Newmont announces solid first quarter results; well-positioned to deliver a strong second half and long-term value from top-tier mining jurisdictions

DENVER–(BUSINESS WIRE)– Newmont Corporation (NYSE: NEM, TSX: NGT) (Newmont or the Company) today announced first quarter 2022 results.

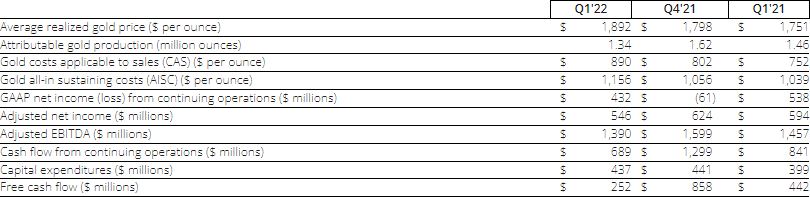

FIRST QUARTER 2022 HIGHLIGHTS

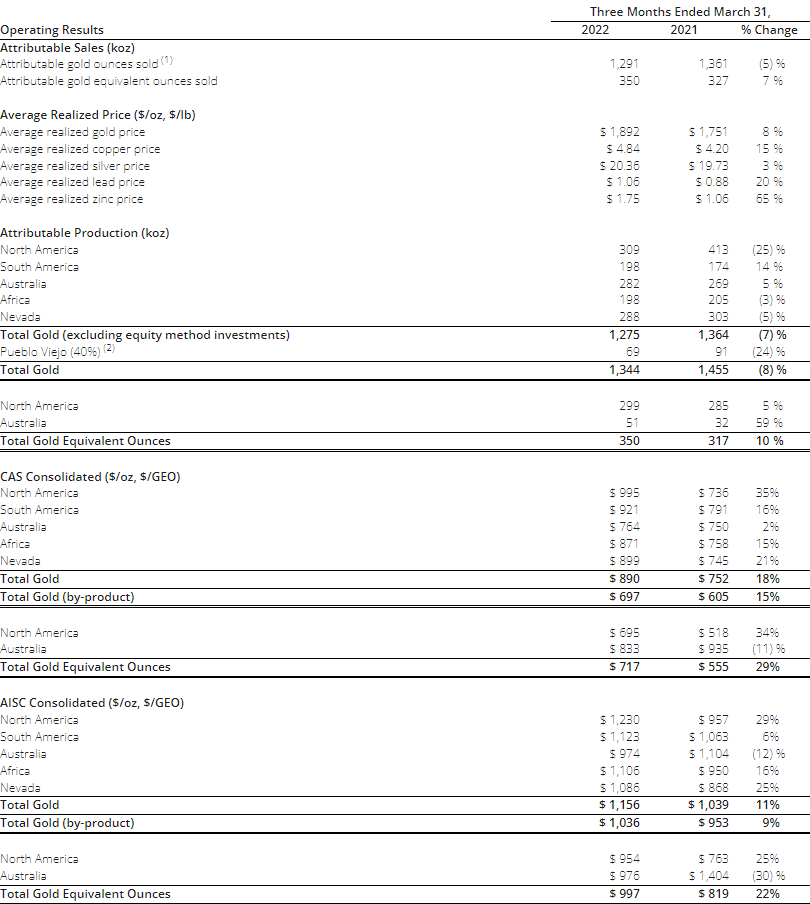

- Produced 1.34 million attributable ounces of gold and 350 thousand attributable gold equivalent ounces from co-products

- Reported gold CAS* of $890 per ounce and AISC* of $1,156 per ounce

- Remain on track to achieve full-year guidance ranges; full-year results continue to be back-half weighted**

- Generated $689 million of cash from continuing operations and $252 million of Free Cash Flow*

- Declared first quarter dividend of $0.55 per share, consistent with the previous quarter; $1 billion share repurchase program to be used opportunistically in 2022, with $475 million remaining***

- Ended the quarter with $4.3 billion of consolidated cash and $7.3 billion of liquidity with a net debt to adjusted EBITDA ratio of 0.3x*

- Credit rating upgraded by S&P Global Ratings to BBB+ from BBB with a stable outlook

- Advancing profitable near-term projects, including Tanami Expansion 2, Ahafo North and Yanacocha Sulfides

- Executed on strategy to consolidate ownership in prolific mining districts with acquisition of Yanacocha’s minority interest stake; increasing ownership in Sulfides project to 100 percent through acquisition of Buenaventura’s 43.65% interest and Sumitomo Corporation’s 5% interest****

- Published 18th Annual Sustainability report, a transparent review of Environmental, Social and Governance (ESG) performance

- Committed $5 million contribution to support humanitarian efforts in Ukraine

- Ranked eleventh on Fortune’s Modern Board 25, a list of the most innovative boards of directors among S&P 500 companies; recognized for gender equality, nationality dispersion and board independence

“Newmont delivered a solid first quarter performance with $1.4 billion in adjusted EBITDA as we safely managed through the Omicron surge. The strength of our proven operating model and global portfolio in the world’s best mining jurisdictions is the foundation of Newmont’s clear and consistent strategy to create value and improve lives through sustainable and responsible mining. In April, we published our 18th Annual Sustainability Report, which provides a transparent look at our ESG performance and the issues and metrics that matter most to our stakeholders. As a values-based organization and the gold sector’s recognized sustainability leader, Newmont has a long history of leading change in our approach to ESG and our core values are fundamental to how we run our business and where we choose to operate.”

– Tom Palmer, Newmont President and Chief Executive Officer

___________________________

*Non-GAAP metrics; see pages 12-26 for reconciliations.

**See discussion of outlook and cautionary statement at end of release regarding forward-looking statements.

***See cautionary statement at the end of this release, including with respect to future dividends and share buybacks.

****The acquisition of the remaining 5% interest in Yanacocha from Sumitomo Corporation is expected to close in Q2 2022.

FIRST QUARTER 2022 FINANCIAL AND PRODUCTION SUMMARY

Attributable gold production1 decreased 8 percent to 1,344 thousand ounces from the prior year quarter primarily due to lower mill throughput at CC&V, Tanami, Porcupine and Nevada Gold Mines, lower ore grades milled at Peñasquito, Pueblo Viejo, Éléonore and Porcupine, and a build-up of in-circuit inventory. These decreases were partially offset by higher ore grade milled at Boddington and higher production at Yanacocha due to the acquisition of Buenaventura’s 43.65% ownership in February 2022.

Gold CAS totaled $1.2 billion for the quarter. Gold CAS per ounce2 increased 18 percent to $890 per ounce from the prior year quarter primarily due to lower ounces sold, higher direct operating costs, a draw-down of in-circuit inventory and lower by-product credits at Yanacocha.

Gold AISC per ounce3 increased 11 percent to $1,156 per ounce from the prior year quarter primarily due to higher CAS per ounce.

Attributable gold equivalent ounce (GEO) production from other metals increased 10 percent to 350 thousand ounces primarily due to higher ore grade milled at Peñasquito and Boddington.

CAS from other metals totaled $251 million for the quarter. CAS per GEO2 increased 29 percent to $717 per ounce from the prior year quarter primarily due to higher allocation of costs to other metals at Peñasquito.

AISC per GEO3 increased 22 percent to $997 per ounce primarily due to higher CAS per GEO.

Net income from continuing operations attributable to Newmont stockholders was $432 million or $0.54 per diluted share, a decrease of $106 million from the prior year quarter primarily due to lower gold sales volumes, higher CAS, a pension settlement charge of $130 million, the loss recognized on the sale of the La Zanja equity method investment in 2022 compared to a gain on the sale of TMAC in 2021 and higher reclamation and remediation charges. These decreases were partially offset by higher average realized metal prices, unrealized gains on marketable and other equity securities in 2022 compared to unrealized losses in 2021 and lower income tax expense.

Adjusted net income4was $546 million or $0.69 per diluted share,compared to $594 million or $0.74 per diluted share in the prior year quarter. Primary adjustments to first quarter net income include pension settlement charges, changes in the fair value of investments, the loss recognized on the sale of the La Zanja equity method investment, reclamation and remediation charges, settlement costs, a voluntary contribution made to support humanitarian efforts in Ukraine, and valuation allowance and other tax adjustments.

Adjusted EBITDA5 decreased 5 percent to $1.4 billion for the quarter, compared to $1.5 billion for the prior year quarter.

Revenue increased5 percent from the prior year quarter to $3.0 billion primarily due to higher average realized gold prices and higher copper sales volumes, which were partially offset by lower gold sales volumes.

Average realized price6 for gold was $1,892, an increase of $141 per ounce over the prior year quarter. Average realized gold price includes $1,883 per ounce of gross price received, the favorable impact of $17 per ounce mark-to-market on provisionally-priced sales and reductions of $8 per ounce for treatment and refining charges.

Capital expenditures7 increased 10 percent from the prior year quarter to $437 million primarily due to higher development capital spend, which was partially offset by lower sustaining capital spend. Development capital expenditures in 2022 primarily include advancing Tanami Expansion 2, Yanacocha Sulfides, Ahafo North, Pamour and Cerro Negro District Expansion 1.

Consolidated operating cash flow from continuing operations decreased 18 percent from the prior year quarter to $689 million primarily due to lower gold sales volumes and an increase in accounts receivable related to timing of cash receipts. These decreases were partially offset by higher average realized metal prices. Free Cash Flow8also decreased to $252 million primarily due to lower operating cash flow and higher development capital expenditures as described above.

Balance sheet and liquidity ended the quarter with $4.3 billion of consolidated cash and approximately $7.3 billion of liquidity; reported net debt to adjusted EBITDA of 0.3x9.

Nevada Gold Mines (NGM) attributable gold production was 288 thousand ounces, with CAS of $899 per ounce and AISC of $1,086 per ounce for the first quarter. NGM EBITDA10 was $278 million.

Pueblo Viejo (PV) attributable gold production was 69 thousand ounces for the quarter. Pueblo Viejo EBITDA10 was $80 million and cash distributions received for the Company’s equity method investment totaled $49 million in the first quarter.

COVID UPDATE

Newmont continues to maintain wide-ranging protective measures for its workforce and neighboring communities, including screening, physical distancing, deep cleaning and avoiding exposure for at-risk individuals. The Company incurred incremental Covid specific costs of $17 million during the quarter for activities such as additional health and safety procedures, increased transportation and distributions from the Newmont Global Community Support Fund. The majority of the additional incremental Covid specific costs have not been adjusted from our non-GAAP metrics.

PROJECTS UPDATE11

Newmont’s project pipeline supports stable production with improving margins and mine life. Newmont’s 2022 and longer-term outlook includes current development capital costs and production related to Tanami Expansion 2, Ahafo North, Yanacocha Sulfides, Pamour and Cerro Negro District Expansion 1. Additional projects not listed below represent incremental improvements to the Company’s outlook.

- Tanami Expansion 2 (Australia) secures Tanami’s future as a long-life, low-cost producer with potential to extend mine life beyond 2040 through the addition of a 1,460 meter hoisting shaft and supporting infrastructure to process 3.3 million tonnes per year and provide a platform for future growth. The expansion is expected to increase average annual gold production by approximately 150,000 to 200,000 ounces per year for the first five years and is expected to reduce operating costs by approximately 10 percent. Capital costs for the project are estimated to be between $850 and $950 million with a commercial production date in 2024. Development costs (excluding capitalized interest) since approval were $333 million, of which $49 million related to the first quarter of 2022.

- Ahafo North (Africa) expands our existing footprint in Ghana with four open pit mines and a stand-alone mill located approximately 30 kilometers from the Company’s Ahafo South operations. The project is expected to add between 275,000 and 325,000 ounces per year with all-in sustaining costs between $600 to $700 per ounce for the first five full years of production (2024-2028). Capital costs for the project are estimated to be between $750 and $850 million with a construction completion date in late 2023 and commercial production in 2024. Ahafo North is the best unmined gold deposit in West Africa with approximately 3.5 million ounces of Reserves and more than 1 million ounces of Measured, Indicated and Inferred Resources and significant upside potential to extend beyond Ahafo North’s current 13-year mine life. Development costs (excluding capitalized interest) since approval were $95 million, of which $28 million related to the first quarter of 2022.

- Yanacocha Sulfides 12 (South America) will develop the first phase of sulfide deposits and an integrated processing circuit, including an autoclave to produce 45% gold, 45% copper and 10% silver. The project is expected to add average annual production of 525,000 gold equivalent ounces per year with all-in sustaining costs between $700 and $800 per ounce for the first five full years of production (2027-2031). Total capital costs for the project are estimated at $2.5 billion, with an investment decision expected in late 2022 and a three year development period. The first phase focuses on developing the Yanacocha Verde and Chaquicocha deposits to extend Yanacocha’s operations beyond 2040 with second and third phases having the potential to extend life for multiple decades.

- Pamour (North America) extends the life of Porcupine and maintains production beginning in 2024. The project will optimize mill capacity, adding volume and supporting high grade ore from Borden and Hoyle Pond, while supporting further exploration in a highly prospective and proven mining district. An investment decision is expected in the second half of 2022 with estimated capital costs between $350 and $450 million.

- Cerro Negro District Expansion 1 (South America) includes the simultaneous development of the Marianas and Eastern districts to extend the mine life of Cerro Negro beyond 2030. The project is expected to improve production to above 350,000 ounces beginning in 2024, while improving all-in sustaining costs to between $800 and $900 per ounce. Capital costs for the project are estimated to be approximately $300 million. This project provides a platform for further exploration and future growth through additional expansions.

________________________________________________

1 Attributable gold production for the first quarter 2022 includes 69 thousand ounces from the Company’s equity method investment in Pueblo Viejo (40%).

2 Non-GAAP measure. See end of this release for reconciliation to Costs applicable to sales.

3 Non-GAAP measure. See end of this release for reconciliation to Costs applicable to sales.

4 Non-GAAP measure. See end of this release for reconciliation to Net income (loss) attributable to Newmont stockholders.

5 Non-GAAP measure. See end of this release for reconciliation to Net income (loss) attributable to Newmont stockholders.

6 Non-GAAP measure. See end of this release for reconciliation to Sales.

7 Capital expenditures refers to Additions to property plant and mine development from the Condensed Consolidated Statements of Cash Flows.

8 Non-GAAP measure. See end of this release for reconciliation to Net cash provided by operating activities.

9 Non-GAAP measure. See end of this release for reconciliation.

10 Non-GAAP measure. See end of this release for reconciliation.

11 All-in sustaining costs are presented using a $1,200/oz gold price assumption. Project estimates remain subject to change based upon uncertainties, including future impacts Covid-19 and other cost pressures, supply chain disruptions and availabilities, commodity price volatility and other factors, which may impact estimated capital expenditures, AISC and timing of projects. See end of this release for cautionary statement regarding forward-looking statements.

12 Consolidated basis.

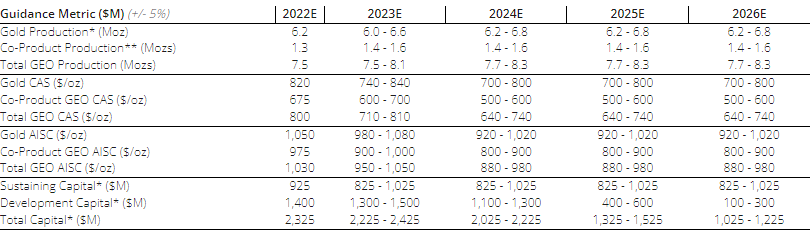

OUTLOOK

Newmont’s outlook reflects increasing gold production and ongoing investment in its operating assets and most promising growth prospects. Outlook includes current development capital costs and production related to Tanami Expansion 2, Ahafo North, Yanacocha Sulfides, Pamour at Porcupine and Cerro Negro District Expansion 1.

Newmont continues to develop our mine plan utilizing a $1,200 per ounce gold price assumption. However, due to sustained higher gold prices over the last two years, Newmont’s 2022 outlook assumes an $1,800 per ounce revenue gold price for CAS and AISC to reflect higher costs from inflation, royalties and production taxes. In 2022, an additional 5% of cost escalation is incorporated into our direct operating costs related to labor, energy, and material and supplies. 2022 and longer-term outlook assumes a $30 per ounce impact from production taxes and royalties attributable to higher gold prices. Outlook assumes operations continue without major Covid-related interruptions. Newmont continues to maintain wide-ranging protective measures for its workforce and neighboring communities, including screening, physical distancing, deep cleaning and avoiding exposure for at-risk individuals, which are expected to impact AISC per gold equivalent ounce by approximately $10 per ounce. If at any point the Company determines that continuing operations poses an increased risk to our workforce or host communities, it will reduce operational activities up to, and including, care and maintenance and management of critical environmental systems. Please see the cautionary statement for additional information.

For a more detailed discussion and outlook presented at a $1,200 per ounce gold price assumption, see the Company’s 2022 and Longer-Term Outlook released on December 2, 2021, available on www.newmont.com. The attributable site-level production for Yanacocha and attributable development capital guidance below accounts for the acquisition of Buenaventura’s 43.65% interest in Yanacocha, as announced on February 8, 2022. All other guidance metrics remain unchanged from the Company’s 2022 and Longer-Term Outlook as announced on December 2, 2021.

Five Year Outlook (+/- 5%): $1,800/oz Gold Price Assumption

*Attributable basis; **Attributable co-product gold equivalent ounces; includes copper, zinc, silver and lead

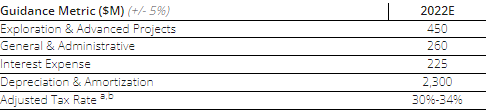

Consolidated Expense Outlook

a The adjusted tax rate excludes certain items such as tax valuation allowance adjustments.

b Assuming average prices of $1,800 per ounce for gold, $3.25 per pound for copper, $23.00 per ounce for silver, $0.95 per pound for lead, and $1.15 per pound for zinc and achievement of current production and sales volumes and cost estimates, we estimate our consolidated adjusted effective tax rate related to continuing operations for 2022 will be between 30%-34%.

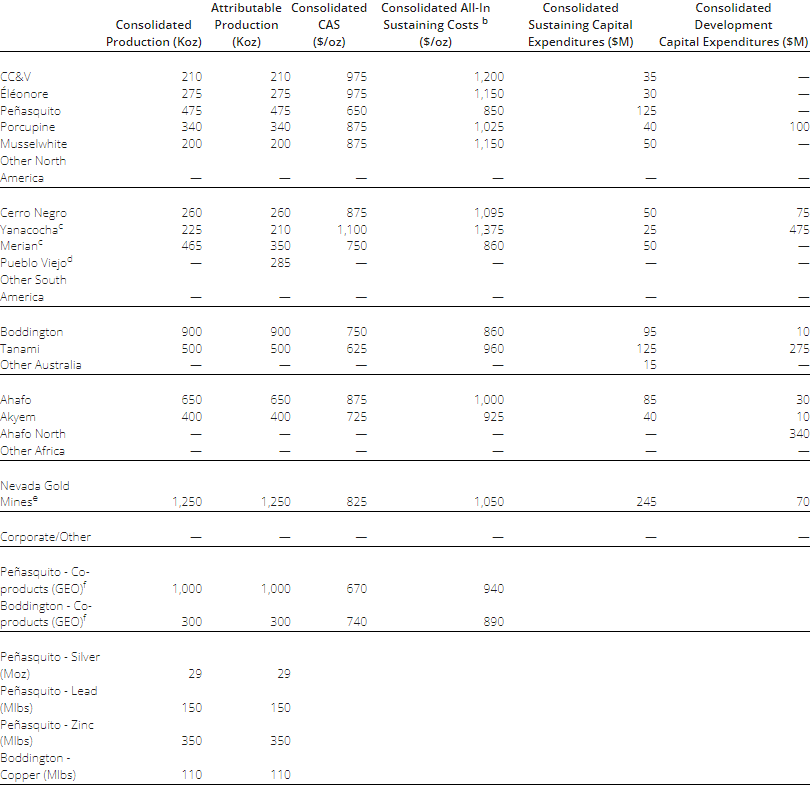

2022 Site Outlook a

a 2022 outlook projections are considered forward-looking statements and represent management’s good faith estimates or expectations of future production results as of December 2, 2021. Outlook is based upon certain assumptions, including, but not limited to, metal prices, oil prices, certain exchange rates and other assumptions. For example, 2022 Outlook assumes $1,800/oz Au, $3.25/lb Cu, $23.00/oz Ag, $1.15/lb Zn, $0.95/lb Pb, $0.75 USD/AUD exchange rate, $0.80 USD/CAD exchange rate and $60/barrel WTI. Production, CAS, AISC and capital estimates exclude projects that have not yet been approved, except for Yanacocha Sulfides, Pamour and Cerro Negro District Expansion 1 which are included in Outlook. The potential impact on inventory valuation as a result of lower prices, input costs, and project decisions are not included as part of this Outlook. Assumptions used for purposes of Outlook may prove to be incorrect and actual results may differ from those anticipated, including variation beyond a +/-5% range. Outlook cannot be guaranteed. As such, investors are cautioned not to place undue reliance upon Outlook and forward-looking statements as there can be no assurance that the plans, assumptions or expectations upon which they are placed will occur. Amounts may not recalculate to totals due to rounding. The attributable production guidance accounts for the acquisition of Buenaventura’s 43.65% interest in Yanacocha, as announced on February 8, 2022. All other guidance metrics remain unchanged from the Company’s outlook as announced on December 2, 2021. See cautionary at the end of this release.

b All-in sustaining costs (AISC) as used in the Company’s Outlook is a non-GAAP metric; see below for further information and reconciliation to consolidated 2022 CAS outlook.

c Consolidated production for Yanacocha and Merian is presented on a total production basis for the mine site; attributable production represents a 95% interest for Yanacocha and a 75% interest for Merian.

d Attributable production includes Newmont’s 40% interest in Pueblo Viejo, which is accounted for as an equity method investment.

e Represents the ownership interest in the Nevada Gold Mines (NGM) joint venture. NGM is owned 38.5% by Newmont and owned 61.5% and operated by Barrick. The Company accounts for its interest in NGM using the proportionate consolidation method, thereby recognizing its pro-rata share of the assets, liabilities and operations of NGM.

f Gold equivalent ounces (GEO) are calculated as pounds or ounces produced multiplied by the ratio of the other metal’s price to the gold price, using Gold ($1,200/oz.), Copper ($3.25/lb.), Silver ($23.00/oz.), Lead ($0.95/lb.), and Zinc ($1.15/lb.) pricing.

- Attributable gold ounces from the Pueblo Viejo mine, an equity method investment, are not included in attributable gold ounces sold.Represents attributable gold from Pueblo Viejo and does not include the Company’s other equity method investments.

- Attributable gold ounces produced at Pueblo Viejo are not included in attributable gold ounces sold, as noted in footnote 1. Income and expenses of equity method investments are included in Equity income (loss) of affiliates.

Original Article: https://www.newmont.com/investors/news-release/news-details/2022/Newmont-Announces-First-Quarter-2022-Results/default.aspx