Highlights

- Mithril Resources Limited (Mithril) (ASX: MTH) (the Target) and Newrange Gold Corp. (Newrange) (the Bidder) are pleased to announce the execution of a binding Scheme Implementation Deed (SID) for the implementation of a Scheme of Arrangement under which Newrange will acquire 100% of the issued capital of Mithril resulting in Newrange remaining as the TSX Venture Exchange (TSXV) listed holding company (Merger).

- Mithril understands that the Merger, which is an arm’s length transaction, will be classified as a Reverse Take Over (RTO) under the rules of the TSXV and, if the Merger is completed, the resulting issuer will be a Tier 2 mining issuer.

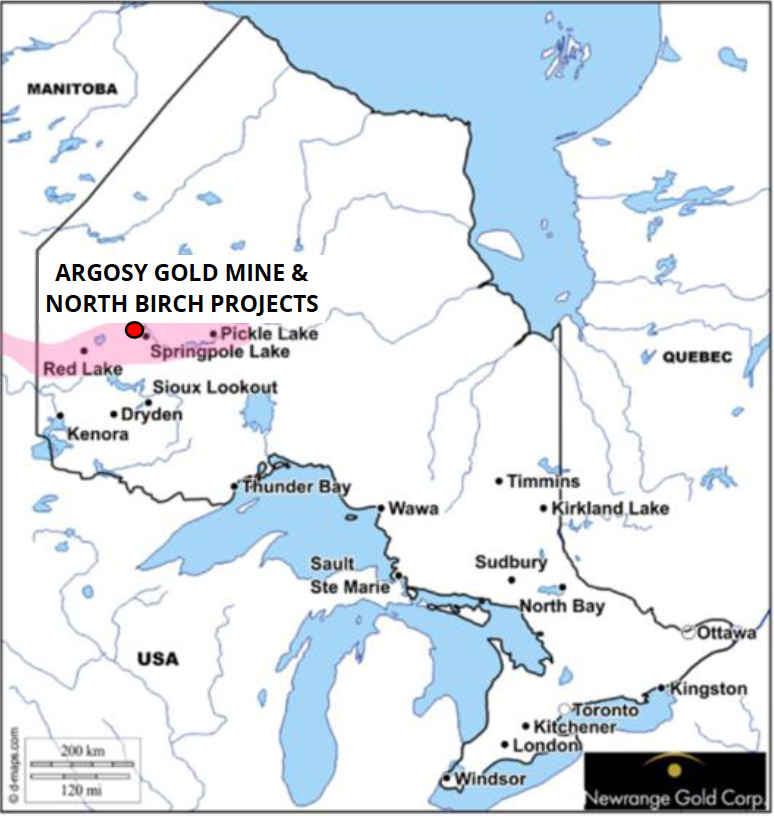

- Newrange is an exploration company listed on the TSXV with a current focus on two highly prospective gold projects in the Red Lake Mining Division of Northwestern Ontario, Canada.

- The Scheme Consideration is:

- 18.08 Newrange shares for every 1,000 Mithril shares held as at the Record Date for a total of 60,907,985 Newrange common shares at a deemed price of C$0.18 per share; and

- 18.08 Newrange warrants for every 1,000 Mithril options held as at the Record Date for a total of 3,164,000 Newrange warrants exercisable at C$0.77 and 3,874,286 Newrange warrants exercisable at C$0.36, implying a fully diluted equity value for Mithril of ~A$11.8 million.

- The Merger will be effected by way of a Share Scheme and an Option Scheme (together, the Schemes).

- The Schemes are unanimously recommended by the Mithril Board of Directors in the absence of a superior proposal and subject to the Independent Expert opining that the Schemes are in the best interests of Mithril shareholders and Mithril Optionholders (together, the Mithril Securityholders). The Schemes are also unanimously recommended by the Newrange Board of Directors.

- The SID contains various standard “no shop”, “no talk”, “notification” and “matching rights” provisions, with a break fee payable in certain circumstances.

- The Schemes are conditional on each other and are also subject to various conditions including approval by Mithril Securityholders at the Scheme Meetings proposed to be held in August 2023, and approval by Newrange shareholders at a meeting proposed to be held in August 2023.

Mithril CEO and Managing Director, John Skeet, commented:

“The Scheme announced today is an important step in the process to place Mithril’s high-grade Copalquin gold-silver property in a market where there is considerable experience and understanding of the globally significant Mexican minerals industry. The new Americas focussed exploration and development company resulting from the merger with TSXV listed Newrange creates highly experienced and focussed Board and management who are well positioned to take advantage of the considerable growth opportunities at the Copalquin mining district and the two Canadian Red Lake District properties. In both jurisdictions, the new company will be among numerous other Canadian listed companies active in these prolific mining regions where the properties are located. The merger, and resulting financing, will provide funds to appropriately advance the properties to increase shareholder value.

The Mithril Board is very pleased to be working with the Newrange Board and extremely proud of the hard work and achievements of Mithril’s Mexico team and the significant progress made in advancing the Copalquin Project to its current exploration and pre-development stages across the Copalquin district.”

Newrange President & CEO, Robert Archer, commented:

“We are very pleased to have entered into the Definitive Agreement with Mithril as this merger represents a new beginning for Newrange shareholders. Not only does the Copalquin Gold-Silver Project bring tremendous value and upside potential but the combined experience of the new management team and board will provide a strong foundation for future growth in the Americas.

Exploration and development in the prolific Red Lake District of Ontario is still active and we intend to capitalize on that with further work on our Argosy Gold Mine and North Birch Projects. Having projects in two leading mining jurisdictions such as Mexico and Canada provides diversity and lowers the risk for shareholders while increasing the discovery potential.

We look forward to completing the RTO process and rebranding the company for a fresh start at a time when precious metal prices are on the rise.”

TRANSACTION SUMMARY

Mithril and Newrange have executed a binding Scheme Implementation Deed (SID) pursuant to which Newrange will, subject to the Schemes, acquire 100% of the issued capital of Mithril.

If the Schemes are implemented, Mithril Securityholders on the Record Date will receive:

- in the case of Mithril Shareholders, 18.08 Newrange shares for every 1,000 Mithril shares held as at the Record Date for a total of 60,907,985 Newrange common shares at a deemed price of C$0.18 per share; and

- in the case of Mithril Optionholders, 18.08 Newrange warrants for every 1,000 Mithril options held as at the Record Date for a total of 3,164,000 Newrange warrants exercisable at C$0.77 and 3,874,286 Newrange warrants exercisable at C$0.36,

implying a fully diluted equity value for Mithril of ~A$11.8 million.1

Mithril understands that the Schemes, if they proceed, will be classified as a reverse takeover of Newrange Gold, under the rules of the TSXV.

If the Schemes are implemented, it is anticipated that:

- Mr. John Skeet will join the Newrange board and assume the role of President & CEO;

- Mr. Robert Archer (current director of Newrange) will become Executive Chairman of Newrange;

- Mr. Ron Schmitz and Mr. Colin Jones (current directors of Newrange) will remain on the board of Newrange;

- Mr. Stephen Layton and Mr. Garry Thomas will join the Newrange board; and

- David Cross will remain as CFO and Company Secretary of Newrange.

A summary of the qualifications and experience of the proposed Newrange board members is set out in Mithril’s initial announcement in relation to the Schemes released on 7 March 2023 at Non-binding term sheet for merger with TSXV Newrange Gold.

Further, it is anticipated that upon completion of the Schemes, Newrange will change its name to Pinnacle Silver and Gold Corp (or such other name as is determined by the newly appointed Newrange board).

MITHRIL BOARD RECOMMENDATION

The Mithril Board, comprised of two independent non-executive directors and one executive director, in consultation with its advisors, has carefully considered a range of matters including its view of the status of Mithril’s main asset, being the pre-development Copalquin District Project in Mexico, compared to the certainty for shareholders of this scrip-for-scrip offer.

Under a scheme of arrangement, the bidder and target must first reach agreement to then be able to provide target securityholders (Mithril Shareholders and Optionholders in this instance) with an opportunity to vote on the proposed scheme.

The Board of Mithril unanimously recommends that, in the absence of a superior proposal and subject to the Independent Expert (namely, RSM Corporate) opining that the Schemes are in the best interests of Mithril Securityholders, that Mithril Securityholders vote in favour of the Scheme.

In the absence of a superior proposal and subject to the favourable opinion of the Independent Expert, each of the directors of Mithril has committed to vote in favour of the Schemes in respect of the shares and options in which they have an interest.2

Details of the recommendation, commitment to vote in favour and a copy of the Independent Expert’s Report will be included in a Scheme Booklet expected to be provided to Mithril Securityholders in July 2023.

NEWRANGE BOARD RECOMMENDATION

Mithril understands that the Newrange Board has:

- unanimously recommended that Newrange shareholders vote in favour of the Scheme; and

- committed to vote in favour of the Schemes at the Newrange shareholder meeting.

A copy of the announcement in which the Newrange Board makes such recommendation and commitment can be found at Newrange’s website at https://newrangegold.com/news/news-releases/.

ABOUT NEWRANGE

Newrange is an exploration company listed on the TSXV, with a focus on district-scale exploration for precious metals in the prolific Red Lake District of north-western Ontario, Canada. The past-producing high-grade Argosy Gold Mine is open to depth, while the adjacent North Birch Project offers additional potential.

A summary of Newrange’s current projects was set out in Mithril’s initial announcement in relation to the Schemes on 7 March 2023 at Non-binding term sheet for merger with TSXV Newrange Gold

DETAILS OF THE SCHEME IMPLEMENTATION DEED (SID)

The SID will be subject to various conditions precedent, including:

- Each of Mithril and Newrange completing satisfactory due diligence enquiries into the records and operations of the other.

2 The directors of Mithril have an interest in a total of 919,653,650 securities in Mithril (comprising 803,463,174Mithril shares and 82,857,143 Mithril options), representing ~23% of Mithril (on a fully diluted basis). Mr. John Skeet, Managing Director of Mithril, holds 25,000,000 ESOP Options which may be exercised and converted into shares and Mr Garry Thomas, a non-executive director of Mithril, holds 33,333,333 Performance Rights, which may be converted into shares upon the earlier of determination by a geological consultant of an Inferred JORC Resource of 5.443 Mt at a combined Au Eq grade of not less than 4 g/t for 700 koz Au (or Au Eq) on the Copalquin Project; or Mithril achieving a market capitalisation equal to or greater than A$150,000,000 for a period of 20 consecutive trading days on which the securities of Mithril traded. The ESOP Options and Performance Rights do not form part of the Schemes and will be subject to a private treaty agreement pursuant to which these securities will either vest (and result in the issue of Mithril shares), lapse, be acquired by Newrange, or otherwise be cancelled or terminated. Despite any of the directors’ personal interests in the outcome of the Schemes, the directors consider that given the importance of the Schemes and their obligations as directors, it is important and appropriate for them to provide a recommendation to Mithril Securityholders in relation to the Schemes.

- Arrangements being made so that all of the existing employee options and performance rights in the capital of Mithril will either be acquired by Newrange, vest (and result in the issue of Mithril shares), lapse or otherwise be cancelled or terminated.

- The Independent Expert concluding that the Schemes are in the best interests of Mithril Securityholders and not changing that conclusion prior to completion.

- All necessary regulatory and government approvals being obtained, including approvals from both the ASX and the TSXV.

- The Court making an order for Mithril to convene the Scheme Meetings.

- The requisite majority of Mithril Securityholders approving the Schemes at a duly convened Scheme Meetings.

- The Newrange shareholders approving the Schemes and a 2:1 consolidation of Newrange shares at

Newrange’s shareholder meeting.

- The Court ordering that the Schemes be implemented (assuming the Mithril Securityholders approve the Schemes at the Scheme Meetings).

- Newrange completing a private placement to raise up to CA$3,600,000, to be used for further exploration and development of the Copalquin Project and working capital (Concurrent Financing) prior to completion of the Schemes.3

- Newrange receiving approval from the TSXV to recommence trading of its securities post-completion of the Schemes.

- The TSXV approving an updated National Instrument 43-101 technical report on the Copalquin Project.

- Other conditions customary for a transaction of this nature.

Full details of the conditions are set out in the SID which is attached as Appendix A to this announcement.

The Company notes that, until due diligence is completed, and the conditions precedent are satisfied, there is no certainty that the Schemes will proceed.

EXCLUSIVITY ARRANGEMENTS

The SID contains various standard “no shop”, “no talk”, “notification” and “matching rights” provisions. Mithril has agreed that it will not solicit any competing proposal or participate in any discussions or negotiations in relation to any competing proposal (unless failure to do so would involve a breach of the fiduciary duties of its directors).

The SID also details circumstances under which Mithril may be required to pay a break fee to Newrange and circumstances where Newrange may be required to pay Mithril a reverse break fee, both equivalent to approximately A$110,000 and payable in certain circumstances.

INDICATIVE TIMETABLE

Mithril Securityholders do not need to take any action at this time.

Shareholders and Optionholders of Mithril will be asked to approve the Schemes at the Scheme Meetings which are expected to be held in August 2023. Further details of the Schemes, transaction terms and recommendations will be provided to Mithril Securityholders through a Scheme Booklet which will include the Independent Expert’s Report.

3 The Newrange Bridge Financing referenced in the Mithril’s initial announcement in relation to the Scheme on 7 March 2023 has been completed. Further information regarding the Bridge Financing and the Concurrent Financing can be found in Newrange’s recent market announcements on the company’s website at https://newrangegold.com/news/news-releases/.

An indicative timetable for the implementation of the Schemes is set out below:

| Event | Date |

| Mithril submits draft Scheme Booklet to ASIC | Mid June 2023 |

| Newrange submits draft Newrange Information Circular to the TSXV | Mid June 2023 |

| First Court Date | Late June 2023 |

| Mithril sends Scheme Booklet to Mithril Shareholders and Mithril Optionholders | Early July 2023 |

| Newrange sends Newrange Information Circular to Newrange Shareholders | Early July 2023 |

| Scheme Meetings | Early August 2023 |

| Newrange Shareholder Meeting | Early August 2023 |

| Newrange Consolidation: completion of 2:1 consolidation | Any time up to completion of the Concurrent Financing |

| Concurrent Financing | By the Delivery Time on the Second Court Date |

| Second Court Date | Late August 2023 |

| Effective Date | Early September 2023 |

| Record Date for Scheme | The second Business Day after the Effective Date |

| Implementation Date | The fifth Business Day after the Record Date |

Note: this timetable is indicative and may be subject to change.

ADVISORS

Mithril has appointed HopgoodGanim Lawyers as Australian legal advisor and Armstrong Simpson as Canadian legal advisor.

Newrange has appointed Steinepreis Paganin as Australian legal advisor and Pacific Star Corporate Finance Law as Canadian legal advisor

About Newrange Gold:

Newrange Gold Corp. is an exploration company listed on the TSXV, with a focus on district-scale exploration for precious metals in the prolific Red Lake District of north-western Ontario. The past-producing high-grade Argosy Gold Mine is open to depth, while the adjacent North Birch Project offers additional potential.

The 100% owned North Birch Gold Project comprises approximately 3,850 hectares and lies in the north- western corner of the Birch-Uchi Greenstone Belt in the Red Lake Mining Division of north-western Ontario, roughly 110 kilometres northeast of the town of Red Lake. It is presently accessible by air only, but road access is improving as logging roads and an all-weather road to the Springpole Gold Project, 12 kilometres to the southeast, are pushing farther north. In the summer, float planes are available from Red Lake, Sioux Lookout and Ear Falls. In the winter, fixed wing aircraft equipped with skis for landing on the frozen lakes are available in Red Lake and Sioux Lookout. Helicopters are also available year-round from Red Lake and Kenora.

The Birch-Uchi Belt is considered to have similar geology to the Red Lake Belt but has seen less exploration and is about three times larger. The North Birch Project covers a geological setting identified from airborne magnetic surveys (Ontario Geological Survey and AurCrest Gold) and interpreted as being a favourable environment for gold mineralisation. Specifically, the Property covers an intensely folded and sheared iron formation that is similar in appearance to the one hosting Newmont Goldcorp’s Musselwhite Mine (past production, reserves and resources exceed 8 million ounces Au), some 190 kilometres to the northeast. In addition, the stratigraphy underlying the bulk of both properties is interpreted as Cycle I volcanics, which are thought by some workers to be equivalent to the Balmer Assemblage, host of the prolific Campbell/Red Lake gold orebody (more than 20 million ounces gold in past production and reserves) in the adjacent Red Lake Greenstone Belt.

Minimal previous exploration has been conducted on the North Birch Property, largely because it lies at the limits of government mapping. However, the past-producing Argosy Gold Mine is only about four kilometres from the southeast boundary of the property and the Richardson Lake deposit lies just 2.5 kilometres north of Argosy. Gold mineralisation at Argosy is hosted by what appears to be a set of extensional veins related to a north-south structure. Veining in iron formation at Richardson Lake is of a similar style, while gold-bearing pyritic quartz veins in iron formation have been reported elsewhere in the vicinity of the Property.

The 100% owned Argosy Gold Mine is situated in the northern part of the Birch-Uchi Greenstone Belt of the Superior Province of the Precambrian Shield. The Birch-Uchi Belt lies between the prolific Red Lake and Pickle Lake Greenstone Belts and contains similar geology. Located 110 kilometres east-northeast of Red Lake, the property hosts the most significant past-producing gold mine in the Birch-Uchi Belt. It also lies just 10 kilometres northwest of the Springpole Deposit being advanced by First Mining Gold Corp. (4.7 million ounces Au in Indicated resources). Newrange owns a 100% interest in the Argosy Gold Mine Property, subject to a 2.5% NSR. The property consists of 43 patented claims and 17 Mining Licences of Occupation comprising 604 hectares.

The Argosy (formerly Jason) Gold Mine was mined between 1931 and 1952 and produced 101,875 ounces of gold and minor amounts of silver from 276,573 tons of ore at an average grade of 0.37 ounces per ton (12.7 g/t) Au. The mine was only developed to a depth of 900 feet (270 metres), however, and although developed ore reserves had been exhausted at the time the mine closed, it is known that high-grade gold mineralization extends below the old workings. The property lay dormant until 1974 and has been only intermittently explored since.

Diamond drilling in October 2002 by a previous operator confirmed the extension of the gold mineralization below the old workings.

The property is underlain by a drag-folded sequence of mafic and intermediate volcanics, greywacke and iron formation. Carbonate and sericite alteration occur over an area of about 3km x 3km. A large body of quartz porphyry occurs on the southern portion of the property and related dykes are found intruding the volcanic and

sedimentary rocks. Quartz veins mineralized with sulphides and gold occur in north-south trending fractures dipping westward between 30 and 85 degrees.

There is exceptional exploration potential on the property and Newrange will be completing a 3D model from previous data in order to mount an exploration program to further demonstrate the continuity of gold mineralisation to depth.

Further information regarding Newrange Gold, including the background of the company’s current Board and Management, can be found on its website at www.newrangegold.com

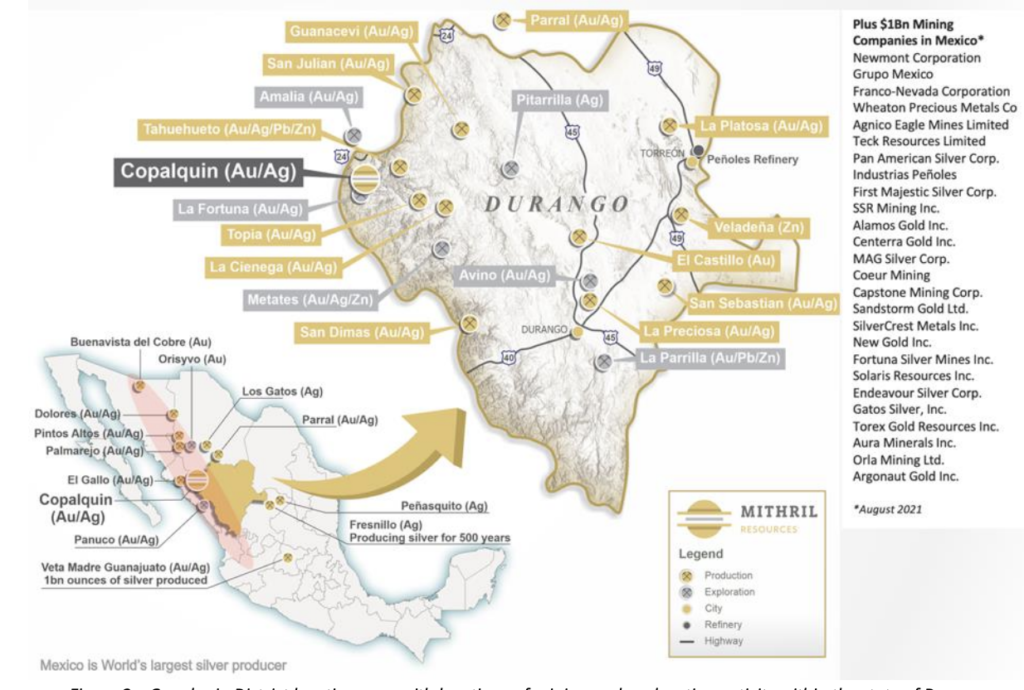

ABOUT THE COPALQUIN GOLD SILVER PROJECT

The Copalquin mining district is located in Durango State, Mexico and covers an entire mining district of 70km2 containing several dozen historic gold and silver mines and workings, ten of which had notable production. The district is within the Sierra Madre Gold Silver Trend which extends north-south along the western side of Mexico and hosts many world-class gold and silver deposits.

Multiple mineralisation events, young intrusives thought to be system-driving heat sources, widespread alteration together with extensive surface vein exposures and dozens of historic mine workings, identify the Copalquin mining district as a major epithermal centre for Gold and Silver.

Within 15 months of drilling in the Copalquin District, Mithril delivered a maiden JORC mineral resource estimate demonstrating the high-grade gold and silver resource potential for the district. This maiden resource is detailed below (see ASX release 17 November 2021)^.

- 2,416,000 tonnes @ 4.80 g/t gold, 141 g/t silver for 373,000 oz gold plus 10,953,000 oz silver (Total 529,000 oz AuEq*) using a cut-off grade of 2.0 g/t AuEq*

- 28.6% of the resource tonnage is classified as indicated

| Tonnes (kt) | Tonnes (kt) | Gold (g/t) | Silver (g/t) | Gold Equiv.* (g/t) | Gold (koz) | Silver (koz) | Gold Equiv.* (koz) | |

| El Refugio | Indicated | 691 | 5.43 | 114.2 | 7.06 | 121 | 2,538 | 157 |

| Inferred | 1,447 | 4.63 | 137.1 | 6.59 | 215 | 6,377 | 307 | |

| La Soledad | Indicated | – | – | – | – | – | – | – |

| Inferred | 278 | 4.12 | 228.2 | 7.38 | 37 | 2,037 | 66 | |

| Total | Indicated | 691 | 5.43 | 114.2 | 7.06 | 121 | 2,538 | 157 |

| Inferred | 1,725 | 4.55 | 151.7 | 6.72 | 252 | 8,414 | 372 | |

| TOTAL | 2,416 | 4.80 | 141 | 6.81 | 373 | 10,953 | 529 |

Table 1 – Mineral resource estimate El Refugio – La Soledad using a cut-off grade of 2.0 g/t AuEq*

* The gold equivalent (AuEq.) values are determined from gold and silver values and assume the following: AuEq. = gold equivalent calculated using and gold:silver price ratio of 70:1. That is, 70 g/t silver = 1 g/t gold. The metal prices used to determine the 70:1 ratio are the cumulative average prices for 2021: gold USD1,798.34 and silver: USD25.32 (actual is 71:1) from kitco.com. Metallurgical recoveries are assumed to be approximately equal for both gold and silver at this early stage. Actual metallurgical recoveries from test work to date are 96% and 91% for gold and silver, respectively. In the Company’s opinion there is reasonable potential for both gold and silver to be extracted and sold. Actual metal prices have not been used in resource estimate, only the price ratio for the AuEq reporting.

* The information in this report that relates to Mineral Resources or Ore Reserves is based on information provided in the following ASX announcement: 17 Nov 2021- MAIDEN JORC RESOURCE 529,000 OUNCES @ 6.81G/T (AuEq*), which includes the full JORC MRE report, also available on the Mithril Resources Limited Website.

The Company confirms that it is not aware of any new information or data that materially affects the information included in the original market announcement and that all material assumptions and technical parameters underpinning the estimates in the relevant market announcement continue to apply and have not materially changed. The company confirms that the form and context in which the Competent Person’s findings are presented have not been materially modified from the original market announcement.

Mining study and metallurgical test work supports the development of the El Refugio-La Soledad resource with conventional mining methods indicated as being appropriate and with high gold-silver recovery to produce metal on-site with conventional processing.

Mithril is currently exploring in the Copalquin District to expand the resource footprint, demonstrating its multi- million-ounce gold and silver potential.

Mithril has an exclusive option to purchase 100% interest in the Copalquin mining concessions by paying US$10M on or any time before 7 August 2026 (option has been extended by 3 years).

–ENDS-

Released with the authority of the Board. For further information contact:

| John Skeet Managing Director and CEO jskeet@mithrilresources.com.au +61 435 766 809 | Mark Flynn Investor Relations mflynn@mithrilresources.com.au +61 416 068 733 |