MONTREAL, February 18, 2022 – Osisko Development Corp. (“Osisko Development” or the “Company”) (TSX.V-ODV) is pleased to announce drilling results from the 2021 exploration and category conversion drill program campaign at its San Antonio Project in Sonora State, Mexico.

Summary

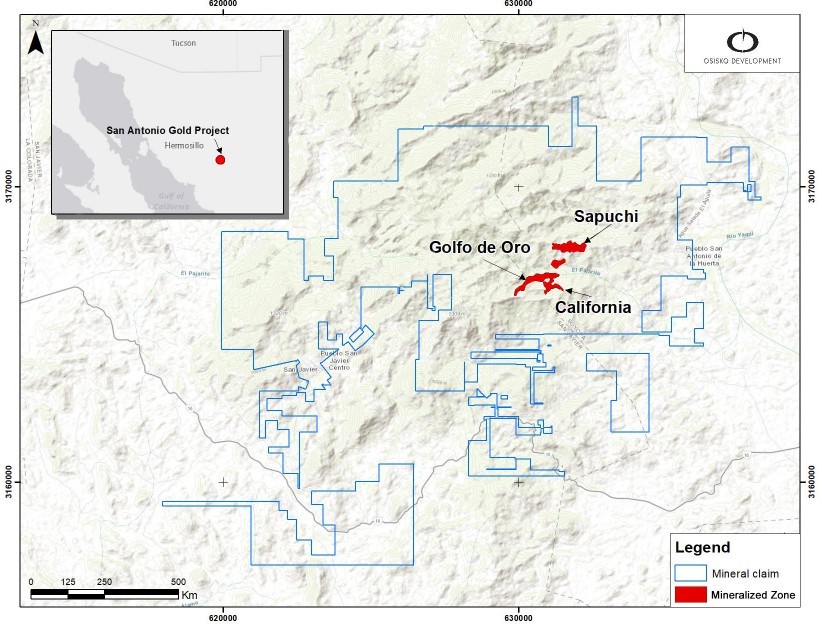

- A total of 177 holes and 27,900 meters were drilled in 2021. The objective of the drill program was to conduct exploration and resource drilling at a spacing of 25 meters and historic drilling validation for the three main target areas (Figure 1).

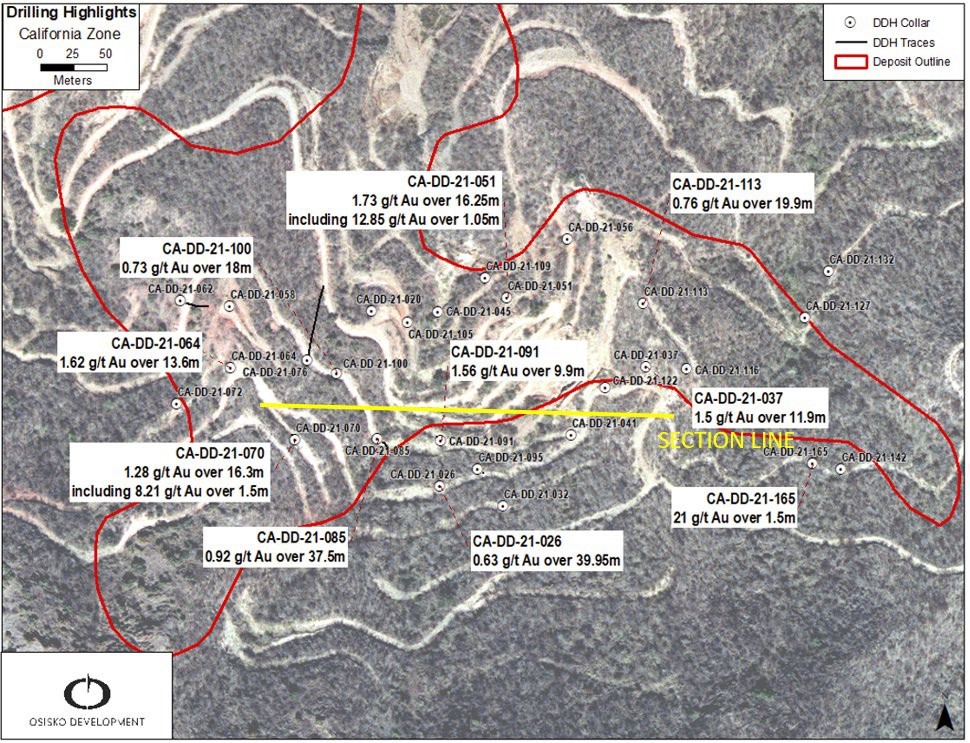

- This news releases encompasses all 5,563 meters from 27 holes at the California Target: CA-DD- 21-020 to CA-DD-21-165 inclusive (Figure 2).

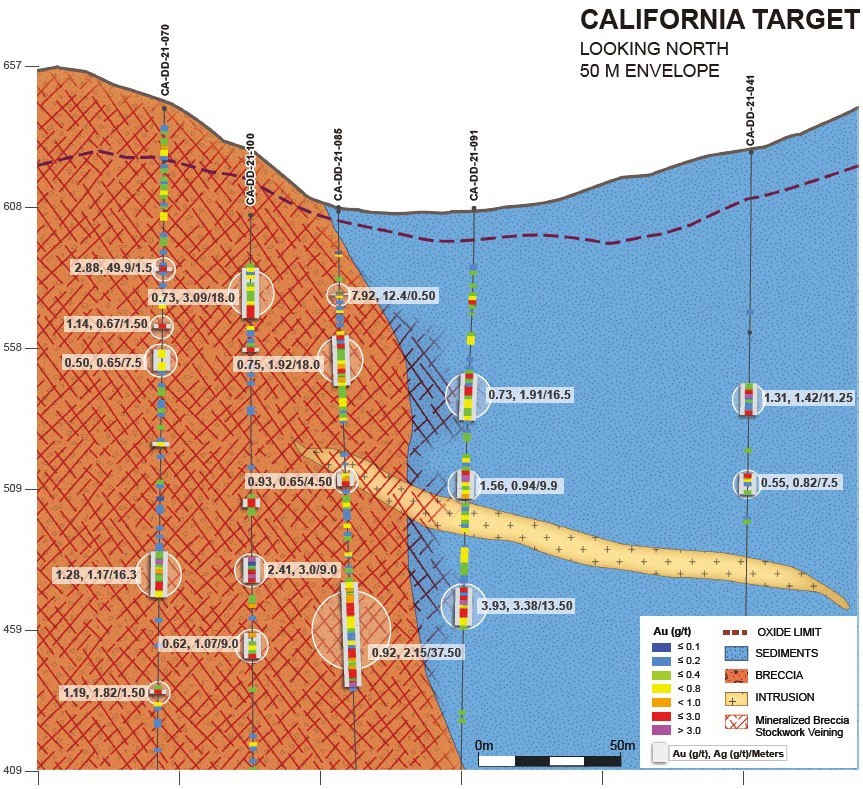

- The California gold mineralization is part of what is known as the El Realito Trend, located approximately 1 km to the southwest of Sapuchi and 4 km in length. The gold mineralization is typically pyrite with minor chalcopyrite and associated with hydrothermal breccia and quartzite, andesite and dacite intrusions.

- CA-DD-21-091 intersected 3.93 g/t Au over 13.50 meters including 26.50 g/t Au over 1.50 meters and is located 45 meters along strike within a sulphide zone from hole CA-DD-21-085 that assayed0.92 g/t Au over 37.50 meters.

- Detailed drilling results are presented in Table 1, drill hole locations are presented in Table 2, and drill hole cross sections are presented in Figure 3.

Assay Highlights

- 0.63 g/t Au and 0.90 g/t Ag over 39.95 meters in hole CA-DD-21-026

- 1.50 g/t Au and 13.96 g/t Ag over 11.90 meters in hole CA-DD-21-037

- 1.73 g/t Au and 13.67 g/t Ag over 16.25 meters in hole CA-DD-21-051 including

- 12.85 g/t Au and 13.10 g/t Ag over 1.05 meters

- 1.62 g/t Au and 2.25 g/t Ag over 13.60 meters in hole CA-DD-21-064

- 1.28 g/t Au and 1.17 g/t Ag over 16.30 meters in hole CA-DD-21-070 including

- 8.21 g/t Au and 1.38 g/t Ag over 1.50 meters

- 0.92 g/t Au and 2.15 g/t Ag over 37.50 meters in hole CA-DD-21-085

- 0.87 g/t Au and 3.44 g/t Ag over 17.20 meters in hole CA-DD-21-085

- 1.56 g/t Au and 0.94 g/t Ag over 9.90 meters in hole CA-DD-21-091

- 3.93 g/t Au and 3.38 g/t Ag over 13.50 meters in hole CA-DD-21-091 including

- 26.50 g/t Au and 4.80 g/t Ag over 1.50 meters

- 0.73 g/t Au and 3.09 g/t Ag over 18.00 meters in hole CA-DD-21-100

- 2.41 g/t Au and 3.00 g/t Ag over 9.00 meters in hole CA-DD-21-100

- 0.76 g/t Au and 0.94 g/t Ag over 19.9 meters in hole CA-DD-21-113

- 2.82 g/t Au and 11.39 g/t Ag over 9.55 meters in hole CA-DD-21-116

- 21.00 g/t Au and 4.50 g/t Ag over 1.50 meters in hole CA-DD-21-0165

Sean Roosen, CEO of Osisko Development commented, “The California target is one of the three main zones at the San Antonio Project. These recent drill results at California show significant anomalous results in the oxide, transition and sulphide horizons and indicate continuity near surface and along strike and, open to the west along trend. These results increase our confidence in the upcoming San Antonio mineral resource estimate, which will be available in the near future. At least a dozen other target areas remain to be drill tested.”

The San Antonio Project gold mineralization is characterized by hydrothermal breccia that forms an approximately 3,000 m long east-northeast trending mineralization corridor with the Luz del Cobre copper deposit at the east. The gold mineralization is associated with intense sericite and chlorite alteration and is intrusion related with host sedimentary rocks. The breccia has been defined to a vertical depth of 500 meters and at an average depth of 250 meters. The upper 250 meters of the breccia is most altered and prospective. Drilling has occurred within the three major zones at Sapuchi, Golfo de Oro and California, over a combined strike length of 900 meters of the 3000 – meter trend.

True widths are estimated to be 80% to 100% of reported core length intervals. Intervals not recovered by drilling were assigned zero grade. Top cuts have not been applied to high grade assays. Complete assay highlights are presented in Table 1, drill hole locations are listed in Table 2.

Qualified Persons

Per National Instrument 43-101 Standards of Disclosure for Mineral Projects, Maggie Layman, P.Geo. Vice President Exploration of Osisko Development Corp., is a Qualified Person and has prepared, validated, and approved the technical and scientific content of this news release.

Quality Assurance – Quality Control

Once received from the drill and processed, all drill core samples are sawn in half, labelled and bagged. The remaining drill core is subsequently stored on site at a secured facility at the project site. Numbered security tags are applied to lab shipments for chain of custody requirements. Quality control (QC) samples are inserted at regular intervals in the sample stream, including blanks and reference materials with all sample shipments to monitor laboratory performance.

Drill core samples are submitted to ALS Geochemistry and Bureau Veritas (BV) preparation laboratory in Hermosillo and then sent to their analytical facilities in Vancouver, British Columbia for analysis. The facilities are accredited to the ISO/IEC 17025 standard for gold assays and all analytical methods include quality control materials at set frequencies with established data acceptance criteria. The entire sample is crushed, and 200 grams is pulverized. Analytical packages for ALS and BV are AA24 and FA450 respectively. Multi Element geochemistry is also analyzed with ME MS61 at ALS and MA 200 at BV.

About Osisko Development Corp.

Osisko Development Corp. is uniquely positioned as a premier gold development company in North America to advance the Cariboo Gold Project and other Canadian and Mexican properties, with the objective of becoming the next mid-tier gold producer. The Cariboo Gold Project, located in central British Columbia, is Osisko Development’s flagship asset with measured and indicated resources of 21.44 Mt at

4.6 Au g/t for a total of 3.2 million ounces of gold and inferred resource of 21.69 Mt at 3.9 Au g/t for a total of 2.7 million ounces of gold (see NI 43-101 Technical Report and mineral resource estimate effective October 5th, 2020). The considerable exploration potential at depth and along strike distinguishes the Cariboo Gold Project relative to other development assets as does the historically low, all-in discovery costs of US $19 per ounce. The Cariboo Gold Project is advancing through permitting as a 4,750 tonnes per day underground operation with a feasibility study on track for completion in the first half of 2022. Osisko Development’s project pipeline is complemented by potential near-term production targeted from the San Antonio gold project, located in Sonora Mexico and early exploration stage properties including the Coulon Project and James Bay Properties located in Québec as well as the Guerrero Properties located in Mexico. Osisko Development began trading on the TSX Venture Exchange under the symbol “ODV” on December 2, 2020 and the Company’s 14,789,373 outstanding share purchase warrants were listed on the TSX Venture Exchange under the symbol “ODV.WT” on October 25, 2021.

| For further information, please contact Osisko Development Corp.: |

| Jean Francois Lemonde VP Investor Relations jflemonde@osiskodev.com Tel: 514-299-4926 |

Forward-looking Statements

Certain statements contained in this press release may be deemed “forward‐looking statements” within the meaning of applicable Canadian and U.S. securities laws. These forward‐looking statements, by their nature, require Osisko Development to make certain assumptions and necessarily involve known and unknown risks and uncertainties that could cause actual results to differ materially from those expressed or implied in these forward‐looking statements. Forward‐looking statements are not guarantees of performance. Words such as “may”, “will”, “would”, “could”, “expect”, “believe”, “plan”, “anticipate”, “intend”, “estimate”, “continue”, or the negative or comparable terminology, as well as terms usually used in the future and the conditional, are intended to identify forward‐looking statements. Information contained in forward‐looking statements is based upon certain material assumptions that were applied in drawing a conclusion or making a forecast or projection, including management’s perceptions of historical trends, current conditions and expected future developments, results of further exploration work to define and expand mineral resources, that exploration work will continue to show significant anomalous results in the oxide, transition and sulphide horizons and indicate continuity near surface and along strike and, open to the west along trend, that the gold mineralization continues to be associated with intense sericite and chlorite alteration and be intrusion related with host sedimentary rocks, that the breccia continues to be defined to a vertical depth of 500 meters and at an average depth of 250 meters, as well as other considerations that are believed to be appropriate in the circumstances. Osisko Development considers its assumptions to be reasonable based on information currently available, but cautions the reader that their assumptions regarding future events, many of which are beyond the control of Osisko Development, may ultimately prove to be incorrect since they are subject to risks and uncertainties that affect Osisko Development and its business. Such risks and uncertainties include, among others, risks relating to the ability of exploration activities (including drill results) to accurately predict mineralization; errors in management’s geological modelling; the ability of to complete further exploration activities, including drilling; property and stream interests in the San Antonio gold project; the ability of the Corporation to obtain required approvals; the results of exploration activities; risks relating to exploration, development and mining activities; the global economic climate; metal prices; dilution; environmental risks; and community and non-governmental actions and the responses of relevant governments to the COVID-19 outbreak and the effectiveness of such responses.

For additional information with respect to these and other factors and assumptions underlying the forward‐ looking statements made in this news release concerning Osisko Development, see the Filing Statement available electronically on SEDAR (www.sedar.com) under Osisko Development’s issuer profile. The forward‐looking statements set forth herein concerning Osisko Development reflect management’s expectations as at the date of this news release and are subject to change after such date. Osisko Development disclaims any intention or obligation to update or revise any forward-looking statements, whether as a result of new information, future events or otherwise, other than as required by law.

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this news release. No stock exchange, securities commission or other regulatory authority has approved or disapproved the information contained herein.

Table 1: San Antonio Gold Project 2021 Length Weighted Drill Hole Gold and Silver Composites from California Zone

| HOLE ID | FROM (M) | TO (M) | LENGTH (M) | AU (G/T) | AG (G/T) |

| CA-DD-21-020 | 159.40 | 166.35 | 6.95 | 1.19 | 1.25 |

| Including | 160.70 | 161.85 | 1.15 | 5.28 | 1.63 |

| 201.55 | 202.95 | 1.40 | 0.94 | 0.34 | |

| CA-DD-21-026 | 58.45 | 67.65 | 9.20 | 0.48 | 1.24 |

| Including | 64.70 | 66.15 | 1.45 | 1.49 | 2.47 |

| 90.75 | 91.55 | 0.80 | 0.71 | 2.24 | |

| 124.45 | 164.40 | 39.95 | 0.63 | 0.90 | |

| Including | 124.45 | 125.95 | 1.50 | 4.05 | 5.96 |

| and | 133.00 | 133.65 | 0.65 | 3.58 | 1.13 |

| and | 147.10 | 148.60 | 1.50 | 1.82 | 0.75 |

| and | 161.40 | 162.50 | 1.10 | 3.15 | 1.60 |

| CA-DD-21-032 | 123.90 | 133.55 | 9.65 | 0.90 | 13.74 |

| Including | 127.55 | 129.05 | 1.50 | 1.82 | 28.20 |

| and | 129.05 | 130.55 | 1.50 | 1.29 | 6.48 |

| and | 132.05 | 133.55 | 1.50 | 1.21 | 5.96 |

| CA-DD-21-037 | 29.00 | 30.35 | 1.35 | 1.38 | 0.89 |

| 86.40 | 98.30 | 11.90 | 1.50 | 13.96 | |

| Including | 86.40 | 87.05 | 0.65 | 9.51 | 24.40 |

| and | 87.05 | 87.95 | 0.90 | 9.81 | 64.20 |

| CA-DD-21-041 | 82.65 | 93.90 | 11.25 | 1.31 | 1.42 |

| Including | 84.90 | 86.40 | 1.50 | 1.49 | 2.81 |

| and | 86.40 | 87.80 | 1.40 | 5.48 | 3.44 |

| and | 92.40 | 93.90 | 1.50 | 2.17 | 1.36 |

| 114.90 | 122.40 | 7.50 | 0.55 | 0.82 | |

| Including | 114.90 | 116.40 | 1.50 | 1.79 | 1.22 |

| CA-DD-21-045 | 0.00 | 9.80 | 9.80 | 0.80 | 1.22 |

| Including | 5.25 | 8.25 | 3.00 | 2.14 | 1.57 |

| 29.55 | 36.00 | 6.45 | 0.64 | 1.55 | |

| Including | 29.55 | 31.05 | 1.50 | 2.16 | 4.30 |

| CA-DD-21-051 | 4.35 | 23.00 | 18.65 | 0.67 | 30.83 |

| Including | 9.85 | 11.35 | 1.50 | 1.20 | 4.75 |

| and | 12.85 | 14.35 | 1.50 | 1.23 | 9.07 |

| and | 14.35 | 15.85 | 1.50 | 1.11 | 127.00 |

| and | 17.35 | 18.85 | 1.50 | 1.35 | 70.00 |

| 38.10 | 51.90 | 13.80 | 0.58 | 5.38 | |

| Including | 47.10 | 48.60 | 1.50 | 1.33 | 2.72 |

| and | 51.00 | 51.90 | 0.90 | 2.89 | 26.80 |

| 128.90 | 130.40 | 1.50 | 2.49 | 6.21 | |

| 151.10 | 151.65 | 0.55 | 5.18 | 3.94 | |

| 175.00 | 190.05 | 15.05 | 0.59 | 3.41 | |

| Including | 187.85 | 188.95 | 1.10 | 1.11 | 2.43 |

| and | 188.95 | 190.05 | 1.10 | 1.27 | 2.83 |

| 208.10 | 224.35 | 16.25 | 1.73 | 13.67 | |

| Including | 212.80 | 214.30 | 1.50 | 2.19 | 13.90 |

| and | 214.30 | 215.35 | 1.05 | 12.85 | 13.10 |

| and | 215.35 | 216.35 | 1.00 | 6.27 | 8.33 |

| CA-DD-21-056 | 87.45 | 91.85 | 4.40 | 1.40 | 16.81 |

| 104.30 | 104.85 | 0.55 | 5.61 | 8.11 | |

| CA-DD-21-058 | 40.95 | 42.45 | 1.50 | 1.06 | 5.95 |

| 122.50 | 124.00 | 1.50 | 1.01 | 6.98 | |

| CA-DD-21-062 | 70.15 | 71.20 | 1.05 | 1.03 | 0.37 |

| CA-DD-21-064 | 114.80 | 128.40 | 13.60 | 1.62 | 2.25 |

| Including | 120.90 | 122.40 | 1.50 | 2.00 | 1.70 |

| and | 123.90 | 125.40 | 1.50 | 3.68 | 2.50 |

| and | 125.40 | 126.90 | 1.50 | 2.39 | 1.77 |

| 194.40 | 204.90 | 10.50 | 0.64 | 1.10 | |

| Including | 201.90 | 203.40 | 1.50 | 3.08 | 1.05 |

| CA-DD-21-070 | 56.55 | 58.05 | 1.50 | 2.88 | 49.90 |

| 76.95 | 78.45 | 1.50 | 1.14 | 0.67 | |

| 86.05 | 93.55 | 7.50 | 0.50 | 0.65 | |

| 119.05 | 120.55 | 1.50 | 0.71 | 1.24 | |

| 158.05 | 174.35 | 16.30 | 1.28 | 1.17 | |

| Including | 161.00 | 162.50 | 1.50 | 8.21 | 1.38 |

| 207.35 | 208.85 | 1.50 | 1.19 | 1.82 | |

| CA-DD-21-072 | 145.10 | 147.45 | 2.35 | 0.66 | 0.38 |

| CA-DD-21-076 | 87.40 | 88.40 | 1.00 | 1.32 | 1.68 |

| 149.90 | 150.80 | 0.90 | 3.46 | 1.43 | |

| 158.20 | 165.60 | 7.40 | 1.24 | 0.68 | |

| Including | 162.95 | 164.20 | 1.25 | 3.39 | 1.07 |

| and | 164.20 | 165.60 | 1.40 | 2.92 | 1.86 |

| 190.15 | 191.20 | 1.05 | 3.04 | 1.46 | |

| 210.70 | 212.70 | 2.00 | 1.51 | 1.06 | |

| 232.80 | 246.20 | 13.40 | 0.64 | 1.69 | |

| Including | 232.80 | 233.95 | 1.15 | 1.35 | 5.30 |

| and | 241.60 | 242.20 | 0.60 | 2.07 | 2.80 |

| 260.75 | 261.15 | 0.40 | 2.66 | 12.35 | |

| CA-DD-21-085 | 30.80 | 31.30 | 0.50 | 7.92 | 12.40 |

| 45.80 | 63.80 | 18.00 | 0.75 | 1.92 | |

| Including | 48.80 | 50.30 | 1.50 | 2.03 | 3.46 |

| 95.30 | 99.80 | 4.50 | 0.93 | 0.65 | |

| 134.30 | 171.80 | 37.50 | 0.92 | 2.15 | |

| Including | 159.80 | 161.30 | 1.50 | 1.70 | 4.82 |

| and | 165.80 | 167.30 | 1.50 | 2.08 | 1.65 |

| and | 170.30 | 171.80 | 1.50 | 3.32 | 5.23 |

| 210.80 | 228.00 | 17.20 | 0.87 | 3.44 | |

| Including | 216.80 | 217.65 | 0.85 | 2.62 | 7.23 |

| and | 220.50 | 221.30 | 0.80 | 2.75 | 3.64 |

| CA-DD-21-091 | 59.20 | 75.70 | 16.50 | 0.73 | 1.91 | |

| Including | 63.70 | 65.20 | 1.50 | 2.07 | 1.10 | |

| and | 65.20 | 66.70 | 1.50 | 2.17 | 7.20 | |

| 93.70 | 103.60 | 9.90 | 1.56 | 0.94 | ||

| Including | 93.70 | 95.20 | 1.50 | 2.06 | 0.90 | |

| and | 95.20 | 97.60 | 2.40 | 3.61 | 1.00 | |

| 135.40 | 148.90 | 13.50 | 3.93 | 3.38 | ||

| Including | 139.90 | 141.40 | 1.50 | 26.50 | 4.80 | |

| and | 142.90 | 144.40 | 1.50 | 2.23 | 11.00 | |

| 201.70 | 207.50 | 5.80 | 0.59 | 1.13 | ||

| Including | 201.70 | 203.20 | 1.50 | 1.35 | 0.90 | |

| CA-DD-21-095 | No Significant Assays | |||||

| CA-DD-21-100 | 18.80 | 36.80 | 18.00 | 0.73 | 3.09 | |

| Including | 35.30 | 36.80 | 1.50 | 2.04 | 4.60 | |

| 47.30 | 48.80 | 1.50 | 1.41 | 9.30 | ||

| 101.30 | 104.30 | 3.00 | 1.41 | 1.80 | ||

| 122.30 | 131.30 | 9.00 | 2.41 | 3.00 | ||

| Including | 122.30 | 123.80 | 1.50 | 3.59 | 1.80 | |

| and | 126.80 | 128.30 | 1.50 | 2.02 | 2.90 | |

| and | 128.30 | 129.80 | 1.50 | 7.30 | 7.10 | |

| 149.30 | 158.30 | 9.00 | 0.62 | 1.07 | ||

| Including | 156.80 | 158.30 | 1.50 | 1.91 | 2.00 | |

| 198.80 | 201.80 | 3.00 | 3.16 | 5.45 | ||

| CA-DD-21-105 | 53.40 | 54.90 | 1.50 | 3.39 | 1.10 | |

| CA-DD-21-109 | 122.10 | 123.30 | 1.20 | 3.61 | 1.60 | |

| CA-DD-21-113 | 32.30 | 52.20 | 19.90 | 0.76 | 0.94 | |

| Including | 32.30 | 33.80 | 1.50 | 3.82 | 0.50 | |

| and | 51.25 | 52.20 | 0.95 | 4.58 | 5.50 | |

| CA-DD-21-116 | 14.50 | 21.45 | 6.95 | 0.84 | 1.14 | |

| Including | 14.50 | 16.00 | 1.50 | 1.32 | 1.40 | |

| and | 16.00 | 17.50 | 1.50 | 1.44 | 1.00 | |

| 33.95 | 34.45 | 0.50 | 5.25 | 4.00 | ||

| 89.15 | 98.70 | 9.55 | 2.82 | 11.39 | ||

| Including | 89.15 | 90.65 | 1.50 | 6.19 | 16.60 | |

| and | 90.65 | 92.15 | 1.50 | 4.06 | 6.60 | |

| and | 96.10 | 97.20 | 1.10 | 9.49 | 1.80 | |

| CA-DD-21-122 | 77.40 | 87.80 | 10.40 | 0.77 | 25.02 | |

| Including | 78.80 | 80.30 | 1.50 | 1.02 | 110.60 | |

| and | 86.30 | 87.80 | 1.50 | 3.23 | 39.30 | |

| 97.25 | 98.40 | 1.15 | 7.10 | 4.20 | ||

| CA-DD-21-127 | 68.25 | 69.75 | 1.50 | 5.77 | 51.00 | |

| 97.55 | 103.00 | 5.45 | 1.27 | 2.38 | ||

| Including | 97.55 | 98.30 | 0.75 | 2.27 | 0.50 | |

| and | 101.30 | 102.00 | 0.70 | 6.16 | 2.80 | |

| CA-DD-21-132 | No Significant Assays |

| CA-DD-21-142 | 84.30 | 85.80 | 1.50 | 3.61 | 7.00 |

| CA-DD-21-165 | 57.00 | 63.35 | 6.35 | 0.90 | 1.88 |

| including | 60.70 | 62.20 | 1.50 | 2.19 | 1.90 |

| and | 62.20 | 63.35 | 1.15 | 1.62 | 3.40 |

| 119.40 | 120.90 | 1.50 | 21.00 | 4.50 |

Table 2: Drill Hole Locations and Orientations

| HOLE ID | EASTING | NORTHING | ELEV | DIP | AZI | DEPTH (M) |

| CA-DD-21-020 | 631071 | 3166634 | 592 | 0 | -90 | 230 |

| CA-DD-21-026 | 631122 | 3166502 | 623 | 0 | -90 | 275 |

| CA-DD-21-032 | 631170 | 3166487 | 636 | 0 | -90 | 191 |

| CA-DD-21-037 | 631278 | 3166592 | 637 | 0 | -90 | 209 |

| CA-DD-21-041 | 631221 | 3166540 | 628 | 0 | -90 | 167 |

| CA-DD-21-045 | 631121 | 3166634 | 581 | 0 | -90 | 241 |

| CA-DD-21-051 | 631173 | 3166644 | 593 | 0 | -90 | 233 |

| CA-DD-21-056 | 631219 | 3166688 | 606 | 0 | -90 | 108 |

| CA-DD-21-058 | 630964 | 3166638 | 627 | 0 | -90 | 188 |

| CA-DD-21-062 | 630926 | 3166642 | 614 | 340 | -85 | 188 |

| CA-DD-21-064 | 630964 | 3166591 | 641 | 0 | -90 | 233 |

| CA-DD-21-070 | 631013 | 3166537 | 643 | 0 | -90 | 332 |

| CA-DD-21-072 | 630924 | 3166564 | 630 | 0 | -90 | 179 |

| CA-DD-21-076 | 631022 | 3166597 | 612 | 360 | -80 | 404 |

| CA-DD-21-085 | 631075 | 3166538 | 608 | 0 | -90 | 266 |

| CA-DD-21-091 | 631123 | 3166536 | 608 | 0 | -90 | 215 |

| CA-DD-21-095 | 631151 | 3166515 | 623 | 0 | -90 | 192 |

| CA-DD-21-100 | 631045 | 3166587 | 611 | 0 | -90 | 260 |

| CA-DD-21-105 | 631098 | 3166625 | 589 | 0 | -90 | 209 |

| CA-DD-21-109 | 631156 | 3166659 | 580 | 0 | -90 | 173 |

| CA-DD-21-113 | 631276 | 3166640 | 628 | 0 | -90 | 120 |

| CA-DD-21-116 | 631309 | 3166591 | 633 | 0 | -90 | 126 |

| CA-DD-21-122 | 631247 | 3166576 | 631 | 0 | -90 | 140 |

| CA-DD-21-127 | 631398 | 3166629 | 571 | 0 | -90 | 153 |

| CA-DD-21-132 | 631416 | 3166664 | 571 | 0 | -90 | 167 |

| CA-DD-21-142 | 631425 | 3166515 | 640 | 0 | -90 | 203 |

| CA-DD-21-165 | 631403 | 3166519 | 639 | 0 | -90 | 161 |

Original Article: https://osiskodev.com/wp-content/uploads/2022/02/California_DrillResults_February18_2022_final.pdf