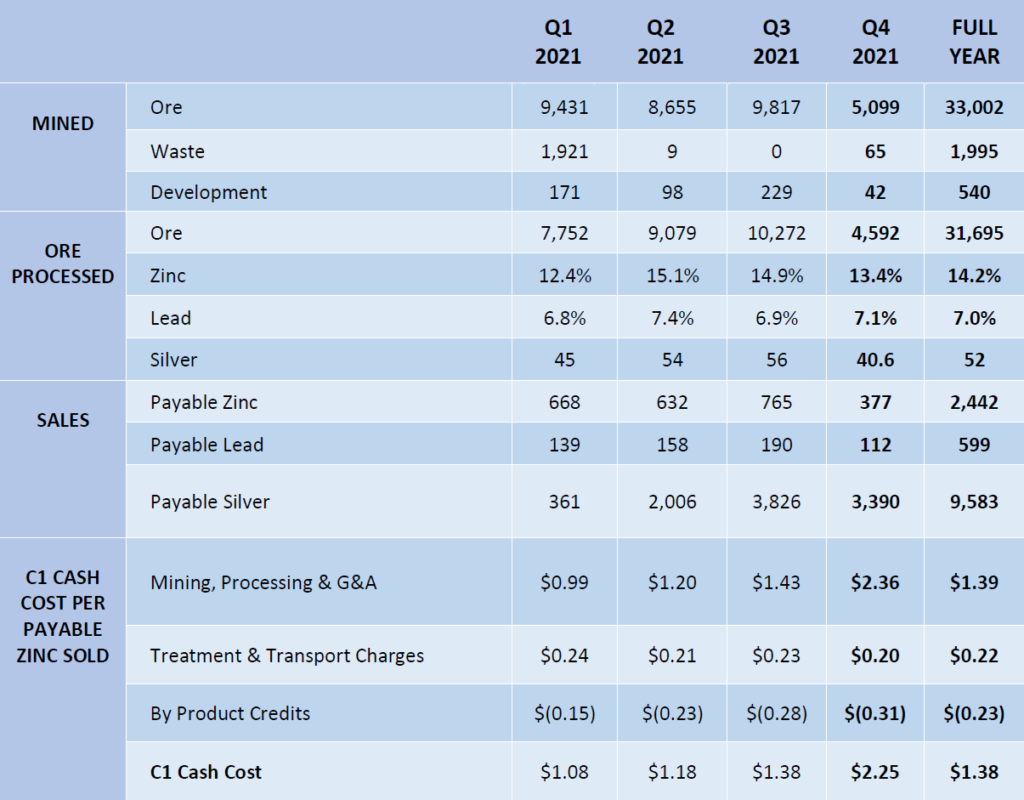

- Production significantly impacted by cumulative impact of several incidents:

- 5,099 tonnes ore mined.

- 4,592 tonnes of ore processed at 13.4% zinc, 7.1% lead and 40.6g/t silver.

- Payable metal sold, 377 tonnes of zinc and 112 tonnes of lead in concentrate.

- Inventory stockpiles at quarter end:

- 618 tonnes of high-grade run-of-mine ore.

- 79 tonnes zinc concentrate & 19 tonnes lead concentrate available for sale.

- Realised zinc price of $1.70/lb for the quarter, $1.36/lb YTD.

- Cash costs high due to disrupted production:

- C1 cash cost of payable zinc sold $2.25/lb for quarter, $1.38/lb YTD.

- C1 cash cost for zinc produced $1.98/lb for the quarter, $1.37/lb YTD.

- Closing cash of US$0.317 million, decreased from the prior quarter of $0.380 million.

- Mina Mexico and Los Alfonsitos exploration potential continues to be positive.

All references in this report are to US$, unless otherwise stated.

Consolidated Zinc Limited (CZL:ASX or “the Company”) presents its December 2021 quarterly activities report.

OPERATIONS – PLOMOSAS MINE, CHIHUAHUA STATE, MEXICO (100% OWNED)

Mining

During the quarter 3,140 tonnes of ore were mined with 5,099 tonnes hauled to the surface at Plomosas. Mining at this rate is not sustainable due to high fixed costs at Plomosas however cost reductions did occur, some of which will be permanent.

Mine production disruptions included rising water levels restricting access to 2 high-grade stopes at levels 7 and 8, due to installation and operating issues with pumping equipment and extended delivery times for parts and services. The pumps have been repaired and returned to Plomosas and the generator set repairs should be completed next week. Access to the under-water stopes should be re-established during February 2022.

The Tri Amigos level 5 stopes were reinstated with services, fans and brought back to production in November. Access to the Carola South stoping area was prepared including increasing the strike drive width from 2.2m to 3m, this work was completed in January 2022.

Ground Floor, 25 Richardson Street, West Perth WA Australia 6005, PO Box 839, West Perth WA Australia 6872 T: +61 8 6400 6222 E: info@conzinc.com.au

ACN 118 554 359

With the additional stopes available, expected dewatering rates and cost reductions, production is expected to return to profitable levels during Q1 2022.

Processing

During the quarter all 4,592 tonnes of ore was processed through the wholly owned Plomosas Plant, at 13.4% Zinc, 7.2% lead and 40.6g/t silver. Recovery of zinc to zinc concentrate was 77.1% with 37.8% recovery of lead to lead concentrate.

During the quarter the Plomosas plant processed more sulphide ore than the previous quarter and continued to deliver on sulphide recoveries at or above 90% for Zinc sulphides and at or above 82% for Lead sulphides.

At the end of the quarter, inventory stockpiles were 618 tonnes of ROM ore available for processing and 76 tonnes of zinc concentrate and 19 tonnes of lead concentrate.

Operating Costs

Due to the low production rate and high fixed operating costs at Plomosas, the unit operating cost were higher than expected.

The quarterly C1 cash operating cost was $2.25 per payable pound of zinc sold, an increase from the third quarter 2021 ($1.38/lb), with the key once-off costs incurred during the quarter:

- Specialist mining consultants commissioned to Plomosas US$0.18/lb of zinc produced; and

- Theft of concentrate reducing payable zinc metal production by 9.5% or US$0.20/lb.

Once the production rate increases, unit operating costs should materially reduce to around budgeted levels which are significantly below the current price of zinc. However, particularly since early 2019, operating in Mexico has been challenging with labour laws and employment practices, the legal and law enforcement system, and Covid-19 related supply issues and costs presenting unexpected issues.

Due to travel restrictions on CZLs Australian management the Jamieson Group, a leading global provider of productivity, implementation and change management consulting services, were engaged to support the management of operations over the last 4 months. The work of the three Mining Industry and Latin America specialists on-site did not translate to good financial performance during the quarter but the improvements to processes, procedures and work culture are evident and expected to impact productivity and improved results in the future.

TABLE 1. QUARTER ENDED 31 DECEMBER 2021 PRODUCTION STATISTICS

Concentrate Sales

918 tonnes of zinc concentrate, and 277 tonnes of lead concentrate were sold in the quarter.

At the end of the quarter, 76 tonnes of zinc concentrate, and 16 tonnes of lead concentrate were stockpiled to be sold in the current quarter.

The realised zinc price for the quarter was $1.70/lb, inclusive of provisional and final pricing adjustments. During the quarter:

- Industrias Penoles S.A. de C.V. (“Penoles”) exercised its option to purchase 100% of the zinc

concentrates produced; and

- An offtake agreement was secured with Latin-American metals trading entity Metco, for the sale of 100% of lead concentrates produced,

from Plomosas for calendar year 2022.

Health, Safety and Environment

There were no reportable environmental incidents during the quarter. Training programmes have been implemented to improve operator practises and to increase safety awareness to remedy minor safety issues.

The company’s enhanced mandatory COVID-19 testing regime continues, this requires all employees and visitors to the Plomosas mine site to require a negative test result, unless fully vaccinated.

No COVID-19 cases were reported at the Plomosas operation during the quarter, however, in early January 2022 employees have returned positive COVID tests whilst on leave breaks. All COVID protocols operated effectively to identify the positive COVID cases, with no impact on operations at Plomosas.

During the quarter there was one lost time injury and zero reportable incidents.

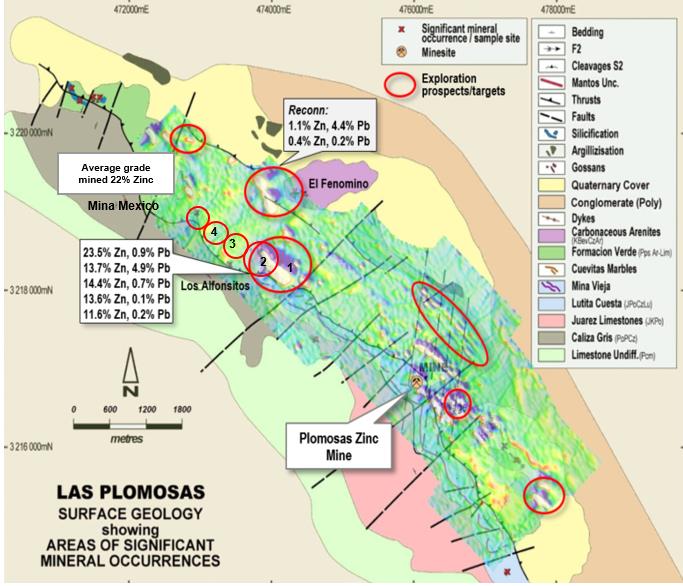

EXPLORATION

Exploration activities focused on:

- Determination of the main orebody fault off-set hypothesis

- The mapping and assessment of commercial exploitation of Mina Mexico

- The mapping and assessment of commercial exploitation of Alfonsitos 1,2,3 &4

- Mapping of the Juarez Mine

Mina Mexico (Prospect)

The Mina Mexico mineralisation has been defined from the surface and a secondary mineralisation in a surface brecciated zinc bearing mineralization has been identified. Sampling and mapping remain ongoing with independent assays results delayed as its being experienced industry wide. Future work will define the extent of the surface brecciated zinc and evaluate the metallurgical performance of the brecciated zinc.

The Juarez mine is located directly north of the Plomosas mine with separate decline access and shafts for ventilation. There is increasing evidence to support the fault off-set rather than the boudinage where the ductile limestone host rock has been bent around a 90o angle.

More work is needed to confirm if the fault was horizontal movement only or if there was a vertical component. The underground mapping completed provides strong support for the off-set fault hypothesis. Should the fault prove geologically correct then it is reasonable to expect the same presence of mineralisation north of the fault as south. Over 2.0m tonnes of ore at 17% zinc has been mined south of the fault.

During the quarter, exploration expenditure was $0.072 million.

CORPORATE

Cash

The Company’s closing cash at the end of the quarter was $0.317 million, a reduction of $0.063 million from the prior quarter of $0.380 million.

Trade Receivables and Payables

The Company’s trade receivables due from the sale of zinc and lead concentrates was $0.320 million (prior quarter $0.885 million) and VAT refundable of $0.878 million (prior quarter $1.236 million).

The VAT refunds are recovered through a combination of cash refunds and offsetting against any monthly VAT payable amounts due to the Mexican government. The VAT refunds are denominated in Mexican Peso and revalued monthly to the functional currency of US Dollars.

The estimated sale value of the zinc and lead concentrate stockpiles at the end of the quarter is $0.108 million (prior quarter $0.311 million), based on provisional assays and commodity prices on 31 December 2021.

Trade payables at the end of the quarter were $2.829 million (prior quarter $2.937 million). Trade payables includes approximately US$1.135 million invoiced by a former contractor but disputed by the Company.

Unsecured borrowings

The Company has a A$0.100 million unsecured loan facility fully drawn (prior quarter A$0.100 million) from an entity related to Mr Andrew Richards (non-executive Chairman). The maturity date was extended from 31 December 2021 to 31 March 2022. All other terms including the interest rate of 10.0% per annum remain unchanged.

Payments to Related Parties

During the quarter, payments totalling $76,000 were made to directors for salaries, directors fees and superannuation.

Board Changes

Angela Pankhurst will return to the role of non-executive Director from 1 February 2022, having completed the additional works and support to the Executive during the difficult impacts of travel restrictions related to COVID-19.

and we thank her for the additional support provided.

Ganti Legal Case

The Federal District Court of Mexico has completed preliminary hearings, with expert reports submitted and witnesses attending the first court discovery hearings. The Court will appoint an independent third-party expert to provide an opinion on the matters of the case.

Legal opinion received by the Company advised there is a high probability of success in defending against Ganti’s claims. If successful, the Group will derecognise the net amount of US$1.035 million recorded as a trade payable to Ganti.

This announcement was authorised for issue to the ASX by the Directors of the Company. For further information please contact:

Brad Marwood Managing Director 08 6400 6222

ABOUT CONSOLIDATED ZINC

Consolidated Zinc Limited (ASX: CZL) owns 100% of the historic Plomosas Mine, located 120km from Chihuahua City, Chihuahua State. Chihuahua State has a strong mining sector with other large base and precious metal projects in operation within the state. Historical mining at Plomosas between 1945 and 1974 extracted over 2 million tonnes of ore grading 22% Zn+Pb and over 80g/t Ag. Only small- scale mining continued to the present day and the mineralised zones remain open at depth and along strike.

The company has recommenced mining and processing at Plomosas and is committed to exploit the high-grade Zinc, Lead and Silver Mineral Resource through the identification, exploration, and exploitation of new zones of mineralisation within and adjacent to the known mineralisation with a view to identify new mineral resources that are exploitable.

Caution Regarding Forward Looking Statements and Forward-Looking Information:

This report contains forward looking statements and forward-looking information, which are based on assumptions and judgments of management regarding future events and results. Such forward-looking statements and forward-looking information involve known and unknown risks, uncertainties, and other factors which may cause the actual results, performance, or achievements of the Company to be materially different from any anticipated future results, performance or achievements expressed or implied by such forward-looking statements. Such factors include, among others, the actual market prices of zinc and lead, the actual results of current exploration, the availability of debt and equity fin ancing, the volatility in global financial markets, the actual results of future mining, processing and development activities, receipt of regulatory approvals as and when required and changes in project parameters as plans continue to be evaluated.

Except as required by law or regulation (including the ASX Listing Rules), Consolidated Zinc undertakes no obligation to provide any additional or updated information whether because of new information, future events, or results or otherwise. Indications of, and guidance or outlook on, future earnings or financial position or performance are also forward-looking statements.

Production Targets:

Production targets referred to in this report are underpinned by estimated Mineral Resources which have been prepared by comp etent persons in accordance with the requirements of the JORC Code. The production targets in this report are sourced from both Indicated and Inferred Mineral Resources and it should be noted that there is a low geological confidence associated with Inferred Mineral Resour ces and there is no certainty that further exploration work will result in the determination of Indicated Mineral Resources or that the production target will be realised.

The stated production target is based on the Company’s current expectations of future results or events and should not be solely relied upon by investors when making investment decisions. Further evaluation work and appropriate studies are required to establish sufficient conf idence that this target will be met.

Competent Persons’ Statement

The information in this report that relates to exploration results, data collection and geological interpretation is based on information compiled by Duncan Greenaway (Hons), Mr Greenaway is a Member of the Australasian Institute of Mining and Metallurgy (AusIMM). Mr. Greenaway has sufficient experience that is relevant to the style of mineralisation and type of deposit under consideration and to the activity that i s being undertaken to qualify as Competent Person as defined in the 2012 edition of the ‘Australasian Code for Reporting of Exploration Results, Minerals Resources and Ore Reserves’ (JORC Code). Mr. Greenaway consents to the inclusion in the report of the matters based on his information in the form and context in which it appears.

The information in this report that relates to Mineral Resources is based on information compiled by Mr Shaun Searle who is a Member of the Australasian Institute of. Mr Searle is a full-time employee of Ashmore Advisory Pty Ltd. Mr Searle has sufficient experience which is relevant to the style of mineralisation and type of deposit under consideration and to the activity which he has undertaken to qualify as a C ompetent Person as defined in the 2012 Edition of the ‘Australasian Code for the Reporting of Exploration Results, Mineral Resources and Ore Reserves’. Mr Searle consents to the inclusion in this report of the matters based on his information in the form and context in which it appears.

Original Article: https://www.consolidatedzinc.com.au/wp-content/uploads/2022/01/CZL-2021-Dec-Qtr-Report-FINAL-ASX-LODGEMENT-1.pdf