all financial figures are in US dollars, unless otherwise indicated

Vancouver, British Columbia–(Newsfile Corp. – May 2, 2023) – Equinox Gold Corp. (TSX: EQX) (NYSE American: EQX) (“Equinox Gold” or the “Company”) is pleased to announce its first quarter 2023 summary financial and operating results. The Company’s unaudited condensed consolidated interim financial statements and related management’s discussion and analysis (“MD&A”) for the three months ended March 31, 2023 will be available for download on the Company’s profile on SEDAR at www.sedar.com, on EDGAR at www.sec.gov/edgar and on the Company’s website at www.equinoxgold.com. The Company will host a conference call and webcast on May 3, 2023 commencing at 7:30 am Vancouver time to discuss the Company’s first quarter results and activities underway at the Company’s projects. Further details are provided at the end of this news release.

Greg Smith, President and CEO of Equinox Gold, commented: “Equinox Gold had a good start to the year, in terms of both development and operations. Greenstone construction continues to progress on time and on budget for first gold pour in the first half of 2024. We successfully strengthened our balance sheet, substantially increasing our cash position and ending Q1 2023 with over $410 million in available cash and credit. Permitting for the expansion of our Castle Mountain mine is progressing well and the feasibility study for the addition of an underground mine at Aurizona is nearing completion for release mid-year. Further, we have continued to achieve strong performance on our safety and environmental targets, and gold production and costs during the quarter have us well positioned to achieve our 2023 guidance.”

HIGHLIGHTS FOR THE THREE MONTHS ENDED MARCH 31, 2023

Operational

- Produced 122,746 ounces of gold

- Sold 123,295 ounces of gold at an average realized gold price of $1,895 per oz

- Total cash costs of $1,376 per oz and AISC of $1,658 per oz(1)

- One lost-time injury, total recordable injury frequency rate(2) of 0.81 for the Quarter (1.38 rolling 12-month)

- Total significant environmental incident frequency rate(2) of 0.20 for the Quarter (0.59 rolling 12-month)

Earnings

- Earnings from mine operations of $14.5 million

- Net income of $17.4 million or $0.06 per share (basic)

- Adjusted net loss of $8.2 million or $0.03 per share(1)(3)

Financial

- Cash flow from operations before changes in non-cash working capital of $195.4 million ($143.4 million after changes in non-cash working capital)

- Adjusted EBITDA of $57.0 million(1)(3)

- Sustaining expenditures of $32.5 million and non-sustaining expenditures of $95.0 million

- Cash and cash equivalents (unrestricted) of $284.9 million at March 31, 2023

- Net debt(1) of $547.8 million at March 31, 2023

Corporate

- Provided 2023 production and cost guidance of 555,000 to 625,000 ounces of gold at cash costs of $1,355 to $1,460 per oz and AISC of $1,575 to $1,695 per oz(1)

- In March 2023, entered into a gold forward sale and prepay arrangement, receiving an upfront gross payment of $140.0 million ($139.5 million net of fees), based on gold forward curve prices averaging approximately $2,170 per ounce, in exchange for equal monthly deliveries of gold from any of the Company’s mines from October 2024 to July 2026 totaling 79,310 ounces

- During the Quarter, sold 12.0 million common shares of the Company’s investment in Solaris Resources Inc. for gross proceeds of $53.3 million (C$71.8 million)

- In March 2023, sold 11.6 million shares of the Company’s investment in i-80 Gold Corp. (“i-80 Gold”) for gross proceeds of $23.7 million (C$32.0 million) and 11,600,000 half warrants, with each whole warrant exercisable to purchase one share of i-80 Gold from Equinox Gold for C$3.45 until March 31, 2024 for potential proceeds of C$20.0 million; as a result of the sale, Equinox Gold’s ownership has decreased to 19.95% of i-80 Gold’s issued and outstanding common shares

- In January 2023, entered into gold collar contracts with an average put strike price of $1,900 per ounce and an average call strike price of $2,065 per ounce, for 10,644 ounces per month beginning February 2023 through to March 2024

- In March 2023, signed a non-binding term sheet with Sandbox Royalties Corp. for a gold purchase and sale arrangement (the “Sandbox Arrangement”) for up to $75 million. Finalization of the Sandbox Arrangement is subject to lender consent and successful intercreditor discussions

- For the three months ended March 31, 2023, the Company issued 4,369,615 common shares under the ATM Program at a weighted average share price of $3.88 per common share for total gross proceeds of $16.9 million. No shares have been issued under the program since the end of January 2023

Construction, development and exploration

- Advanced Greenstone construction with the following achieved as of March 31, 2023:

– Greenstone had achieved 3 million hours worked with no lost-time injuries

– Greenstone was 73% complete and on track to pour gold in H1 2024

– Spent $83.8 million of non-sustaining capital (Equinox Gold’s 60% share)

– All buildings had been enclosed and heated as planned

– Installation of the two ball mills commenced on schedule

– Leach tank installation was completed and access on the bridge was finalized and secured

– Advanced mechanical installation of the secondary crusher, pre-leach thickener and conveyors

Responsible Mining

- In February 2023, published the Company’s inaugural Climate Action Report in alignment with the Task Force on Climate Related Financial Disclosures (TCFD), and committed to reducing the Company’s greenhouse gas emissions by 25% by 2030, compared to forecast “business-as-usual” emissions if no intervention measures were taken

RECENT DEVELOPMENTS

- In April 2023, the Company entered into gold collar contracts with an average put strike price of $1,950 per ounce and an average call strike price of $2,250 per ounce, for 3,050 ounces per month beginning April 2023 through to March 2024

_____________________________

(1) Cash costs per oz sold, AISC per oz sold, adjusted net income, adjusted EBITDA, adjusted earnings per share (“EPS”) and net debt are non-IFRS measures. See Non-IFRS Measures and Cautionary Notes.

(2) Total recordable injury frequency rate and significant environmental incident frequency rate are both reported per million hours worked. Total recordable injury frequency rate is the total number of injuries excluding those requiring simple first aid treatment.

(3) Primary adjustments for the three months ended March 31, 2023 relate to a $34.5 million gain on sale of partial interest and reclassification of investment in i-80 Gold, a $13.1 million unrealized gain on foreign exchange contracts, and a $16.0 million share of net loss on investment in associate.

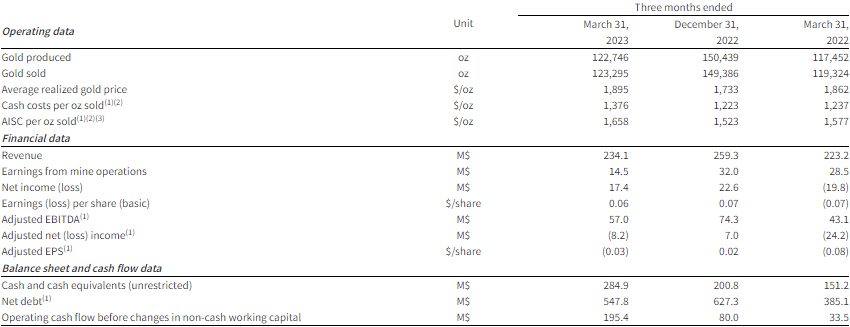

CONSOLIDATED OPERATIONAL AND FINANCIAL HIGHLIGHTS

(1) Cash costs per oz sold, AISC per oz sold, adjusted EBITDA, adjusted net income (loss), adjusted EPS and net debt are non-IFRS measures. See Non-IFRS Measures and Cautionary Notes.

(2) Consolidated cash cost per oz sold and AISC per oz sold for the three months ended March 31, 2022 excludes Santa Luz results while the mine was in pre-commercial production up until the achievement of commercial production at the end of Q3 2022.

(3) Consolidated AISC per oz sold excludes corporate general and administration expenses.

(4) Numbers may not sum due to rounding.

In Q1 2023 the Company sold 3% more gold ounces compared to Q1 2022 primarily due to the contribution of production from Santa Luz, which achieved commercial production at the end of Q3 2022, and higher production at Aurizona, offset partially by no production at Mercedes, which was sold in April 2022. Compared to Q1 2022, gold sales at Aurizona were 12% higher due to higher grades and mill throughput.

In Q1 2023, earnings from mine operations were $14.5 million compared to $28.5 million in Q1 2022. The decrease in earnings from mine operations compared to Q1 2022 was primarily due to no earnings from mine operations at Mercedes, as well as lower earnings from mine operations at Mesquite and Castle Mountain, driven by lower production, and at Aurizona, driven by higher operating costs related to the impact of a contract renewal with the current mining contractor, which reflects the increasing cost of operations, offset partially by higher earnings from mine operations at Los Filos, driven by higher production.

Net income in Q1 2023 increased to $17.4 million compared to a net loss of $19.8 million in Q1 2022. The higher net income was mainly due to other income of $31.9 million in Q1 2023 compared to other expense of $19.0 million in Q1 2022, offset partially by lower earnings from mine operations. Other income for Q1 2023 includes a $34.5 million gain on the sale of the Company’s partial interest and reclassification of investment in i-80 Gold.

In Q1 2023, adjusted EBITDA was $57.0 million compared to $43.1 million in Q1 2022, and adjusted net loss was $8.2 million compared to adjusted net loss of $24.2 million in Q1 2022. Adjusted EBITDA increased and adjusted net loss decreased in Q1 2023 compared to Q1 2022 primarily due to a realized loss on gold contracts in Q1 2022 compared to a realized gain on gold contracts in Q1 2023, offset partially by lower earnings from mine operations compared to Q1 2022.

Sustaining and non-sustaining expenditures totaled $32.5 million and $95.0 million, respectively, for the three months ended March 31, 2023. Sustaining and non-sustaining expenditures are broken down by mine site in the MD&A.

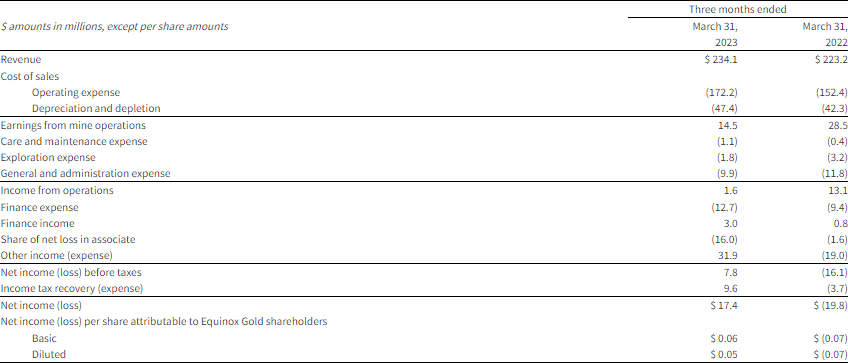

SELECTED FINANCIAL RESULTS FOR THE THREE MONTHS ENDED MARCH 31, 2023 AND 2022

Additional information regarding the Company’s financial and operating results is available in the Company’s Q1 2023 Financial Statements and accompanying MD&A for the three months ended March 31, 2023, which will be available for download on the Company’s website at www.equinoxgold.com, on SEDAR at www.sedar.com and on EDGAR at www.sec.gov/edgar.

CONFERENCE CALL AND WEBCAST

Equinox Gold will host a conference call and webcast on Wednesday, May 3, 2023 commencing at 7:30 am Vancouver time to discuss the Company’s first quarter results and activities underway at the Company. All participants will have the opportunity to ask questions of Equinox Gold’s CEO and executive team. The webcast will be archived on Equinox Gold’s website until November 3, 2023.

Conference call

Toll-free in U.S. and Canada: 1-800-319-4610

International callers: +1 604-638-5340

Webcast

www.equinoxgold.com

ABOUT EQUINOX GOLD

Equinox Gold is a growth-focused Canadian mining company with seven operating gold mines, construction underway at a new project, and a path to achieve more than one million ounces of annual gold production from a pipeline of development and expansion projects. Equinox Gold’s common shares are listed on the TSX and the NYSE American under the trading symbol EQX. Further information about Equinox Gold’s portfolio of assets and long-term growth strategy is available at www.equinoxgold.com or by email at ir@equinoxgold.com.

EQUINOX GOLD CONTACTS

Greg Smith, President & Chief Executive Officer

Rhylin Bailie, Vice President, Investor Relations

Tel: +1 604-558-0560

Email: ir@equinoxgold.com

NON-IFRS MEASURES

This news release refers to cash costs, cash costs per oz sold, AISC, AISC per oz sold, AISC contribution margin, adjusted net income, adjusted EPS, mine-site free cash flow, adjusted EBITDA, net debt, and sustaining capital expenditures that are measures with no standardized meaning under IFRS, i.e. they are non-IFRS measures, and may not be comparable to similar measures presented by other companies. Their measurement and presentation is consistently prepared and is intended to provide additional information and should not be considered in isolation or as a substitute for measures of performance prepared in accordance with IFRS. Numbers presented in the tables below may not sum due to rounding.

Cash costs and cash costs per oz sold

Cash costs is a common financial performance measure in the gold mining industry; however, it has no standard meaning under IFRS. The Company reports total cash costs on a per oz sold basis. The Company believes that, in addition to conventional measures prepared in accordance with IFRS, certain investors use this information to evaluate the Company’s performance and ability to generate operating income and cash flow from mining operations. Cash costs are calculated as mine site operating costs plus the principal portion of lease payments and are net of silver by-product credits. Cash costs are divided by ounces sold to arrive at cash costs per oz sold. In calculating cash costs, the Company includes silver by-product credits as it considers the cost to produce the gold is reduced as a result of the by-product sales incidental to the gold production process, thereby allowing management and other stakeholders to assess the net costs of gold production. The measure is not necessarily indicative of cash flow from operations under IFRS or operating costs presented under IFRS.

AISC per oz sold

The Company uses AISC per oz of gold sold to measure performance. The methodology for calculating AISC was developed internally and is calculated below. Current IFRS measures used in the gold industry, such as operating expenses, do not capture all of the expenditures incurred to discover, develop and sustain gold production. The Company believes the AISC measure provides further transparency into costs associated with producing gold and will assist analysts, investors and other stakeholders of the Company in assessing its operating performance, its ability to generate free cash flow from current operations and its overall value. AISC includes cash costs (described above) and also includes sustaining capital expenditures, reclamation cost accretion and amortization and exploration and evaluation costs. This measure seeks to reflect the full cost of gold production from current operations, therefore, expansionary capital and non-sustaining expenditures are excluded.

The following table provides a reconciliation of cash costs per oz of gold sold and AISC per oz of gold sold to the most directly comparable IFRS measure on an aggregate basis.

| $’s in millions, except ounce and per oz figures | Three months ended | ||

| March 31, 2023 | December 31, 2022 | March 31, 2022 | |

| Gold ounces sold | 123,295 | 149,386 | 119,324 |

| Santa Luz gold ounces sold(1) | – | – | (210) |

| Adjusted gold ounces sold | 123,295 | 149,386 | 119,114 |

| Operating expense | $ 172.2 | $ 168.2 | $ 152.4 |

| Lease payments | 3.8 | 2.5 | 2.4 |

| Silver by-product credits | (0.3) | (0.2) | (1.0) |

| Fair value adjustment on acquired inventories | (5.9) | 12.2 | (5.9) |

| Santa Luz operating expense(1) | – | – | (0.4) |

| Total cash costs | $ 169.7 | $ 182.7 | $ 147.3 |

| Cash costs per gold oz sold | $ 1,376 | $ 1,223 | $ 1,237 |

| Total cash costs | $ 169.7 | $ 182.7 | $ 147.3 |

| Sustaining capital | 32.5 | 43.1 | 37.1 |

| Reclamation expense | 2.2 | 1.8 | 2.4 |

| Sustaining exploration expense | – | – | 1.0 |

| Total AISC | $ 204.4 | $ 227.6 | $ 187.8 |

| AISC per oz sold | $ 1,658 | $ 1,523 | $ 1,577 |

(1) Consolidated cash cost per oz sold and AISC per oz sold for the three months ended March 31, 2022 excludes Santa Luz results while the mine was in pre-commercial production up until the achievement of commercial production at the end of Q3 2022.

Sustaining capital expenditures

Sustaining capital expenditures are defined as those expenditures which do not increase annual gold ounce production at a mine site and excludes all expenditures at the Company’s projects and certain expenditures at the Company’s operating sites which are deemed expansionary. Sustaining capital expenditures can include, but are not limited to, capitalized stripping costs at open pit mines, underground mine development, mining and milling equipment and TSF raises.

The following table provides a reconciliation of sustaining capital expenditures to the Company’s total capital expenditures for continuing operations.

| Three months ended | |||

| $’s in millions | March 31, 2023 | December 31, 2022 | March 31, 2022 |

| Capital additions to mineral properties, plant and equipment(1) | $ 154.5 | $ 163.2 | $ 129.1 |

| Less: Non-sustaining capital at operating sites | (4.6) | (10.8) | (30.3) |

| Less: Non-sustaining capital at development projects | (91.1) | (103.4) | (60.4) |

| Less: Capital expenditures – corporate | (0.1) | – | (0.1) |

| Less: Other non-cash additions(2) | (26.1) | (5.9) | (1.2) |

| Sustaining capital expenditures | $ 32.5 | $ 43.1 | $ 37.1 |

(1) Per note 5 of the condensed consolidated interim financial statements. Capital additions are exclusive of non-cash changes to reclamation assets arising from changes in discount rate and inflation rate assumptions in the reclamation provision.

(2) Non-cash additions include right-of-use assets associated with leases recognized in the period, capitalized depreciation for deferred stripping activities, and capitalized non-cash share-based compensation.

Total mine-site free cash flow

Mine-site free cash flow is a non-IFRS financial performance measure. The Company believes this measure is a useful indicator of its ability to operate without reliance on additional borrowing or usage of existing cash. In calculating total mine-site free cash flow, the Company excludes the impact of fair value adjustments on acquired inventories as these adjustments do not impact cash flow from operating mine sites. Mine-site free cash flow is intended to provide additional information only and does not have any standardized meaning under IFRS and may not be comparable to similar measures of performance presented by other mining companies. Mine-site free cash flow should not be considered in isolation or as a substitute for measures of performance prepared in accordance with IFRS.

Prior to Q1 2023, mine-site free cash flow was calculated inclusive of fair value adjustments on acquired inventories. The calculation of mine-site free cash flow for comparative periods has been adjusted to conform with the current methodology and is different from the measure previously reported.

The following table provides a reconciliation of mine-site free cash flow to the most directly comparable IFRS measure on an aggregate basis:

| Three months ended | |||

| $’s in millions | March 31, 2023 | December 31, 2022 | March 31, 2022 |

| Operating cash flow before non-cash changes in working capital | $ 195.4 | $ 80.0 | $ 33.5 |

| Fair value adjustments on acquired inventories | 5.9 | (12.2) | 5.9 |

| Operating cash flow (generated) used by non-mine site activity(1) | (138.3) | 7.4 | 33.2 |

| Cash flow from operating mine sites | $ 63.0 | $ 75.2 | $ 72.6 |

| Mineral property, plant and equipment additions | $ 154.5 | 163.2 | 129.1 |

| Less: Capital expenditures relating to development projects and corporate and other non-cash additions | (117.3) | (109.3) | (61.7) |

| Capital expenditure from operating mine sites | 37.1 | 53.9 | 67.3 |

| Lease payments related to non-sustaining capital items | 4.8 | 3.9 | 3.4 |

| Non-sustaining exploration expense | 1.8 | 5.4 | 2.1 |

| Total mine-site free cash flow | $ 19.3 | $ 12.0 | $ (0.3) |

(1) Includes taxes paid that are not factored into mine-site free cash flow and are included in operating cash flow before non-cash changes in working capital in the statement of cash flows.

AISC contribution margin, EBITDA and adjusted EBITDA

The Company believes that, in addition to conventional measures prepared in accordance with IFRS, certain investors, and other stakeholders use AISC contribution margin, AISC contribution margin per gold ounce sold and adjusted EBITDA to evaluate the Company’s performance and ability to generate cash flows and service debt. AISC contribution margin is defined as revenue less AISC. EBITDA is defined as earnings before interest, tax, depreciation and amortization. Adjusted EBITDA is defined as earnings before interest, tax, depreciation, and amortization, adjusted to exclude specific items that are significant but not reflective of the underlying operating performance of the Company, such as the impact of fair value changes of warrants, foreign exchange contracts and gold contracts; unrealized foreign exchange gains and losses, transaction costs, and non-cash share-based compensation expense. It is also adjusted to exclude items whose timing or amount cannot be reasonably estimated in advance or that are not considered representative of core operating performance, such as impairments and gains and losses on disposals of assets.

The following tables provide the calculation of AISC contribution margin, EBITDA and adjusted EBITDA, as calculated by the Company:

AISC Contribution Margin

| Three months ended | |||

| $’s in millions | March 31, 2023 | December 31, 2022 | March 31, 2022 |

| Revenue | $ 234.1 | $ 259.3 | $ 223.2 |

| Less: AISC | (204.4) | (227.6) | (187.8) |

| AISC contribution margin | $ 29.7 | $ 31.7 | $ 35.4 |

| Gold ounces sold | 123,295 | 149,386 | 119,324 |

| Less: Santa Luz gold ounces sold(1) | – | – | (210) |

| Adjusted gold ounces sold | 123,295 | 149,386 | 119,114 |

| AISC contribution margin per oz sold | $ 241 | $ 212 | $ 297 |

(1) AISC contribution margin for three months ended March 31, 2022 excludes Santa Luz results while the mine was in pre-commercial production up until the achievement of commercial production at the end of Q3 2022.

EBITDA and Adjusted EBITDA

| Three months ended | |||

| $’s in millions | March 31, 2023 | December 31, 2022 | March 31, 2022 |

| Net income (loss) | $ 17.4 | 22.6 | (19.8) |

| Income tax (recovery) expense | $ (9.6) | (27.6) | 3.7 |

| Depreciation and depletion | 47.5 | 59.8 | 42.6 |

| Finance expense | 12.7 | 12.4 | 9.4 |

| Finance income | (3.0) | (2.6) | (0.8) |

| EBITDA | $ 65.0 | $ 64.6 | $ 35.1 |

| Non-cash share-based compensation expense | 1.5 | 1.1 | 0.9 |

| Unrealized loss (gain) on change in fair value of warrants | 3.7 | (2.9) | 18.7 |

| Unrealized loss on gold contracts | 5.4 | – | – |

| (Gain) loss on gold contracts acquired in a business combination | – | – | (5.4) |

| Unrealized (gain) loss on foreign exchange contracts | (13.1) | (7.7) | (18.1) |

| Unrealized foreign exchange loss | 2.3 | 3.1 | 10.5 |

| Share of net loss of investment in associate | 16.0 | 3.6 | 1.6 |

| Other (income) expense(1) | (24.0) | 12.5 | (0.4) |

| Transaction costs | – | – | 0.1 |

| Adjusted EBITDA | $ 57.0 | $ 74.3 | $ 43.1 |

(1) Other income for the three months ended March 31, 2023 primarily includes a $34.5 million gain on sale of partial interest and reclassification of investment in i-80 Gold, offset partially by a modification loss of $4.3 million related to amendments on the Company’s revolving credit facility. Other expense for the three months ended December 31, 2022 includes a $12.9 million loss at Santa Luz related to a write-down of equipment.

Adjusted net income and adjusted EPS

Adjusted net income and adjusted EPS are used by management and investors to measure the underlying operating performance of the Company. Adjusted net income is defined as net income adjusted to exclude specific items that are significant but not reflective of the underlying operating performance of the Company, such as the impact of fair value changes in the value of warrants, foreign exchange contracts and gold contracts, unrealized foreign exchange gains and losses, and non-cash share-based compensation expense. It is also adjusted to exclude items whose timing or amount cannot be reasonably estimated in advance or that are not considered representative of core operating performance, such as impairments and gains and losses on disposals of assets. Adjusted net income per share amounts are calculated using the weighted average number of shares outstanding on a basic and diluted basis as determined by IFRS.

The following table provides the calculation of adjusted net income and adjusted EPS, as adjusted and calculated by the Company:

| Three months ended | |||

| $’s and shares in millions | March 31, 2023 | December 31, 2022 | March 31, 2022 |

| Basic weighted average shares outstanding | 311.6 | 305.2 | 302.2 |

| Diluted weighted average shares outstanding | 341.6 | 351.4 | 302.2 |

| Net income (loss) attributable to Equinox Gold shareholders | $ 17.4 | $ 22.6 | $ (19.8) |

| Add (deduct): | |||

| Non-cash share-based compensation expense | 1.5 | 1.1 | 0.9 |

| Unrealized (gain) loss on change in fair value of warrants | 3.7 | (2.9) | 18.7 |

| Unrealized loss on gold contracts | 5.4 | – | – |

| (Gain) loss on gold contracts acquired in a business combination | – | – | (5.4) |

| Unrealized (gain) loss on foreign exchange contracts | (13.1) | (7.7) | (18.1) |

| Unrealized foreign exchange loss | 2.3 | 3.1 | 10.5 |

| Share of net loss of investment in associate | 16.0 | 3.6 | 1.6 |

| Other (income) expense(1) | (24.0) | 12.5 | (0.4) |

| Transaction costs | – | – | 0.1 |

| Income tax impact related to above adjustments | (0.1) | (3.0) | (1.8) |

| Unrealized foreign exchange (gain) loss recognized in deferred tax expense | (17.5) | (22.2) | (10.6) |

| Adjusted net (loss) income | $ (8.2) | $ 7.0 | $ (24.2) |

| Adjusted (loss) income per share – basic ($/share) | $(0.03) | $0.02 | $(0.08) |

| Adjusted (loss) income per share – diluted ($/share) | $(0.03) | $0.02 | $(0.08) |

(1) Other income for the three months ended March 31, 2023 primarily includes a $34.5 million gain on sale of partial interest and reclassification of investment in i-80 Gold, offset partially by a modification loss of $4.3 million related to amendments on the Company’s revolving credit facility. Other expense for the three months ended December 31, 2022 includes a $12.9 million loss at Santa Luz related to a write-down of equipment.

Net debt

The Company believes that in addition to conventional measures prepared in accordance with IFRS, the Company and certain investors and analysts use net debt to evaluate the Company’s performance. Net debt does not have any standardized meaning prescribed under IFRS, and therefore it may not be comparable to similar measures employed by other companies. This measure is intended to provide additional information and should not be considered in isolation or as a substitute for measures of performances prepared in accordance with IFRS. Net debt is calculated as the sum of the current and non-current portions of long-term debt, net of the cash and cash equivalent balance as at the balance sheet date. A reconciliation of net debt is provided below.

| March 31, 2023 | December 31, 2022 | March 31, 2022 | |

| Current portion of loans and borrowings | $ – | $ – | $ 26.7 |

| Non-current portion of loans and borrowings | 832.7 | 828.0 | 509.6 |

| Total debt | 832.7 | 828.0 | 536.2 |

| Less: Cash and cash equivalents (unrestricted) | (284.9) | (200.8) | (151.2) |

| Net debt | $ 547.8 | $ 627.2 | $ 385.1 |

Technical Information

Doug Reddy, MSc, P.Geo., Chief Operating Officer, is a Qualified Person under National Instrument 43-101 for Equinox Gold and has reviewed and approved the technical information in this document.

Cautionary Notes & Forward-looking Statements

This news release contains certain forward-looking information and forward-looking statements within the meaning of applicable securities legislation and may include future-oriented financial information. Forward-looking statements and forward-looking information in this news release relate to, among other things: the strategic vision for the Company and expectations regarding exploration potential, production capabilities and future financial or operational performance, including investment returns; the Company’s production and cost guidance; the timing for and Company’s ability to successfully advance its growth and development projects, including the construction of Greenstone and the expansions at Los Filos, Aurizona and Castle Mountain; the strength of the Company’s balance sheet, and the Company’s liquidity and future cash requirements; the closing of the Sandbox Arrangement; the aggregate value of common shares which may be issued pursuant to the ATM Program; the potential future offerings of Securities under the Base Shelf Prospectus or corresponding Registration Statement and any Prospectus Supplement; the Company’s expectations for reducing its GHG emissions and the impact of its operations on climate change, including reaching its GHG emissions reduction target; the expectations for the Company’s investments in Sandbox Royalties, i-80 Gold, Pilar Gold, Inca One and Bear Creek; and conversion of Mineral Resources to Mineral Reserves. Forward-looking statements or information generally identified by the use of the words “believe”, “achieve”, “expect”, “strategy”, “increase”, “plan”, “on time”, “potential”, “intend”, “on budget”, “on track”, “target”, “objective”, and similar expressions and phrases or statements that certain actions, events or results “may”, “could”, or “should”, or the negative connotation of such terms, are intended to identify forward-looking statements and information. Although the Company believes that the expectations reflected in such forward-looking statements and information are reasonable, undue reliance should not be placed on forward-looking statements since the Company can give no assurance that such expectations will prove to be correct.

The Company has based these forward-looking statements and information on the Company’s current expectations and projections about future events and these assumptions include: Equinox Gold’s ability to achieve the exploration, production, cost and development expectations for its respective operations and projects; prices for gold remaining as estimated; currency exchange rates remaining as estimated; availability of funds for the Company’s projects and future cash requirements; the ability of the Company and Sandbox to complete the Sandbox Arrangement; prices for energy inputs, labour, materials, supplies and services remaining as expected; construction of Greenstone being completed and performed in accordance with current expectations; expansion projects at Los Filos, Castle Mountain and Aurizona being completed and performed in accordance with current expectations; the mine plans outlined in the technical reports for each project, including estimated development schedules, are unchanged; tonnage of ore to be mined and processed; ore grades and recoveries are consistent with mine plans; capital, decommissioning and reclamation estimates; Mineral Reserve and Mineral Resource estimates and the assumptions on which they are based; no labour-related disruptions and no unplanned delays or interruptions in scheduled construction, development and production, including by blockade or industrial action; the Company’s working history with the workers, unions and communities at Los Filos; all necessary permits, licenses and regulatory approvals are received in a timely manner; the Company’s ability to comply with environmental, health and safety laws and other regulatory requirements; the strategic visions for Sandbox Royalties, i-80 Gold, Pilar Gold, Inca One and Bear Creek and their respective abilities to successfully advance their businesses; the ability of Pilar Gold, Inca One and Bear Creek to meet their respective payment commitments to the Company; and the ability of Equinox Gold to work productively with its joint venture partner and Indigenous partners at Greenstone. While the Company considers these assumptions to be reasonable based on information currently available, they may prove to be incorrect. Accordingly, readers are cautioned not to put undue reliance on the forward-looking statements or information contained in this news release.

The Company cautions that forward-looking statements and information involve known and unknown risks, uncertainties and other factors that may cause actual results and developments to differ materially from those expressed or implied by such forward-looking statements and information contained in this news release and the Company has made assumptions and estimates based on or related to many of these factors. Such factors include, without limitation: fluctuations in gold prices; fluctuations in prices for energy inputs, labour, materials, supplies and services; fluctuations in currency markets; operational risks and hazards inherent with the business of mining (including environmental accidents and hazards, industrial accidents, equipment breakdown, unusual or unexpected geological or structural formations, cave-ins, flooding and severe weather); inadequate insurance, or inability to obtain insurance to cover these risks and hazards; employee relations; relationships with, and claims by, local communities and Indigenous populations; the effect of blockades and community issues on the Company’s production and cost estimates; the Company’s ability to obtain all necessary permits, licenses and regulatory approvals in a timely manner or at all; changes in laws, regulations and government practices, including environmental and export and import laws and regulations; legal restrictions relating to mining; risks relating to expropriation; increased competition in the mining industry; a successful relationship between the Company and its joint venture partner; the failure by Pilar Gold, Inca One or Bear Creek to meet their respective commitments to the Company; and those factors identified in the section “Risks and Uncertainties” in the Company’s MD&A dated February 21, 2023 from the year ended December 31, 2022 and in the section titled “Risks Related to the Business” in the Company’s most recently filed Annual Information Form, both of which are available on SEDAR at www.sedar.com and on EDGAR at www.sec.gov/edgar. Forward-looking statements and information are designed to help readers understand management’s views as of that time with respect to future events and speak only as of the date they are made. Except as required by applicable law, the Company assumes no obligation to update or to publicly announce the results of any change to any forward-looking statement or information contained or incorporated by reference to reflect actual results, future events or developments, changes in assumptions or changes in other factors affecting the forward-looking statements and information. If the Company updates any one or more forward-looking statements, no inference should be drawn that the Company will make additional updates with respect to those or other forward-looking statements. All forward-looking statements and information contained in this news release are expressly qualified in their entirety by this cautionary statement.

Cautionary Note to U.S. Readers Concerning Estimates of Mineral Reserves and Mineral Resources

Disclosure regarding the Company’s mineral properties, including with respect to mineral reserve and mineral resource estimates included in this news release, was prepared in accordance with National Instrument 43-101 – Standards of Disclosure for Mineral Projects (“NI 43-101”). NI 43-101 is a rule developed by the Canadian Securities Administrators that establishes standards for all public disclosure an issuer makes of scientific and technical information concerning mineral projects. NI 43-101 differs significantly from the disclosure requirements of the Securities and Exchange Commission (the “SEC”) generally applicable to U.S. companies. Accordingly, information contained in this news release is not comparable to similar information made public by U.S. companies reporting pursuant to SEC disclosure requirements.

Original Article: https://www.newsfilecorp.com/release/164561