Impressive drill results demonstrate the potential for ongoing resource expansion and mine life extension at ELG Underground

TORONTO, July 11, 2023 (GLOBE NEWSWIRE) — Torex Gold Resources Inc. (the “Company” or “Torex”) (TSX: TXG) announces assay results from the Company’s ongoing drilling program at the El Limón Guajes underground mine, including zones referred to as El Limón Deep (“ELD”), Sub-Sill, Sub-Sill South, El Limón Sur Deep, and El Limón West (collectively “ELG Underground”).

Jody Kuzenko, President & CEO of Torex, stated:

“We are excited about the positive results from the ongoing drilling program at ELG Underground. The program is a key facet of our strategy to optimize and extend the mine life at ELG Underground with a view to filling the mill beyond 2027.

“Infill and step-out drilling to the south at El Limón Sur Deep was successful in extending higher-grade mineralization outside of the current resource block model. Several drill holes returned notable intersects over favourable widths including 88.92 grams per tonne gold equivalent (“gpt AuEq”) over 14.5 metres (“m”) in drill hole LS-220, 11.20 gpt AuEq over 29.4 m and 19.03 gpt AuEq over 13.3 m in LS-221, 6.86 gpt AuEq over 16.6 m in LS-187, and 7.46 gpt AuEq over 11.6 m in LS-184. These drill results, which include several higher-grade sub-intervals in addition to other impressive intersects, validate the high grade potential associated with the area that runs from El Limón Sur Deep to the La Flaca fault (600 m), known as the El Limón Sur Trend, with potential to extend deeper.

“Drilling at El Limón Sur Deep also encountered areas of economic copper mineralization which we expect to mine after the flotation circuit, part of the Media Luna Project, is commissioned in late-2024. This will enable us to maximize margins from this zone of the deposit and to compliment copper production from Media Luna.

“Additionally, step-out drilling looking for the north-south continuity of the feeders on the north side of the Z71 fault completed in late-2022 encountered the deepest recognized mineralization at the 400 m elevation within the El Limón Sur Trend, with drill hole SST-299 intersecting 4.17 gpt AuEq over 3.7 m. This hole was drilled within a cluster of holes which included an intersect of 9.56 gpt AuEq over 5.0 m in SST-278 and 6.23 gpt AuEq over 8.9 m in SST-282. This set of drill holes demonstrates the continuity of mineralization at depth at ELG Underground and supports previous information from exploratory drill holes that highlight the resource potential at depth.

“Step-out and infill drilling continue to support our ability to expand and upgrade resources within the ELD, Sub-Sill, and Sub-Sill South deposits. Drilling at a zone approximately 100 m to the west of El Limón Sur Deep, referred to as El Limón West, continues to highlight the potential for another underground mining front below the El Limón Sur open pit. Further work will be conducted in the near future on El Limón West to explore the potential for a second, parallel corridor of mineralization to the El Limón Sur Trend.

“Overall, the positive results from the underground drilling program support ongoing resource expansion and reserve growth within ELG Underground, which in turn supports our strategic focus on filling the mill with higher-grade feed beyond 2027.”

Gold equivalent (“AuEq”) grades use the same metal prices ($1,550/oz gold (“Au”), $20/oz silver (“Ag”), and $3.50/lb copper (“Cu”)) and metallurgical recoveries (90% Au, 86% Ag, and 93% Cu) used in the year-end 2022 Mineral Resource estimate for the ELG Underground (AuEq (gpt) = Au (gpt) + Ag (gpt) * 0.0123 + Cu (%) * 1.6000).

ELG UNDERGROUND – 2023 DRILLING PROGRAM

Through the end of May, approximately 34,300 meters and 177 holes were drilled as part of the 2023 drilling program at ELG Underground. This represents 60% of the planned meters in this area for 2023 (30,000 m under the ELG Underground program and 27,000 m under the near-mine program), for which assays have been received for 54% of the metres drilled. The level of infill drilling is expected to increase through the back half of the year, with a focus on upgrading Inferred mineral resources to the Indicated category. Step-out drilling from south of the La Flaca fault to El Limón Sur Deep will focus on further expanding mineralization with the goal of increasing Inferred mineral resources across the ELG Underground.

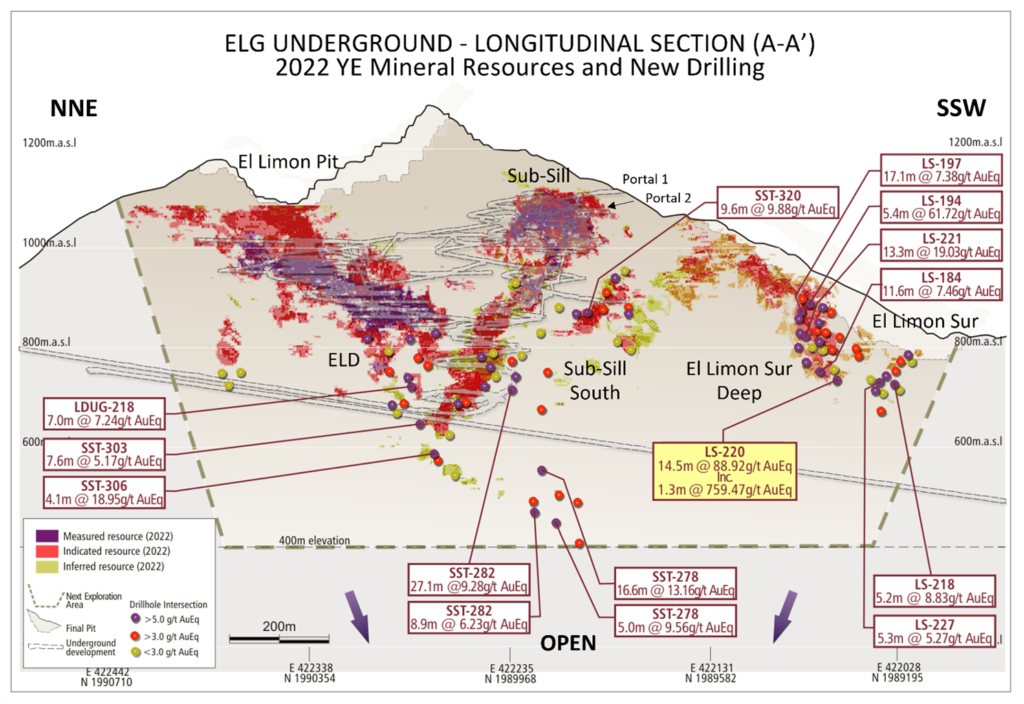

The excellent results from the 2022 drilling program and initial results from the 2023 drilling program, including high grade intersects in several of the underground deposits, have been instrumental in exploring the extent of the mineralization at depth. This is supported by an improved understanding of the structural controls of mineralization, which suggest high grade feeders controlled by fault systems trending NNW/SSE and NE/SW, in the intrusive and sedimentary sequence, within a regional North-South deep structural trend (Figure 1). The improved interpretation of mineral controls will be incorporated into future drilling programs as the Company looks to identify higher-margin feed to fill the mill beyond 2027.

Figure 1: Drilling program highlights at ELG Underground (Plan View)

Assay results reported in this press release include drill holes completed under the 2023 underground drilling program as well as drill holes completed in late-2022, for which assays were received after the cut-off date for inclusion in the year-end Mineral Resource estimate. Drill hole intersects are core lengths and not true widths.

Results from the ongoing underground drilling program are reported in Table 1 (El Limón Sur Deep), Table 2 (Sub-Sill South), Table 3 (ELD), Table 4 (Sub-Sill), and Table 5 (El Limón West).

El Limón Sur Trend

Drilling completed in late-2022 that focused on the extension of the Sub-Sill and ELD deposits to the south encountered mineralization down to an elevation of 400 m (drill hole SST-299), which is 125 m below the lowest Inferred resource at Sub-Sill and 275 m below the lowest elevation of Inferred resources at ELD. This hole, as well as drill holes SST-278 and SST-282 confirm the existence of deep mineralization that was previously detected in exploratory holes. The mineralization appears to be related to the higher-grade feeders of the El Limón Sur Trend (Figures 1, 2, and 3).

- SST-278

- 13.16 gpt AuEq over 16.64 m (11.79 gpt Au, 14.3 gpt Ag and 0.74% Cu)

- including 21.67 gpt AuEq over 5.39 m (19.73 gpt Au, 21.3 gpt Ag and 1.05% Cu)

- 9.56 gpt AuEq over 4.95 m (9.13 gpt Au, 6.2 gpt Ag and 0.22% Cu)

- 13.16 gpt AuEq over 16.64 m (11.79 gpt Au, 14.3 gpt Ag and 0.74% Cu)

- SST-282

- 6.23 gpt AuEq over 8.93 m (5.63 gpt Au, 12.2 gpt Ag and 0.28% Cu)

- SST-299

- 4.17 gpt AuEq over 3.66 m (4.08 gpt Au, 1.0 gpt Ag and 0.05% Cu)

The resource categorization and expansion program at El Limón Sur Deep has yielded outstanding results, particularly in extending mineralization outside of the current resource block model, both laterally and vertically to the north and south. Drilling at El Limón Sur Deep returned several impressive intersects over favourable widths, which confirm the high grade potential of the main feeders. Drill results from this area include strong copper intersects which are expected to be mined after upgrades to the processing plant (including a copper flotation circuit) are completed in late-2024 as part of the Media Luna Project (Figure 3).

- LS-220

- 88.92 gpt AuEq over 14.46 m (88.61 gpt Au, 20.6 gpt Ag and 0.04% Cu)

- including 75.97 gpt AuEq over 2.00 m (75.53 Au, 30.0 Ag and 0.04% Cu)

- including 759.47 gpt AuEq over 1.29 m (757.86 gpt Au, 126.1 gpt Ag and 0.04% Cu)

- 88.92 gpt AuEq over 14.46 m (88.61 gpt Au, 20.6 gpt Ag and 0.04% Cu)

- LS-221

- 11.20 gpt AuEq over 29.38 m (9.86 gpt Au, 42.0 gpt Ag and 0.52% Cu)

- including 26.06 gpt AuEq over 4.55 m (25.31 gpt Au, 29.0 gpt Ag and 0.25% Cu)

- including 28.98 gpt AuEq over 3.38 m (25.61 gpt Au, 108.2 gpt Ag and 1.27% Cu)

- 19.03 gpt AuEq over 13.31 m (11.84 gpt Au, 73.7 gpt Ag and 3.93% Cu)

- including 28.29 gpt AuEq over 5.55 m (21.18 gpt Au, 94.5 gpt Ag and 3.72% Cu)

- 11.20 gpt AuEq over 29.38 m (9.86 gpt Au, 42.0 gpt Ag and 0.52% Cu)

- LS-197

- 7.38 gpt AuEq over 17.06 m (5.78 gpt Au, 44.0 gpt Ag and 0.66% Cu)

- including 11.39 gpt AuEq over 3.84 m (8.88 gpt Au, 74.5 gpt Ag and 1.00% Cu)

- 10.39 gpt AuEq over 5.86 m (4.13 gpt Au, 125.9 gpt Ag and 2.94% Cu)

- 7.38 gpt AuEq over 17.06 m (5.78 gpt Au, 44.0 gpt Ag and 0.66% Cu)

- LS-187

- 6.86 gpt AuEq over 16.63 m (4.61 gpt Au, 34.4 gpt Ag and 1.14% Cu)

- including 9.05 gpt AuEq over 3.89 m (3.60 gpt Au, 65.8 gpt Ag and 2.90% Cu)

- 6.86 gpt AuEq over 16.63 m (4.61 gpt Au, 34.4 gpt Ag and 1.14% Cu)

- LS-183

- 17.85 gpt AuEq over 5.21 m (16.66 gpt Au, 20.6 gpt Ag and 0.58% Cu)

- LS-184

- 7.46 gpt AuEq over 11.62 m (6.00 gpt Au, 40.7 gpt Ag and 0.60% Cu)

- LS-203

- 9.95 gpt AuEq over 7.50 m (9.56 gpt Au, 10.1 gpt Ag and 0.17% Cu)

Drilling at Sub-Sill South was also successful, with assay results highlighting the potential to upgrade Inferred resources to the Indicated category and expand Inferred resources both laterally and vertically to the north and south (Figure 3).

- SST-320

- 9.88 gpt AuEq over 9.62 m (9.41 gpt Au, 11.3 gpt Ag and 0.21% Cu)

- SST-321

- 5.77 gpt AuEq over 3.00 m (4.59 gpt Au, 23.3 gpt Ag and 0.56% Cu)

- SST-286

- 5.07 gpt AuEq over 7.76 m (4.16 gpt Au, 8.2 gpt Ag and 0.51% Cu)

ELD

At ELD, step-out drilling along the southwest extension of the deposit and infill drilling returned several impressive intersects that indicate the potential to expand resources at depth while upgrading Inferred resources to the Indicated category (Figure 2).

- LDUG-233

- 11.29 gpt AuEq over 34.89 m (9.48 gpt Au, 23.6 gpt Ag and 0.95% Cu)

- Including 21.13 gpt AuEq over 15.10 m (18.03 gpt Au, 45.5 gpt Ag and 1.59% Cu)

- 11.29 gpt AuEq over 34.89 m (9.48 gpt Au, 23.6 gpt Ag and 0.95% Cu)

- LDUG-229

- 9.70 gpt AuEq over 18.17 m (9.20 gpt Au, 6.3 gpt Ag and 0.26% Cu)

- 8.68 gpt AuEq over 16.87 m (7.63 gpt Au, 25.5 gpt Ag and 0.46% Cu)

- 10.65 gpt AuEq over 4.00 m (9.47 gpt Au, 10.9 gpt Ag and 0.65% Cu)

- 8.82 gpt AuEq over 5.18 m (8.71 gpt Au, 2.8 gpt Ag and 0.05% Cu)

- LDUG-218

- 6.06 gpt AuEq over 4.75 m (5.80 gpt Au, 3.3 gpt Ag and 0.14% Cu)

- 7.24 gpt AuEq over 7.03 m (7.09 gpt Au, 2.9 gpt Ag and 0.07% Cu)

Sub-Sill

Step-out drilling to the north and south of the deeper extension of the Sub-Sill deposit and infill drilling around the existing resource continue to support the potential to expand and upgrade resources at depth (Figure 4).

- SST-306

- 18.95 gpt AuEq over 4.08 m (18.83 gpt Au, 3.7 gpt Ag and 0.05% Cu)

- SST-303

- 5.17 gpt AuEq over 7.61 m (4.39 gpt Au, 7.8 gpt Ag and 0.43% Cu)

- SST-301

- 5.12 gpt AuEq over 6.11 m (5.04 gpt Au, 1.5 gpt Ag and 0.04% Cu)

El Limón West

Follow-up drilling at El Limón West, a zone of mineralization below the El Limón Sur pit and approximately 100 m west of the El Limón Sur Deep deposit, continues to highlight the potential for another new mining front within ELG Underground (Figure 5). Mineralization at El Limón West is controlled and hosted by a phreatomagmatic breccia pipe, which differs from the mineralization commonly associated with the El Limón Sur Trend. This indicates the potential of a second structural corridor and other styles of mineralization across the broader Morelos Property and will be explored further in the near future.

- LS-207

- 6.16 gpt AuEq over 16.01 m (4.92 gpt Au, 30.4 gpt Ag and 0.54% Cu)

- LS-218

- 8.83 gpt AuEq over 5.21 m (8.10 gpt Au, 25.1 gpt Ag and 0.26% Cu)

- LS-169

- 7.52 gpt AuEq over 4.41 m (6.25 gpt Au, 30.3 gpt Ag and 0.56% Cu)

EL LIMÓN GUAJES MINE COMPLEX GEOLOGY

The ELG Mine Complex, located in the central part of the Guerrero Gold Belt in southwest Mexico, is hosted in the Mesozoic carbonate-rich Morelos Platform, which has been intruded by Paleocene granodiorite stocks, sills, and dikes. Skarn-hosted gold mineralization is developed along the contacts of the intrusive rocks and the enclosing carbonate-rich sedimentary rocks of the Cuautla and Morelos formations as well as along the footwall contact of the Mezcala Formation.

Gold mineralization at ELG occurs in association with a skarn body that was developed along a 2-kilometre-long corridor following the northeast contact of the ELG granodiorite stock. The skarn zone that occurs at the marble stratigraphic level of the Morelos Formation is in contact with hornfels developed in the Mezcala Formation. At El Limón, skarn mineralization is also structurally controlled by NE-SW and WNW-ESE trending faults and fracture zones. Skarn alteration and mineralization at ELG are fairly typical of calcic gold-skarn systems. Zones of coarse, massive, garnet-dominant skarn appear within and along the stock margin, with fine-grained pyroxene-dominant skarn more common at greater distances from the contact with the stock. Significant gold mineralization at ELG is associated with the skarn, preferentially occurring in pyroxene-rich exoskarn but also hosted in garnet-rich endoskarn that has been affected by retrograde alteration.

Pre- and post-mineralization dykes and sills are found to crosscut the hornfels and marble, along the structural trends mentioned above, and are spatially associated with the skarn formation.

The style of mineralization at El Limón Sur Deep is like Sub-Sill and ELD, and is characterized by gold, with locally high silver and copper grades. Gold occurs in variably sulfidized, pyrrhotite-rich skarn, while silver and copper mineralization is controlled primarily by the degree of sulfidation of the host skarn. Mineralization is mainly associated with retrograde alteration characterized by the occurrence of phlogopite, amphibole, chlorite, calcite and lesser amounts of quartz and epidote, and local magnetite.

QA/QC AND QUALIFIED PERSON

Torex maintains an industry-standard analytical quality assurance and quality control (QA/QC) and data verification program to monitor laboratory performance and ensure high-quality assays. Results from this program confirm reliability of the assay results. All sampling and analytical work for the mine exploration program is performed by SGS de Mexico S.A. de C.V. (“SGS”) in Durango, and by SGS at Minera Media Luna site facilities in Mexico. Gold analyses comprise fire assays with atomic absorption or gravimetric finish. External check assays for QA/QC purposes are performed at ALS Chemex de Mexico S.A. de C.V.

The analytical QA/QC program is currently overseen by Carlo Nasi, Chief Mine Geologist for Minera Media Luna, S.A. de C.V.

Scientific and technical data contained in this news release has been reviewed and approved by Carolina Milla, P.Eng. Ms. Milla is a member of the Association of Professional Engineers and Geoscientists of Alberta (Member ID #168350), has experience relevant to the style of mineralization under consideration, is a qualified person under NI 43-101, and is an employee of Torex. Ms. Milla has verified the data disclosed, including sampling, analytical, and test data underlying the drill results; verification included visually reviewing the drillholes in three dimensions, comparing the assay results to the original assay certificates, reviewing the drilling database, and reviewing core photography consistent with standard practice. Ms. Milla consents to the inclusion in this release of said data in the form and context in which they appear.

Additional information on the El Limón Sur deposit, sampling and analyses, analytical labs, and methods used for data verification is available in the Company’s technical report entitled the “Morelos Property, NI 43-101 Technical Report, ELG Mine Complex Life of Mine Plan and Media Luna Feasibility Study, Guerrero State, Mexico”, dated effective March 16, 2022 filed on March 31, 2022 (the “2022 Technical Report”) and in the annual information form (“AIF”) dated March 30, 2023, each filed on SEDAR at www.sedar.com and the Company’s website at www.torexgold.com.

ABOUT TOREX GOLD RESOURCES INC.

Torex is an intermediate gold producer based in Canada, engaged in the exploration, development, and operation of its 100% owned Morelos Property, an area of 29,000 hectares in the highly prospective Guerrero Gold Belt located 180 kilometres southwest of Mexico City. The Company’s principal asset is the Morelos Complex, which includes the El Limón Guajes (“ELG”) Mine Complex, the Media Luna Project, a processing plant and related infrastructure. Commercial production from the Morelos Complex commenced on April 1, 2016 and an updated Technical Report for the Morelos Complex was released in March 2022. Torex’s key strategic objectives are to extend and optimize production from the ELG Mining Complex, de-risk and advance Media Luna to commercial production, build on ESG excellence, and to grow through ongoing exploration across the entire Morelos Property.

FOR FURTHER INFORMATION, PLEASE CONTACT:

| TOREX GOLD RESOURCES INC. | |

| Jody Kuzenko | Dan Rollins |

| President and CEO | Senior Vice President, Corporate Development & Investor Relations |

| Direct: (647) 725-9982 | Direct: (647) 260-1503 |

| jody.kuzenko@torexgold.com | dan.rollins@torexgold.com |

CAUTIONARY NOTES ON FORWARD LOOKING STATEMENTS

This press release contains “forward-looking statements” and “forward-looking information” within the meaning of applicable Canadian securities legislation. Forward-looking information also includes, but is not limited to, statements about: impressive drill results demonstrate the potential for ongoing resource expansion and mine life extension at ELG Underground; the Company’s strategy to optimize and extend the mine life at ELG Underground with a view to filling the mill beyond 2027; the results of the infill and step-out drilling to the south at El Limón Sur Deep validate the high grade potential associated with the area that runs from El Limón Sur Deep to the La Flaca fault (known as the “El Limón Sur Trend”), with potential to extend deeper; the expectation that the Company will mine areas of copper mineralization encountered at El Limón Sur Deep after the flotation circuit is commissioned in late 2024 as part of the Media Luna Project; the mining of these areas of copper mineralization will enable the Company to maximize margins from this zone of the deposit and will compliment copper production from Media Luna; the step-out drilling looking for the north-south continuity of the feeders on the north side of the Z71 fault demonstrates the continuity of mineralization at depth in ELG Underground and supports previous information from exploratory drill holes that highlights the resource potential at depth; the step-out and infill drilling continue to support the Company’s ability to expand and upgrade resources within the ELD, Sub-Sill, and Sub-Sill South deposits; drilling at a zone approximately 100 m to the west of El Limón Sur Deep, referred to as El Limón West, continues to highlight the potential for another underground mining front below the El Limón Sur open pit; further work will be conducted in the near future on El Limón West to explore the potential for a second, parallel corridor of mineralization to the El Limón Sur Trend; overall, the positive results from the drilling program support ongoing resource expansion and reserve growth within ELG Underground, which in turn supports the Company’s strategic focus on filling the mill with higher-grade feed beyond 2027; the level of infill drilling is expected to increase through the back half of the year, with a focus on upgrading Inferred mineral resources to the Indicated category; step-out drilling from south of the La Flaca fault to El Limón Sur Deep will focus on further expanding mineralization with the goal of increasing Inferred mineral resources across the ELG Underground; the assay results from drilling at Sub-Sill South highlight the potential to upgrade Inferred resources to the Indicated category and expand Inferred resources both laterally and vertically to the north and to the south; at ELD, step-out and infill drilling along the southwest extension of the deposit returned several impressive intersects that indicate the potential to expand resources at depth while upgrading Inferred resources to the Indicated category; step-out drilling to the north and south of the deeper extension of the Sub-Sill deposit and infill drilling around the existing resource continue to support the potential to expand and upgrade resources at depth; the potential of a second structural corridor and other styles of mineralization across the broader Morelos Property and will be explored further in the near future; follow-up drilling at El Limón West continues to highlight the potential for another new mining front within ELG Underground; and the Company’s key strategic objectives to extend and optimize production from the ELG Mining Complex, de-risk and advance Media Luna to commercial production, build on ESG excellence, and to grow through ongoing exploration across the entire Morelos Property. Generally, forward-looking information can be identified by the use of forward-looking terminology such as “strategy”, “demonstrate”, “potential”, “continue”, “ongoing”, “goal” or variations of such words and phrases or statements that certain actions, events or results “will”, or “is/are expected to” occur or “with a view to”. Forward-looking information is subject to known and unknown risks, uncertainties and other factors that may cause the actual results, level of activity, performance or achievements of the Company to be materially different from those expressed or implied by such forward-looking information, including, without limitation, those risk factors identified in the 2022 Technical Report and the Company’s annual information form (“AIF”) and management’s discussion and analysis (“MD&A”) or other unknown but potentially significant impacts. Forward-looking information is based on the assumptions discussed in the 2022 Technical Report, the AIF and the MD&A and such other reasonable assumptions, estimates, analysis and opinions of management made in light of its experience and perception of trends, current conditions and expected developments, and other factors that management believes are relevant and reasonable in the circumstances at the date such statements are made. Although the Company has attempted to identify important factors that could cause actual results to differ materially from those contained in the forward-looking information, there may be other factors that cause results not to be as anticipated. There can be no assurance that such information will prove to be accurate, as actual results and future events could differ materially from those anticipated in such information. Accordingly, readers should not place undue reliance on forward-looking information. The Company does not undertake to update any forward-looking information, whether as a result of new information or future events or otherwise, except as may be required by applicable securities laws.

Figure 2: Drilling program highlights at the ELG Underground (Long Section)

Figure 3: Drilling along the El Limón Sur Trend highlights the potential for resource expansion at both the Sub-Sill South and El Limón Sur Deep deposits

Figure 4: Drilling at Sub-Sill demonstrates potential to expand resources outside of current resource shell

Figure 5: Drilling at El Limón West (~100 m west of El Limón Sur Deep) continues to support potential for a new zone of underground mineralization below the El Limón Sur open pit

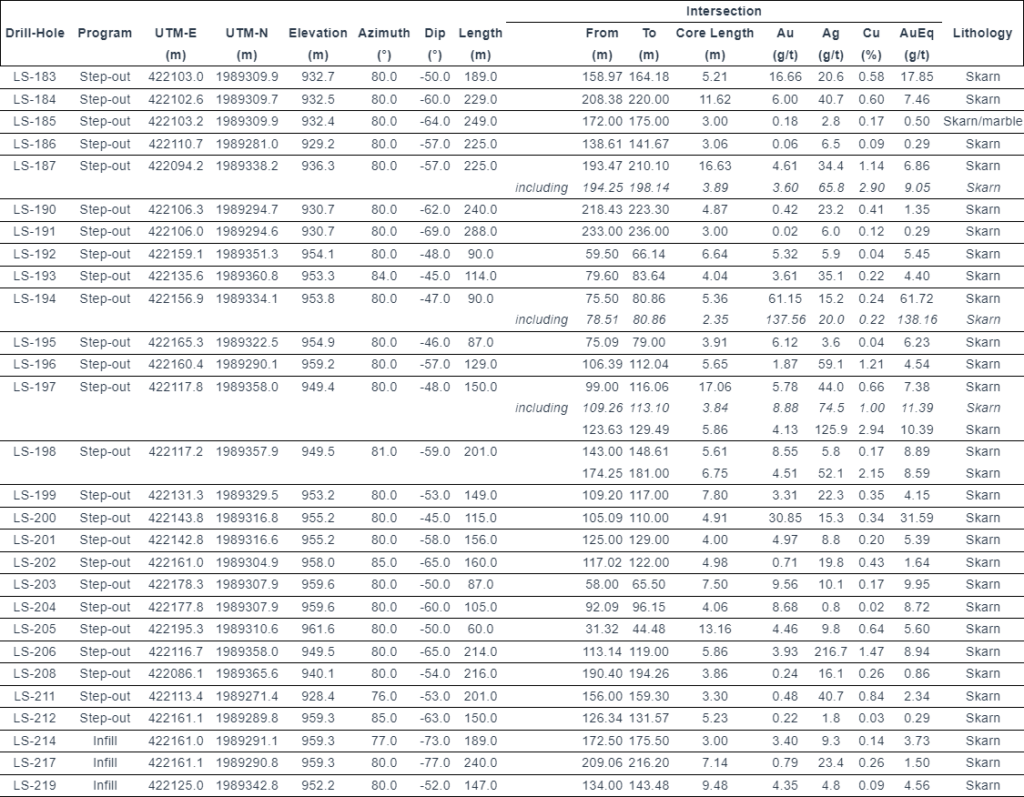

Table 1: Drill results from infill and step-out drilling to the south testing mineralization extensions at El Limón Sur Deep

Table 1: Drill results from infill and step-out drilling to the south testing mineralization extensions at El Limón Sur Deep (continued)

Notes to Table

1) Intersections are core lengths and do not represent true thickness of mineralized zones.

2) Core lengths subject to rounding.

3) Torex is not aware of any drilling, sampling, recovery, or other factors that could materially affect the accuracy or reliability of the data.

4) Gold equivalent (“AuEq”) grades use the same metal prices ($1,550/oz gold (“Au”), $20/oz silver (“Ag”) and $3.50/lb copper (“Cu”)) and metallurgical recoveries (90% Au, 86% Ag and 93% Cu) used in the Mineral Resource estimate for ELG Underground (AuEq (gpt) = Au (g/t) + Ag (gpt) * 0.0123 + Cu (%) * 1.6000).

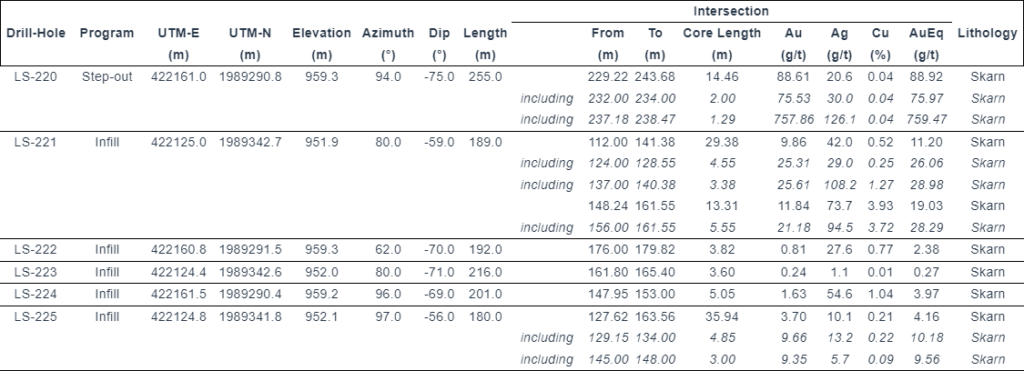

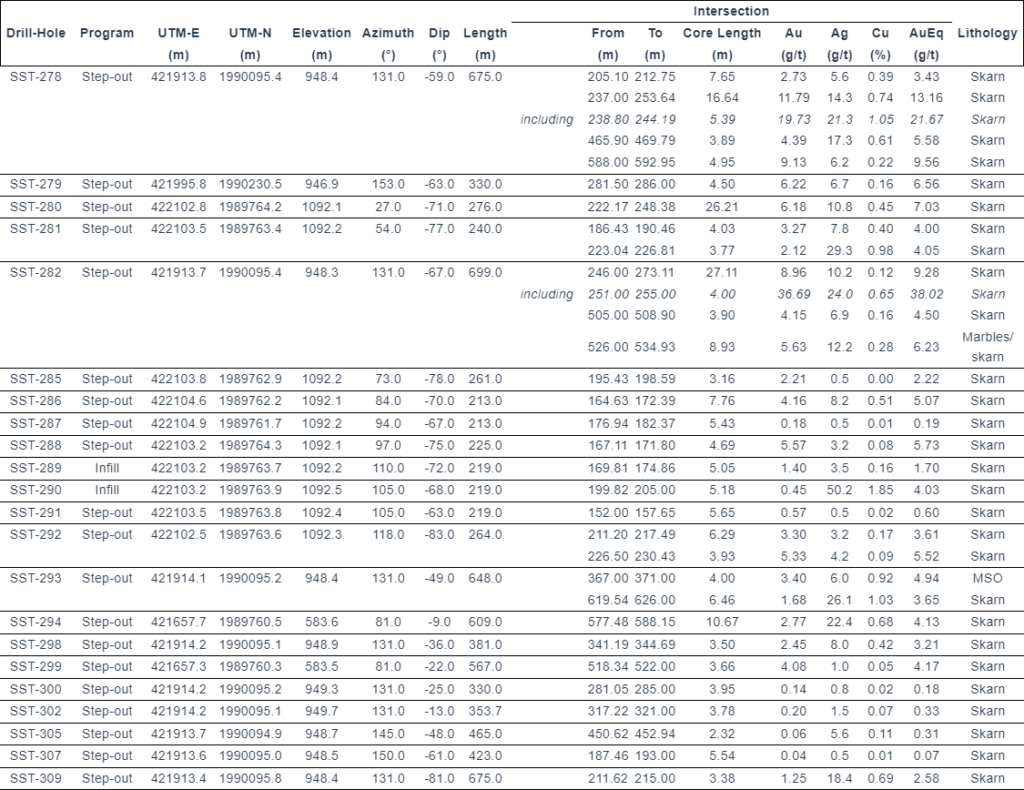

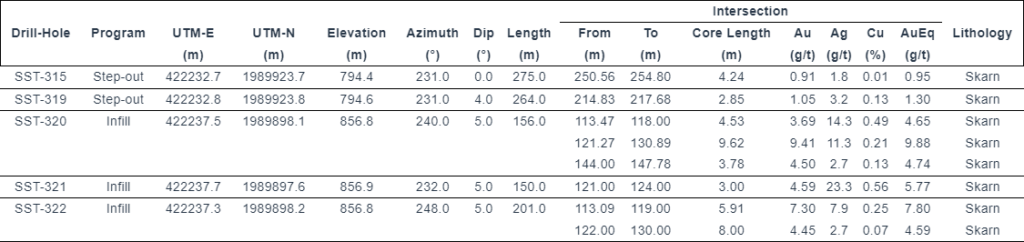

Table 2: Drill results from infill and step-out drilling to the north targeting underground mineralization at Sub-Sill South

Table 2: Drill results from infill and step-out drilling to the north targeting underground mineralization at Sub-Sill South (continued)

Notes to Table

1) Intersections are core lengths and do not represent true thickness of mineralized zones.

2) Core lengths subject to rounding.

3) Torex is not aware of any drilling, sampling, recovery, or other factors that could materially affect the accuracy or reliability of the data.

4) Gold equivalent (“AuEq”) grades use the same metal prices ($1,550/oz gold (“Au”), $20/oz silver (“Ag”) and $3.50/lb copper (“Cu”)) and metallurgical recoveries (90% Au, 86% Ag and 93% Cu) used in the Mineral Resource estimate for ELG Underground (AuEq (gpt) = Au (g/t) + Ag (gpt) * 0.0123 + Cu (%) * 1.6000).

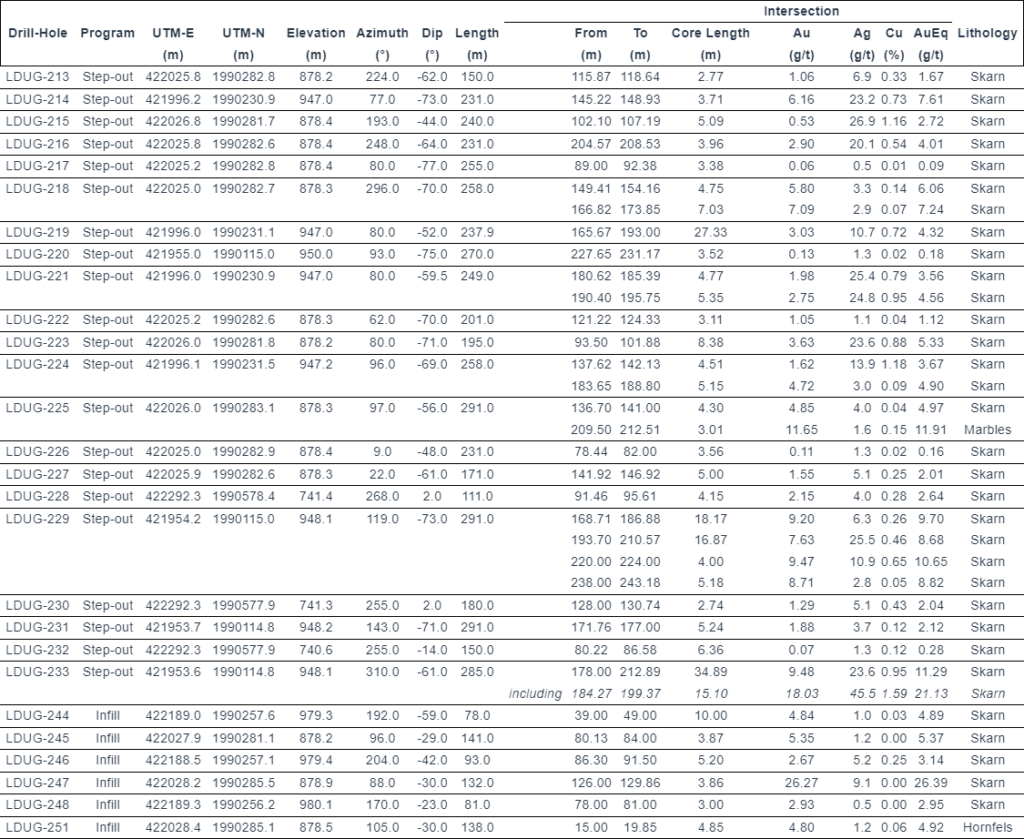

Table 3: Drill results from infill and step-out drilling to the southwest targeting mineralization extensions at ELD

Notes to Table

1) Intersections are core lengths and do not represent true thickness of mineralized zones.

2) Core lengths subject to rounding.

3) Torex is not aware of any drilling, sampling, recovery, or other factors that could materially affect the accuracy or reliability of the data.

4) Gold equivalent (“AuEq”) grades use the same metal prices ($1,550/oz gold (“Au”), $20/oz silver (“Ag”) and $3.50/lb copper (“Cu”)) and metallurgical recoveries (90% Au, 86% Ag and 93% Cu) used in the Mineral Resource estimate for ELG Underground (AuEq (gpt) = Au (g/t) + Ag (gpt) * 0.0123 + Cu (%) * 1.6000).

Table 4: Drill results from infill and step-out drilling to the north and south targeting mineralization at Sub-Sill

Notes to Table

1) Intersections are core lengths and do not represent true thickness of mineralized zones.

2) Core lengths subject to rounding.

3) Torex is not aware of any drilling, sampling, recovery, or other factors that could materially affect the accuracy or reliability of the data.

4) Gold equivalent (“AuEq”) grades use the same metal prices ($1,550/oz gold (“Au”), $20/oz silver (“Ag”) and $3.50/lb copper (“Cu”)) and metallurgical recoveries (90% Au, 86% Ag and 93% Cu) used in the Mineral Resource estimate for ELG Underground (AuEq (gpt) = Au (g/t) + Ag (gpt) * 0.0123 + Cu (%) * 1.6000).

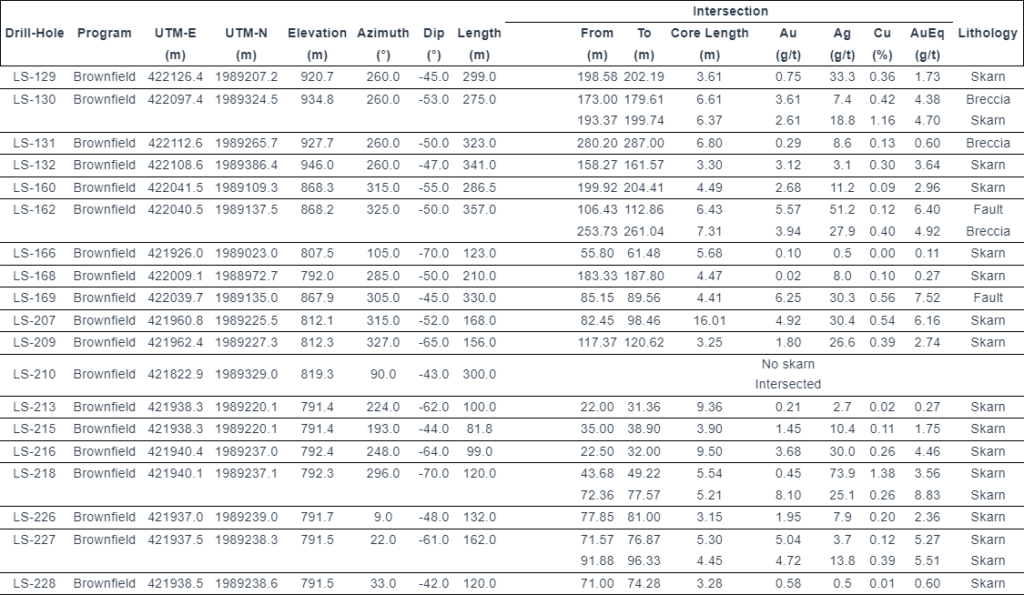

Table 5: Drill results from infill and step-out drilling targeting underground mineralization at El Limón West

Notes to Table

1) Intersections are core lengths and do not represent true thickness of mineralized zones.

2) Core lengths subject to rounding.

3) Torex is not aware of any drilling, sampling, recovery, or other factors that could materially affect the accuracy or reliability of the data.

4) Gold equivalent (“AuEq”) grades use the same metal prices ($1,550/oz gold (“Au”), $20/oz silver (“Ag”) and $3.50/lb copper (“Cu”)) and metallurgical recoveries (90% Au, 86% Ag and 93% Cu) used in the Mineral Resource estimate for ELG Underground (AuEq (gpt) = Au (g/t) + Ag (gpt) * 0.0123 + Cu (%) * 1.6000).

Original Article: https://www.globenewswire.com/news-release/2023/07/11/2702411/0/en/Torex-Gold-Reports-Positive-Drilling-Results-from-ELG-Underground.html