area, such as new handling and pumping infrastructure, are expected to be delivered and installed in early 2024, after which we expect Mantos Blancos to consistently deliver nameplate throughput rates.

The capital enhancements will enable future expansion opportunities as there will be installed capacity in certain parts of the process in excess of 20,000 tonnes per day. Once nameplate capacity is reached, we will recommence evaluating the potential to increase throughput of the Mantos Blancos sulphide concentrator plant to at least 27,000 tonnes per day using existing process infrastructure and new technologies, while also evaluating options to extend the life of copper cathode production.

Chilean Tax Reform

In August 2023, Chile passed the proposed Mining Royalty into law to be effective on January 1, 2024, replacing the current Specific Tax on Mining Activity.

The Mining Royalty contains two components, an ad-valorem component and a mine operating margin component. The ad-valorem component is applicable to companies with annual sales of copper that are higher than the equivalent of 50,000 metric tonnes of fine copper (“MTFC”). If the company’s “Adjusted Mining Operational Taxable Income”, or “RIOMA” as it is referred to in Chile, is negative, the ad-valorem component to be paid will be calculated by subtracting the negative amount of the RIOMA from the ad-valorem component. The ad-valorem component of the Mining Royalty will be deductible when determining First Category income taxes, however, not for purposes of determining RIOMA. The ad-valorem component is capped at 1% of gross copper revenues and will be reported in the royalties line on the income statement.

The mine operating margin (“MOM”) component will vary depending on the sales volume of the company, along with whether more than 50% of its annual production is copper. Mining companies which derive more than 50% of their income from copper sales and exceed 50,000 MTFC will pay a tax rate that fluctuates between 8% and 26% based on the following table:

| MOM | Maximum effective rate |

| Less than 20% | 8% |

| greater than 20% but less than 45% | the rate increases linearly to 12% |

| greater than 45% but less than 60% | the rate increases linearly to 26% |

| Greater than 60% | 26% |

The MOM component will not be applicable in cases where the RIOMA is negative and is calculated based on total mine operating margin, which includes silver and gold by-products. The Mining Royalty allows depreciation as a fully deductible operational expense in the calculation of RIOMA, however, unlike the First Category deduction, it is on a non-accelerated basis.

The Mining Royalty includes a maximum limit to the total tax burden, consisting of (1) the corporate income tax paid in the respective year, (2) the Mining Royalty (both ad-valorem and MOM components) and (3) withholding taxes to which owners would be subject to upon distribution of dividends. The calculation of withholding taxes assumes a 100% distribution, and is calculated considering a tax burden of 35% of net taxable income, i.e. an additional 8% to the First Category rate of 27%. The Mining Royalty establishes that when the sum of three component exceeds 46.5% of RIOMA, then the Mining Royalty would be adjusted in such a way that it does not exceed the limit.

As a change in tax law is accounted for in the period of enactment, rather than from its effective date, the Company recorded a deferred income tax charge of $31.5 million and a corresponding increased to deferred income tax liabilities. The impact to Capstone operating mines is less than expected due to pre-existing tax losses and accelerated deprecation rates. The Mining Royalty is not expected to have an impact on Santo Domingo which has 15 years of tax stability post commencement of commercial production as a result of Decree Law No. 600 (“DL 600”) during which time it will remain subject to the current Specific Tax on Mining. Furthermore, given the Company’s growth projects in Chile, we do not expect to incur cash withholding taxes for several years but the deduction is available when calculating the cap under the new mining royalty.

Mantoverde – Santo Domingo District Integration Plan

The Company is focused on creating a world-class mining district in the Atacama region of Chile, targeting over 200,000 tonnes per year of low-cost copper production with the potential to also become one of the largest and lowest cost battery grade cobalt producers in the world outside of China and the DRC. Capstone Copper has the opportunity to unlock operating cost synergies, while also enabling additional copper and cobalt production, infrastructure capital savings, and the potential for significant tax synergies.

Santo Domingo FS Update

Santo Domingo has completed the flowsheet optimization process previously announced and Ausenco is currently updating the Feasibility Study (“FS”) with contributions from third parties. Ausenco is optimizing the Technical Report to take into consideration recently produced metallurgical testwork data and updated mine plan. The optimized Technical Report is now expected to be delivered in the first half of 2024 as we are taking additional time to finalize key value drivers within the study and ensure we have selected the optimal project configuration.

MVDP Optimized FS and Phase II

The Company is currently analyzing the next expansion of the sulphide concentrator. Capstone has identified that the desalination plant capacity and major components of the comminution and flotation circuits of the MVDP are capable of sustaining average annual throughput of approximately 45,000 tonnes per day with no major capital equipment upgrades. Capstone continues to work with Ausenco’s engineering team to develop the MVDP Optimized Feasibility Study, including evaluating the costs and timelines of debottlenecking the minor components of the plant to meet the potential increased throughput target. The feasibility study is expected in the first half of 2024.

Given the above, the Mantoverde Phase II opportunity will evaluate the addition of an entire second processing line, possibly a duplication of the first line, to process some of the additional 77% of resources not utilized by the MVDP Optimized.

Mantoverde – Santo Domingo Cobalt Study

A district cobalt plant for Mantoverde – Santo Domingo may allow for low-cost by-product cobalt production while producing a by-product of sulphuric acid which can then be consumed internally to further significantly lower operating costs in the cathode leaching process at Mantoverde.

The cobalt recovery process consists of a concentration step, an oxidation step, and a cobalt recovery step. The concentration step considers a conventional froth flotation circuit treating copper flotation tails to produce a cobaltiferous pyrite concentrate which is expected to contain between 0.5% and 1.0% Co depending on the ore grade. The oxidation step entails adding the pyrite concentrate to the Mantoverde heap leach process, which will be converted to a bioleaching process to oxidize and break down the pyrite, thereby releasing the cobalt into solution. The cobalt is then recovered from the heap leach solutions via a continuous ion exchange process treating the SX raffinate. The approach has been successfully demonstrated at the bench scale and onsite piloting is expected to begin before the end of 2023. Pending successful piloting, engineering would commence for a small plant treating only Mantoverde pyrite concentrates to produce up to 1,500 tonnes per annum (“tpa”) of contained cobalt. Timing of the studies will depend on the results of work.

At a combined MV-SD target of 4.5 to 6.0 thousand tonnes of cobalt production per year, this would be one of the largest and lowest cost cobalt producers in the world outside of China and the DRC.

PV District Growth Study

The company continues to review and evaluate the consolidation potential of the Pinto Valley district. Opportunities under evaluation include a potential mill expansion and increased leaching capacity supported by optimized water, heap and dump leach, and tailings infrastructure. This could unlock significant ESG opportunities and may transform our approach to create value for all stakeholders in the Globe-Miami District. Constructive discussions with key district stakeholders advanced during the quarter. A district growth study at Pinto Valley is anticipated in the second half of 2024.

Management Additions

Effective October 17, 2023, Jaime Rivera Machado was appointed as General Manager, Mantos Blancos. Jaime has over 16 years of progressive experience at large mining operations in Chile and previously held the position of General Manager at BHP’s Escondida mine and CODELCO’s Ministro Hales and Andina mines.

Effective August 14, 2023, Sergio Gaete joined the Chile team as Project Director, Mantos Blancos. Sergio has more than 25 years of experience in metallurgy and copper, gold and molybdenum concentrator operations and projects. He previously held senior roles with CODELCO at its Andina, El Salvador, Chuquicamata, and Radomiro Tomic assets, and with Antofagasta Minerals at its Esperanza project.

Surety Bond Utilization

In May 2023, Minto Metals Corp. (“Minto”) announced that they had ceased all operations at the Minto Mine located within the Selkirk First Nation’s territory in the Yukon and that the Yukon Government had assumed care and control of the site.

In conjunction with Capstone’s sale of the Minto Mine in 2019, Minto posted a surety bond of C$72 million to cover potential future reclamation liabilities. While this surety bond is outstanding, the Company remains an indemnitor to the surety bond provider. As Minto defaulted on the surety bond, Capstone recognized a liability of approximately US$54 million (C$72 million) related to our obligations to the issuer of the surety bond.

While Capstone has not made any payments against the liability during the current quarter, $21.8 million has been reclassified to current other liabilities reflecting our estimate of the amount to be paid within the next 12 months.

Corporate Exploration Update

Cozamin: Q3 2023 infill drilling at the Mala Noche Main Vein West Target was on hold while the development of the lower elevation mine cross-cut was completed. Infill drilling will recommence in early Q4 2023 to support an updated mineral resource estimate in 2024.

Copper Cities, Arizona: On January 20, 2022, Capstone Mining announced that it had entered into an 18-month access agreement with BHP Copper Inc. (“BHP”) to conduct drill and metallurgical test-work at BHP’s Copper Cities project (“Copper Cities”), located approximately 10 km east of the Pinto Valley mine. An amendment to the agreement was completed in March 2023 extending the term by another six months. A second amendment to the agreement now extends the term further to September 2024. Drilling with two surface rigs twinning historical drill holes was completed in 2022 with metallurgical testing continuing in 2023. As explained in the PV District Growth Study section, district consolidation opportunities are being evaluated.

Planalto, Brazil: Subsequent to Q3 2023, Capstone notified Lara Exploration Ltd. (“Lara”) of the intent to relinquish the Planalto Option Agreement and fully exit the project.

2023 Outlook

The Company re-affirms its H2 copper production guidance of 83,000 to 93,000 tonnes. C1 cash costs1 are trending towards the upper end of the H2 guidance range of $2.55/lb to $2.75/lb per payable pound of copper produced due to additional unplanned maintenance expenditures.

The company re-affirms its full year capital expenditure guidance (including capitalized stripping) of $620 million with a reclassification of expenditures by operation as follows:

| Capital Expenditures ($ millions) | Updated Guidance | Previous Guidance |

| Pinto Valley | 80 | 100 |

| Cozamin | 35 | 30 |

| MVDP2 | 240 | 225 |

| Mantoverde2 | 145 | 145 |

| Mantos Blancos | 95 | 95 |

| Santo Domingo | 25 | 25 |

| Total Expenditures | 620 | 620 |

2Mantoverde capital expenditures shown on a 100% basis.

Exploration guidance (brownfield and greenfield) of $10 million remains unchanged.

FINANCIAL OVERVIEW

Please refer to Capstone’s Q3 2023 MD&A and Financial Statements for detailed financial results.

CONFERENCE CALL AND WEBCAST DETAILS

Capstone will host a conference call and webcast on Friday, November 3, 2023 at 08:00 am PT/11:00 am ET. Link to the audio webcast: https://app.webinar.net/meMBwLPw1kY

Dial-in numbers for the audio-only portion of the conference call are below. Due to an increase in call volume, please dial-in at least five minutes prior to the call to ensure placement into the conference line on time.

Toronto: (+1) 416-764-8650

Vancouver: (+1) 778-383-7413

North America toll free: 888-664-6383

A replay of the conference call will be available until November 10, 2023. Dial-in numbers for Toronto: (+1) 416-764-8677 and North American toll free: 888-390-0541. The replay code is 579377#. Following the replay, an audio file will be available on Capstone’s website at https://capstonecopper.com/investors/events-and-presentations/.

CAUTIONARY NOTE REGARDING FORWARD-LOOKING STATEMENTS

This document may contain “forward-looking information” within the meaning of Canadian securities legislation and “forward-looking statements” within the meaning of the United States Private Securities Litigation Reform Act of 1995 (collectively, “forward-looking statements”). These forward-looking statements are made as of the date of this document and the Company does not intend, and does not assume any obligation, to update these forward-looking statements, except as required under applicable securities legislation.

Forward-looking statements relate to future events or future performance and reflect our expectations or beliefs regarding future events. Our Sustainable Development Strategy goals and strategies are based on a number of assumptions, including, but not limited to, the biodiversity and climate-change consequences; availability and effectiveness of technologies needed to achieve our sustainability goals and priorities; availability of land or other opportunities for conservation, rehabilitation or capacity building on commercially reasonable terms and our ability to obtain any required external approvals or consensus for such opportunities; the availability of clean energy sources and zero-emissions alternatives for transportation on reasonable terms; availability of resources to achieve the goals in a timely manner, our ability to successfully implement new technology; and the performance of new technologies in accordance with our expectations.

Forward-looking statements include, but are not limited to, statements with respect to the estimation of Mineral Resources and Mineral Reserves, the success of the underground paste backfill and tailings filtration projects at Cozamin, the timing and cost of the Mantoverde Development Project (“MVDP”), the timing and results of the Optimized Mantoverde Development Project (“MVDP Optimized FS”) and Mantoverde Phase II study, the timing and results of PV District Growth Study (as defined below), the timing and results of Mantos Blancos Phase II Feasibility Study, the expected reduction in capital requirements for the Santo Domingo project, the timing and success of the Mantoverde – Santo Domingo Cobalt Feasibility Study, the timing and results of the Santo Domingo FS Update and success of incorporating synergies previously identified in the Mantoverde – Santo Domingo District Integration Plan, the realization of Mineral Reserve estimates, the timing and amount of estimated future production, the costs of production and capital expenditures and reclamation, the timing and costs of the Minto surety bond obligations and other obligations related to the closure of the Minto Mine, the budgets for exploration at Cozamin, Santo Domingo, Pinto Valley, Mantos Blancos, Mantoverde, and other exploration projects, the timing and success of the Copper Cities project, the success of our mining operations, the continuing success of mineral exploration, the estimations for potential quantities and grade of inferred resources and exploration targets, our ability to fund future exploration activities, our ability to finance the Santo Domingo project, environmental risks, unanticipated reclamation expenses and title disputes, the success of the synergies and catalysts related to prior transactions, in particular but not limited to, the potential synergies with Mantoverde and Santo Domingo, the anticipated future production, costs of production, including the cost of sulphuric acid and oil and other fuel, capital expenditures and reclamation of Company’s operations and development projects, our estimates of available liquidity, and the risks included in our continuous disclosure filings on SEDAR+ at www.sedarplus.ca. The impact of global events such as pandemics, geopolitical conflict, or other events, to Capstone is dependent on a number of factors outside of our control and knowledge, including the effectiveness of the measures taken by public health and governmental authorities to combat the spread of diseases, global economic uncertainties and outlook due to widespread diseases or geopolitical events or conflicts, supply chain delays resulting in lack of availability of supplies, goods and equipment, and evolving restrictions relating to mining activities and to travel in certain jurisdictions in which we operate. In certain cases, forward-looking statements can be identified by the use of words such as “anticipates”, “approximately”, “believes”, “budget”, “estimates”, “expects”, “forecasts”, “guidance”, “intends”, “plans”, “scheduled”, “target”, or variations of such words and phrases, or statements that certain actions, events or results “be achieved”, “could”, “may”, “might”, “occur”, “should”, “will be taken” or “would” or the negative of these terms or comparable terminology.

In certain cases, forward-looking statements can be identified by the use of words such as “anticipates”, “approximately”, “believes”, “budget”, “estimates”, expects”, “forecasts”, “guidance”, intends”, “plans”, “scheduled”, “target”, or variations of such words and phrases, or statements that certain actions, events or results “be achieved”, “could”, “may”, “might”, “occur”, “should”, “will be taken” or “would” or the negative of these terms or comparable terminology. In this document certain forward-looking statements are identified by words including “anticipated”, “expected”, “guidance” and “plan”. By their very nature, forward-looking statements involve known and unknown risks, uncertainties and other factors that may cause our actual results, performance or achievements to be materially different from any future results, performance or achievements expressed or implied by the forward-looking statements. Such factors include, amongst others, risks related to inherent hazards associated with mining operations and closure of mining projects, future prices of copper and other metals, compliance with financial covenants, inflation, surety bonding, our ability to raise capital, Capstone Copper’s ability to acquire properties for growth, counterparty risks associated with sales of our metals, use of financial derivative instruments and associated counterparty risks, foreign currency exchange rate fluctuations, market access restrictions or tariffs, changes in general economic conditions, availability and quality of water, accuracy of Mineral Resource and Mineral Reserve estimates, operating in foreign jurisdictions with risk of changes to governmental regulation, compliance with governmental regulations, compliance with environmental laws and regulations, reliance on approvals, licences and permits from governmental authorities and potential legal challenges to permit applications, contractual risks including but not limited to, our ability to meet the completion test requirements under the Cozamin Silver Stream Agreement with Wheaton Precious Metals Corp. (“Wheaton”), our ability to meet certain closing conditions under the Santo Domingo Gold Stream Agreement with Wheaton, acting as Indemnitor for Minto Metals Corp.’s surety bond obligations, impact of climate change and changes to climatic conditions at our operations and projects, changes in regulatory requirements and policy related to climate change and greenhouse gas (“GHG”) emissions, land reclamation and mine closure obligations, introduction or increase in carbon or other “green” taxes, aboriginal title claims and rights to consultation and accommodation, risks relating to widespread epidemics or pandemic outbreaks; the impact of communicable disease outbreaks on our workforce, risks related to construction activities at our operations and development projects, suppliers and other essential resources and what effect those impacts, if they occur, would have on our business, including our ability to access goods and supplies, the ability to transport our products and impacts on employee productivity, the risks in connection with the operations, cash flow and results of Capstone Copper relating to the unknown duration and impact of the epidemics or pandemics, impacts of inflation, geopolitical events and the effects of global supply chain disruptions, uncertainties and risks related to the potential development of the Santo Domingo project, risks related to the Mantoverde Development Project, increased operating and capital costs, increased cost of reclamation, challenges to title to our mineral properties, increased taxes in jurisdictions the Company operates or is subject to tax, changes in tax regimes we are subject to and any changes in law or interpretation of law may be difficult to react to in an efficient manner, maintaining ongoing social licence to operate, seismicity and its effects on our operations and communities in which we operate, dependence on key management personnel, potential conflicts of interest involving our directors and officers, corruption and bribery, limitations inherent in our insurance coverage, labour relations, increasing input costs such as those related to sulphuric acid, electricity, fuel and supplies, increasing inflation rates, competition in the mining industry including but not limited to competition for skilled labour, risks associated with joint venture partners and non-controlling shareholders or associates, our ability to integrate new acquisitions and new technology into our operations, cybersecurity threats, legal proceedings, the volatility of the price of the common shares, the uncertainty of maintaining a liquid trading market for the common shares, risks related to dilution to existing shareholders if stock options or other convertible securities are exercised, the history of Capstone Copper with respect to not paying dividends and anticipation of not paying dividends in the foreseeable future and sales of common shares by existing shareholders can reduce trading prices, and other risks of the mining industry as well as those factors detailed from time to time in the Company’s interim and annual financial statements and MD&A of those statements and Annual Information Form, all of which are filed and available for review under the Company’s profile on SEDAR+ at www.sedarplus.ca. Although the Company has attempted to identify important factors that could cause our actual results, performance or achievements to differ materially from those described in our forward-looking statements, there may be other factors that cause our results, performance or achievements not to be as anticipated, estimated or intended. There can be no assurance that our forward-looking statements will prove to be accurate, as our actual results, performance or achievements could differ materially from those anticipated in such statements. Accordingly, readers should not place undue reliance on our forward-looking statements.

COMPLIANCE WITH NI 43-101

Unless otherwise indicated, Capstone Copper has prepared the technical information in this document (“Technical Information”) based on information contained in the technical reports, Annual Information Form and news releases (collectively the “Disclosure Documents”) available under Capstone Copper’s company profile on SEDAR+ at www.sedarplus.ca. Each Disclosure Document was prepared by or under the supervision of a qualified person (a “Qualified Person”) as defined in National Instrument 43-101 – Standards of Disclosure for Mineral Projects of the Canadian Securities Administrators (“NI 43-101”). Readers are encouraged to review the full text of the Disclosure Documents which qualifies the Technical Information. Readers are advised that Mineral Resources that are not Mineral Reserves do not have demonstrated economic viability. The Disclosure Documents are each intended to be read as a whole, and sections should not be read or relied upon out of context. The Technical Information is subject to the assumptions and qualifications contained in the Disclosure Documents.

Disclosure Documents include the National Instrument 43-101 compliant technical reports titled “NI 43-101 Technical Report on the Cozamin Mine, Zacatecas, Mexico” effective January 1, 2023, “NI 43-101 Technical Report on the Pinto Valley Mine, Arizona, USA” effective March 31, 2021, “Santo Domingo Project, Region III, Chile, NI 43-101 Technical Report” effective February 19, 2020, and “Mantos Blancos Mine NI 43-101 Technical Report Antofagasta / Región de Antofagasta, Chile” and “Mantoverde Mine and Mantoverde Development Project NI 43-101 Technical Report Chañaral / Región de Atacama, Chile”, both effective November 29, 2021.

The disclosure of Scientific and Technical Information in this document was reviewed and approved by Clay Craig, P.Eng., Director, Mining & Strategic Planning (technical information related to Mineral Reserves at Pinto Valley and Cozamin), and Cashel Meagher, P.Geo., President and Chief Operating Officer (technical information related to project updates at Santo Domingo and Mineral Reserves and Resources at Mantos Blancos and Mantoverde) all Qualified Persons under NI 43-101.

Alternative Performance Measures

Alternative performance measures are furnished to provide additional information. These non-GAAP performance measures are included in this document because these statistics are key performance measures that management uses to monitor performance, to assess how the Company is performing, and to plan and assess the overall effectiveness and efficiency of mining operations. These performance measures do not have a standard meaning within IFRS and, therefore, amounts presented may not be comparable to similar data presented by other mining companies. These performance measures should not be considered in isolation as a substitute for measures of performance in accordance with IFRS.

Some of these alternative performance measures are presented in Highlights and discussed further in other sections of the document. These measures provide meaningful supplemental information regarding operating results because they exclude certain significant items that are not considered indicative of future financial trends either by nature or amount. As a result, these items are excluded for management assessment of operational performance and preparation of annual budgets. These significant items may include, but are not limited to, restructuring and asset impairment charges, individually significant gains and losses from sales of assets, share based compensation, unrealized gains or losses, and certain items outside the control of management. These items may not be non-recurring. However, excluding these items from GAAP or Non-GAAP results allows for a consistent understanding of the Company’s consolidated financial performance when performing a multi-period assessment including assessing the likelihood of future results. Accordingly, these Non-GAAP financial measures may provide insight to investors and other external users of the Company’s consolidated financial information.

C1 Cash Costs Per Payable Pound of Copper Produced

C1 cash costs per payable pound of copper produced is a measure reflective of operating costs per unit. C1 cash costs is calculated as cash production costs of metal produced net of by-product credits and is a key performance measure that management uses to monitor performance. Management uses this measure to assess how well the Company’s producing mines are performing and to assess overall efficiency and effectiveness of the mining operations and assumes that realized by-product prices are consistent with those prevailing during the reporting period.

All-in Sustaining Costs Per Payable Pound of Copper Produced

All-in sustaining costs per payable pound of copper produced is an extension of the C1 cash costs measure discussed above and is also a non-GAAP key performance measure that management uses to monitor performance. Management uses this measure to analyze margins achieved on existing assets while sustaining and maintaining production at current levels. Consolidated All-in sustaining costs includes sustaining capital and corporate general and administrative costs.

Net debt / Net cash

Net debt / Net cash is a non-GAAP performance measure used by the Company to assess its financial position and is composed of Long-term debt (excluding deferred financing costs and purchase price accounting (“PPA”) fair value adjustments), Cost overrun facility from MMC, Cash and cash equivalents and Short-term investments.

Attributable Net debt / Net cash

Attributable net debt / net cash is a non-GAAP performance measure used by the Company to assess its financial position and is calculated as net debt / net cash excluding amounts attributable to non-controlling interests.

Available Liquidity

Available liquidity is a non-GAAP performance measure used by the Company to assess its financial position and is composed of RCF credit capacity, the $520 million Mantoverde DP facility capacity, Cash and cash equivalents and Short-term investments. For clarity, Available liquidity does not include the Mantoverde $60 million cost overrun facility from MMC nor the $260 million undrawn portion of the Gold stream from Wheaton related to the Santo Domingo project as they are not available for general purposes.

Adjusted net (loss) income attributable to shareholders

Adjusted net (loss) income attributable to shareholders is a non-GAAP measure of Net (loss) income attributable to shareholders as reported, adjusted for certain types of transactions that in our judgment are not indicative of our normal operating activities or do not necessarily occur on a regular basis.

EBITDA

EBITDA is a non-GAAP measure of net (loss) income before net finance expense, tax expense, and depletion and amortization.

Adjusted EBITDA

Adjusted EBITDA is non-GAAP measure of EBITDA before the pre-tax effect of the adjustments made to net (loss) income (above) as well as certain other adjustments required under the RCF agreement in the determination of EBITDA for covenant calculation purposes.

The adjustments made to Adjusted net (loss) income attributable to shareholders and Adjusted EBITDA allow management and readers to analyze our results more clearly and understand the cash generating potential of the Company.

Sustaining Capital

Sustaining capital is expenditures to maintain existing operations and sustain production levels. A reconciliation of this non-GAAP measure to GAAP segment MPPE additions is included within the mine site sections of this document.

Expansionary Capital

Expansionary capital is expenditures to increase current or future production capacity, cash flow or earnings potential. A reconciliation of this non-GAAP measure to GAAP segment MPPE additions is included within the mine site sections of this document.

Realized copper price (per pound)

Realized price per pound is a non-GAAP ratio that is calculated using the non-GAAP measures of revenue on new shipments, revenue on prior shipments, and pricing and volume adjustments. Realized prices exclude the effects of the stream cash effects as well as TC/RCs. Management believes that measuring these prices enables investors to better understand performance based on the realized copper sales in the current and prior period.

Contacts

Jerrold Annett, SVP, Strategy and Capital Markets

647-273-7351

jannett@capstonecopper.com

Daniel Sampieri, Director, Investor Relations & Strategic Analysis

437-788-1767

dsampieri@capstonecopper.com

Original Article: https://www.businesswire.com/news/home/20231103588152/en/