Second highest silver production in Hecla’s history

COEUR D’ALENE, Idaho–(BUSINESS WIRE)–Hecla Mining Company (NYSE:HL) today announced its preliminary silver and gold production for the fourth quarter and full year 2020 and year-end cash position.1

HIGHLIGHTS

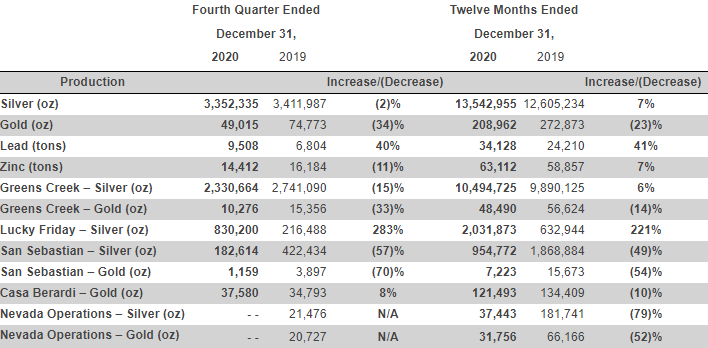

- Silver production of 13.5 million ounces, an increase of 7%, second highest production only to 2016.

- Gold production of 208,962 ounces, expected lower gold production from the Nevada operation decreased production 23% from 2019, which was Hecla’s highest gold production.

- Zinc and lead production increased 7% and 41%, respectively, due to the ramp up of the Lucky Friday Mine.

- Silver equivalent production of 40.7 million ounces and gold equivalent production of 471,413 ounces.2

- Year-end cash position of $131 million with the credit facility undrawn.

- Net debt reduction of approximately $75 million, or 16%, from March 31, 2020.3

- All injury frequency rate (AIFR) of 1.22 for 2020, lowest in the Company’s history and a reduction of 24% over 2019.

“Despite the challenges of operating during the pandemic, 2020 marked a year of very strong operational performance with silver production significantly exceeding guidance,” said Hecla’s President and CEO, Phillips S. Baker, Jr. “Our U.S. silver production was 15% higher than the year before and more than 50% higher than 2018, strengthening our position as the United States largest silver producer. The strong performance allowed Hecla to reduce net debt, increase dividends, and double exploration expenditures while more than doubling last year’s cash position. At current prices, we could repeat these results in 2021.”

Greens Creek

At the Greens Creek Mine in 2020, 10.5 million ounces of silver and 48,490 ounces of gold were produced. For the fourth quarter, 2.3 million ounces of silver and 10,276 ounces of gold were produced. The mill operated at an average of 2,236 tons per day (tpd) in 2020. Fourth quarter production was affected by a significant weather event in December when southeast Alaska was impacted by historically high winds and heavy rains that caused heavy damage in the area and communities. Mr. Baker commended the team at Greens Creek for the management of this weather event and noted, “The preparation and response to this event is a testament to the excellent team at Greens Creek and their commitment to safety and the environment.”

Casa Berardi

At the Casa Berardi Mine, 121,493 and 37,580 ounces of gold were produced in 2020 and the fourth quarter, respectively. The latter represents an increase of 11,175 ounces over the third quarter due to more tons milled and higher grades. The mill operated at an average of 3,699 tpd in 2020. Overall, 2020 gold production decreased by 10%, or 12,916 ounces, compared to 2019, primarily due to the three-week suspension of operations at the mine to comply with the Government of Quebec’s COVID‑19 order in April, and downtime for planned major mill repairs in the third quarter.

- See cautionary statement regarding preliminary statements at the end of this release.

- Silver and gold equivalent calculation based on average actual prices for each metal in the year as follows: $20.51 for Ag, $1,770 for Au, $0.83 for Pb, and $1.03 for Zn.

- Net debt represents a non-U.S. Generally Accepted Principles (GAAP) measurement, see cautionary language at the end of this release.

Lucky Friday

At the Lucky Friday Mine, 2.0 million and 0.8 million ounces of silver were produced in 2020 and fourth quarter, respectively. Lucky Friday achieved full production in the fourth quarter with estimated annual production in excess of 3 million ounces of silver in 2021.

San Sebastian

At the San Sebastian Mine in 2020, 1.0 million ounces of silver and 7,223 ounces of gold were produced. For the fourth quarter, 0.2 million ounces of silver and 1,159 ounces of gold were produced. Mining was completed in the third quarter and milling completed in the fourth quarter of 2020. The mill operated at an average of 474 tpd when in production. The Company continues to explore this highly prospective land package and will evaluate further mining based on exploration results.

Nevada Operations

At the Nevada operations in 2020, 31,756 ounces of gold and 37,443 ounces of silver were produced. Ore mined during the third and fourth quarters was stockpiled for expected processing in early 2021. Mining of non-refractory ore is substantially complete. Mining of refractory ore for the bulk sample test continued through the fourth quarter of 2020. Production from this test is expected to be in the range of five thousand ounces of gold in the first half of 2021.

PRODUCTION SUMMARY

STRENGTHENING THE BALANCE SHEET

Cash and cash equivalents of $131 million on December 31, 2020, with the revolving line of credit undrawn. The Company also received the final tranche from Investissment Quebec of C$12.5 million in October (US$9.2 million).

ABOUT HECLA

Founded in 1891,Hecla Mining Company (NYSE:HL) is a leading low-cost U.S. silver producer with operating mines in Alaska and Idaho and is a growing gold producer with an operating mine in Quebec. The Company also has exploration and pre-development properties in eight world-class silver and gold mining districts in the U.S., Canada, and Mexico.

Cautionary Statements Regarding Estimates and Forward-Looking Statements

All measures of the Company’s full year and fourth quarter 2020 operating and financial results and conditions contained in this release are preliminary and reflect the Company’s expected results as of the date of this release. Actual reported full year and fourth quarter 2020 results are subject to management’s final review as well as review by the Company’s independent registered accounting firm and may vary significantly from current expectations because of a number of factors, including, without limitation, additional or revised information and changes in accounting standards or policies or in how those standards are applied.

Statements made or information provided in this news release that are not historical facts are “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995 and “forward-looking information” within the meaning of Canadian securities laws. Words such as “may”, “will”, “should”, “expects”, “intends”, “projects”, “believes”, “estimates”, “targets”, “anticipates” and similar expressions are used to identify these forward-looking statements. Forward-looking statements in this news release may include, without limitations, (i) 2021 results could be similar to 2020 results at current prices; (ii) Lucky Friday anticipated production in 2021 in excess of 3 million ounces; (iii) continued exploration in Mexico; and (iv) at the Nevada Operations (1) stockpiled ore is anticipated to be processed in 2021, (2) gold production is anticipated to be realized in early or the first half of 2021, and (3) mining of refractory ore for the bulk sample is expected to continue in 2021 and is expected to yield production in the range of 5,000 ounces of gold. The material factors or assumptions used to develop such forward-looking statements or forward-looking information include that the Company’s plans for development and production will proceed as expected and will not require revision as a result of risks or uncertainties, whether known, unknown or unanticipated, to which the Company’s operations are subject.

Forward-looking statements involve a number of risks and uncertainties that could cause actual results to differ materially from those projected, anticipated, expected, or implied. These risks and uncertainties include, but are not limited to, metals price volatility, volatility of metals production and costs, litigation, regulatory and environmental risks, operating risks, project development risks, political risks, labor issues, ability to raise financing and exploration risks and results. Refer to the Company’s Form 10-K and 10-Q reports for a more detailed discussion of factors that may impact expected future results. The Company undertakes no obligation and has no intention of updating forward-looking statements other than as may be required by law.

Cautionary Note Regarding Non-GAAP measure

Non-GAAP financial measures are intended to provide additional information and do not have any standard meaning prescribed by generally accepted accounting principles in the United States (GAAP). These measures should not be considered in isolation or as a substitute for measures of performance prepared in accordance with GAAP.

Net debt is a non-GAAP measurement, it is an important measure for management to measure relative indebtedness and the ability to service the debt relative to its peers. It is calculated as total debt outstanding less total cash on hand.

Category: Press Release

Contacts

Russell Lawlar

Treasurer

Jeanne DuPont

Corporate Communications Coordinator

800-HECLA91 (800-432-5291)

Investor Relations

Email: hmc-info@hecla-mining.com

Website: www.hecla-mining.com