85% of Nameplate Stacking Capacity Achieved in January

VANCOUVER, BC, Feb. 16, 2022 /CNW/ – Orla Mining Ltd. (TSX: OLA) (NYSE: ORLA) (“Orla” or the “Company”) is pleased to provide an operational update for the Camino Rojo Oxide Mine.

(All amounts are in U.S. dollars unless otherwise stated)

CAMINO ROJO OXIDE MINE OPERATIONAL UPDATE

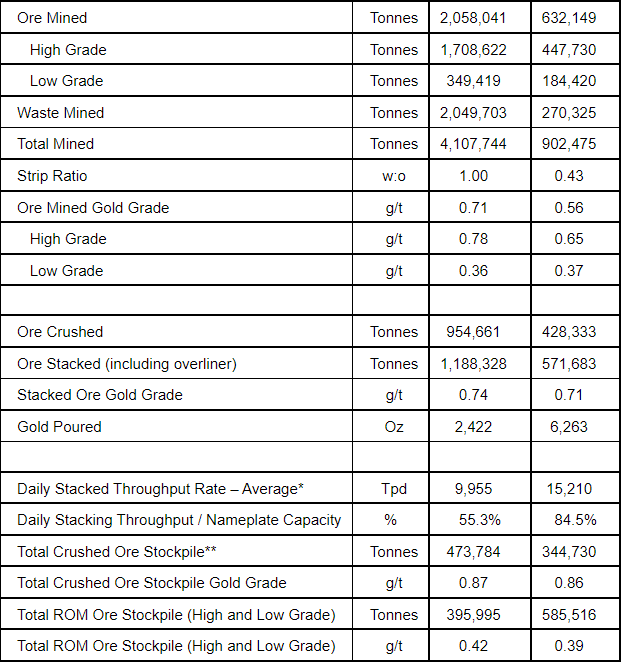

- Camino Rojo Oxide Mine poured first gold on December 13, 2021. Gold production totalled 2,422 ounces in 2021 and 6,263 ounces January 2022.

- Commissioning activities are substantially complete; mining and processing throughput rates and availabilities are in-line with the ramp-up plan. The Company is targeting declaration of commercial production and release of 2022 production and cost guidance in the first quarter of 2022.

- The average daily stacking throughput for January was 15,210 tonnes per day or 84.5% of nameplate capacity of 18,000 tonnes per day. Process recoveries to date are in line with the metallurgical recovery model.

*Average stacking rate calculation excludes stacked overliner material (272kt in 2021, and 100kt in January 2022).

**Crushed ore stockpile includes crushed ore in the live ore cone, crushed unplaced overliner, and stockpiled ore fines.

ROM stockpile includes low-grade and high-grade ore material yet to be crushed.

Camino Rojo Stacking Tonnes per Day

- During the month of January, the operations mined 447,730 tonnes of ore at an average gold grade of 0.65 g/t. To date, mined block model ore tonnes and grade are reconciling to within 0.5% of the block model. Since the commencement of mining operations, a considerable amount of additional mined material modelled as waste has converted to ore and was mined and crushed or stockpiled (737,000 tonnes of ore at an average gold grade of 0.68 g/t and 490,000 tonnes of low-grade ore at an average gold grade of 0.27 g/t).

- Camino Rojo project construction was 99% complete as of January 31, 2022, with only punch list activities remaining to be completed. In December and January, the following construction activities were completed:

- Dry and wet commissioning of the crushing and conveying circuits as well as the Merrill-Crowe plant.

- Installation of heap leach liner in cell two and event pond, placement of overliner material on cell two of the heap leach, commissioning of the third and final overland conveyor.

- Construction of the airstrip.

- Camino Rojo capital expenditures are $116.8 million for the project to date as of January 31, 2022. The current project estimate at completion totals $134.1 million, consistent with the total project capital expenditure estimate, and the remaining project spend will occur in the first half of the year. The project estimate at completion includes $3.5 million in unallocated contingency that is not forecasted to be spent. Management, therefore, anticipates the Camino Rojo Oxide Project to be completed within the total project capital estimate.

- Total expenditures related to working capital and initial fills for the project totalled $9.8 million as at December 31, 2021, in-line with the initial budget. As of January 1, 2022, all working capital items are accounted for as operating costs.

- Since the first gold pour on December 13, 2021, to January 31, 2022, the Company has generated $10.2 million in gold and silver sales. The Company had a cash balance of $20.5 million at December 31, 2021, and $20.8 million at January 31, 2022.

- Operational safety and environmental performance continues to be excellent and strict COVID-19 measures implemented at Camino Rojo have allowed an uninterrupted operational ramp up.

- To date, of all employees and contractors at Camino Rojo, 99% have received at least one dose of COVID-19 vaccine and 95% have received two doses of COVID-19 vaccine.

- At the end of January 2022, Camino Rojo workforce totalled 190 employees with 100% of individuals from Mexico and 56% from the local surrounding communities.

“Now that we have poured gold and begun the transition to producer, the team remains focused on achieving steady state operations,” said Jason Simpson, President and Chief Executive Officer of Orla Mining. “We look forward to announcing commercial production and achieving project completion on schedule and on budget.”

UPCOMING MILESTONES

- Achieving commercial production at Camino Rojo Oxide Mine

- 2022 production and cost guidance

- Metallurgical results for Camino Rojo Sulphides Project

About Orla Mining Ltd.

Orla is operating the Camino Rojo Oxide Gold Mine, a gold and silver open-pit and heap leach mine, located in Zacatecas State, Central Mexico. The operation is 100% owned by Orla and covers over 160,000 hectares. The technical report for the 2021 Feasibility Study on the Camino Rojo oxide gold project entitled “Unconstrained Feasibility Study NI 43-101 Technical Report on the Camino Rojo Gold Project – Municipality of Mazapil, Zacatecas, Mexico” dated January 11, 2021, is available on SEDAR and EDGAR under the Company’s profile at www.sedar.com and www.sec.gov, respectively. The technical report is also available on Orla’s website at www.orlamining.com. Orla also owns 100% of Cerro Quema located in Panama which includes a near-term gold production scenario and various exploration targets. Cerro Quema is a proposed open pit mine and gold heap leach operation. The technical report for the Pre-Feasibility Study on the Cerro Quema oxide gold project entitled “Project Pre-Feasibility Updated NI 43-101 Technical Report on the Cerro Quema Project, Province of Los Santos, Panama” dated January 18, 2022, is available on SEDAR and EDGAR under the Company’s profile at www.sedar.com and www.sec.gov, respectively. The technical report is also available on Orla’s website at www.orlamining.com.

Forward-looking Statements

This news release contains certain “forward-looking information” and “forward-looking statements” within the meaning of Canadian securities legislation and within the meaning of Section 27A of the United States Securities Act of 1933, as amended, Section 21E of the United States Exchange Act of 1934, as amended, the United States Private Securities Litigation Reform Act of 1995, or in releases made by the United States Securities and Exchange Commission, all as may be amended from time to time, including, without limitation, statements regarding the Camino Rojo Project, including the timing of the commencement of commercial production, timing of release of 2022 production and cost guidance, the estimated total and remaining capital expenditure, planned construction activities and the Company’s upcoming milestones. Forward-looking statements are statements that are not historical facts which address events, results, outcomes or developments that the Company expects to occur. Forward-looking statements are based on the beliefs, estimates and opinions of the Company’s management on the date the statements are made and they involve a number of risks and uncertainties. Certain material assumptions regarding such forward-looking statements were made, including without limitation, assumptions regarding the price of gold and silver; the accuracy of mineral resource and mineral reserve estimations; that there will be no material adverse change affecting the Company or its properties; that all required approvals will be obtained, including concession renewals and permitting; that political and legal developments will be consistent with current expectations; that currency and exchange rates will be consistent with current levels; and that there will be no significant disruptions affecting the Company or its properties.Consequently, there can be no assurances that such statements will prove to be accurate and actual results and future events could differ materially from those anticipated in such statements. Forward-looking statements involve significant known and unknown risks and uncertainties, which could cause actual results to differ materially from those anticipated. These risks include, but are not limited to: risks related to uncertainties inherent in the preparation of feasibility studies, including but not limited to, assumptions underlying the production estimates not being realized, changes to the cost assumptions, variations in quantity of mineralized material, grade or recovery rates, changes to geotechnical or hydrogeological considerations, failure of plant, equipment or processes, changes to availability of power or the power rates, ability to maintain social license, changes to interest or tax rates, changes in project parameters, delays and costs inherent to consulting and accommodating rights of local communities, environmental risks, title risks, including concession renewal, commodity price and exchange rate fluctuations, risks relating to COVID-19, delays in or failure to receive access agreements or amended permits, risks inherent in the estimation of mineral reserves and mineral resources; and risks associated with executing the Company’s objectives and strategies, including costs and expenses, as well as those risk factors discussed in the Company’s most recently filed management’s discussion and analysis, as well as its annual information form dated March 29, 2021, available on www.sedar.com and www.sec.gov. Except as required by the securities disclosure laws and regulations applicable to the Company, the Company undertakes no obligation to update these forward-looking statements if management’s beliefs, estimates or opinions, or other factors, should change.

Cautionary Note to U.S. Readers

The disclosure referenced herein uses mineral reserve and mineral resource classification terms that comply with reporting standards in Canada, and mineral reserve and mineral resource estimates are made in accordance with Canadian NI 43-101 and the Canadian Institute of Mining, Metallurgy and Petroleum — CIM Definition Standards on Mineral Resources and Mineral Reserves, adopted by the CIM Council, as amended (the “CIM Definition Standards”). Canadian NI 43-101 establishes standards for all public disclosure an issuer makes of scientific and technical information concerning mineral projects. These standards differ significantly from the mineral reserve disclosure requirements of the United States Securities Exchange Commission (the “SEC”) set forth in Industry Guide 7. Consequently, information regarding mineralization contained or referenced herein is not comparable to similar information that would generally be disclosed by U.S. companies under Industry Guide 7 in accordance with the rules of the SEC which applied to U.S. filings prior to the current SEC Modernization Rules (as defined herein). Further, the SEC has adopted amendments to its disclosure rules to modernize the mineral property disclosure requirements for issuers whose securities are registered with the SEC under the Securities Exchange Act of 1934 (“Exchange Act”). These amendments became effective February 25, 2019 (the “SEC Modernization Rules”) and, commencing for registrants with their first fiscal year beginning on or after January 1, 2021, the SEC Modernization Rules replace the historical property disclosure requirements included in SEC Industry Guide 7. As a foreign private issuer that files its annual report on Form 40-F with the SEC pursuant to the multi-jurisdictional disclosure system, the Company is not required to provide disclosure on its mineral properties under the SEC Modernization Rules and will continue to provide disclosure under NI 43-101 and the CIM Definition Standards. The SEC Modernization Rules include the adoption of terms describing mineral reserves and mineral resources that are “substantially similar” to the corresponding terms under the CIM Definition, but there are differences in the definitions under the SEC Modernization Rules and the CIM Definition Standards. Accordingly, there is no assurance any mineral reserves or mineral resources that the Company may report as “proven mineral reserves”, “probable mineral reserves”, “measured mineral resources”, “indicated mineral resources” and “inferred mineral resources” under NI 43-101 would be the same had the Company prepared the mineral reserve or mineral resource estimates under the standards adopted under the SEC Modernization Rules. U.S. investors are also cautioned that while the SEC recognizes “measured mineral resources”, “indicated mineral resources” and “inferred mineral resources” under the Modernization Rules, investors should not assume that any part or all of the mineralization in these categories will ever be converted into a higher category of mineral resources or into mineral reserves. Mineralization described using these terms has a greater amount of uncertainty as to its existence and feasibility than mineralization that has been characterized as reserves. Accordingly, investors are cautioned not to assume that any measured mineral resources, indicated mineral resources, or inferred mineral resources that the Company reports are or will be economically or legally mineable. Further, “inferred mineral resources” have a greater amount of uncertainty as to their existence and as to whether they can be mined legally or economically. Therefore, U.S. investors are also cautioned not to assume that all or any part of the “inferred mineral resources” exist. Under Canadian securities laws, estimates of “inferred mineral resources” may not form the basis of feasibility or pre-feasibility studies, except in rare cases. For the above reasons, information referenced herein regarding descriptions of our mineral reserve and mineral resource estimates is not comparable to similar information made public by U.S. companies subject to reporting and disclosure requirements of the SEC under either Industry Guide 7 or SEC Modernization Rules.

SOURCE Orla Mining Ltd.

Original Article: https://www.newswire.ca/news-releases/orla-mining-ramping-up-operations-towards-commercial-production-at-camino-rojo-898708198.html