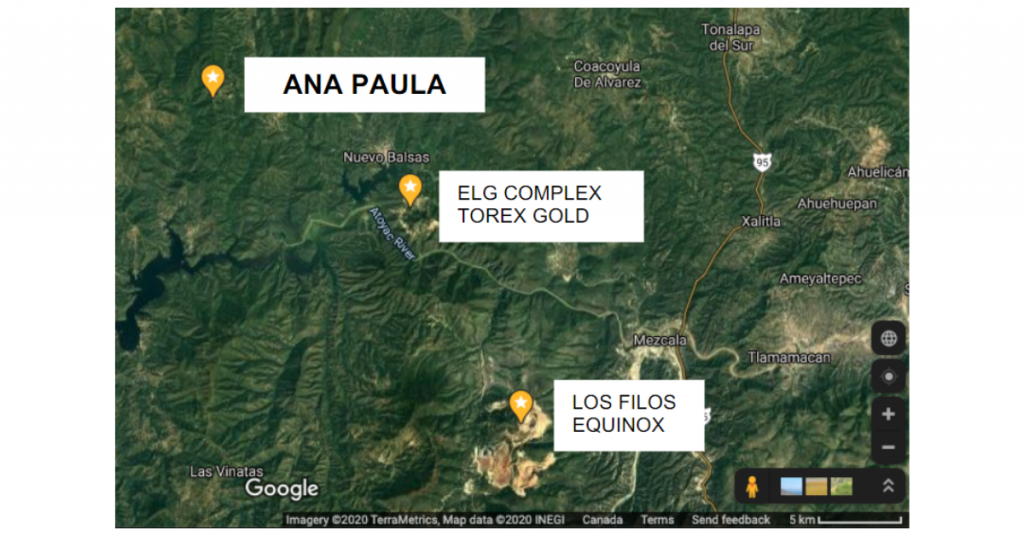

TORONTO, Sept. 11, 2020 /CNW/ – Argonaut Gold Inc. (TSX: AR) (the “Company”, “Argonaut Gold” or “Argonaut”) is pleased to announce it has entered into a definitive agreement for the sale of its Ana Paula gold development project located in the Guerrero Gold belt of Mexico (the “Ana Paula Project”). Total consideration to Argonaut includes:

- US$30 million on closing;

- C$10 million upon the announcement of commencement of construction;

- A 1% net smelter returns royalty; and

- 9.9% of the outstanding common shares of the acquiring company, which will be formed by a business combination of 1252201 BC Ltd (“AP Mining”) and Pinehurst Capital II Inc. (“Pinehurst”), creating a new publicly traded gold development company (the “Resulting Issuer”).

Pete Dougherty, President and CEO stated: “When you consider the value of Alio Gold when we announced the at-market merger less than six months ago, you can begin to recognize the tremendous value-creation opportunity Argonaut’s board and management saw at the time of the merger. The proceeds of this transaction support Argonaut’s focus on the development of our Magino gold project in Ontario, Canada by providing upfront capital while still providing Argonaut shareholders with upside participation in the Ana Paula Project through Argonaut’s equity ownership in the Resulting Issuer, a contingent payment upon a construction announcement and a royalty. Bruce Bragagnolo, the CEO of the Resulting Issuer, was the former CEO of Timmins Gold Corp., a former owner of the Ana Paula Project.”

Sale Agreement

Argonaut has entered into a definitive agreement with AP Mining dated September 10, 2020 (the “Argonaut Agreement”) for the sale of all of the issued and outstanding shares of Aurea Mining Inc. and its wholly-owned subsidiary Minera Aurea S.A. de C.V. (the Ana Paula Project holder).

AP Mining has in turn entered into a definitive agreement with Pinehurst dated September 10, 2020 (the “AP Mining Agreement”), pursuant to which Pinehurst and AP Mining have agreed to complete a business combination (the “Qualifying Transaction”) whereby Pinehurst will be the parent company and 100% of the issued and outstanding securities of AP Mining will be owned by the Resulting Issuer, conditional on the completion by AP Mining of the acquisition of the Ana Paula Project pursuant to the terms of the Argonaut Agreement.

Under the terms of the Argonaut Agreement, AP Mining will acquire all of the issued and outstanding shares of Aurea Mining Inc. and its wholly-owned subsidiary Minera Aurea S.A. de C.V. for an aggregate purchase price comprised of, in part, US$30 million in cash on closing, a promissory note in the amount of C$10 million payable on the date on which the Resulting Issuer announces the commencement of construction at the Ana Paula Project, a 1% net smelter returns royalty and such number of common shares of the Resulting Issuer as is equal to 9.9% of the outstanding common shares of the Resulting Issuer immediately following the completion of the Qualifying Transaction. Closing of the transactions set out in the Argonaut Agreement are subject to a number of conditions including regulatory approval, including TSX Venture approval, approval of the Qualifying Transaction and successful completion of the capital raising in connection with the Qualifying Transaction.

Upon completion of the Qualifying Transaction, Bruce Bragagnolo will serve as the Chief Executive Officer and a director of the Resulting Issuer, with the remaining management team and directors to be determined prior to the completion of the Qualifying Transaction.

Mr. Bragagnolo was the co-founder and Chief Executive Officer of Timmins Gold Corp. Mr. Bragagnolo took Timmins Gold Corp. from its IPO to commercial production and its listing on the NYSE-MKT. While he was CEO, Timmins Gold Corp. built the San Francisco Mine in Mexico. Mr. Bragagnolo led the purchase of the Ana Paula Project by Timmins Gold Corp. in 2015.

Cautionary Note Regarding Forward-looking Statements

This press release contains certain “forward-looking statements” and “forward-looking information” under applicable Canadian securities laws concerning the proposed transaction and the business, operations and financial performance and condition of Argonaut Gold Inc. (“Argonaut” or “Argonaut Gold”). Forward-looking statements and forward-looking information include, but are not limited to, uncertainties related to the Argonaut Agreement and the Qualifying Transaction and the successful approval and completion of the transactions described therein; commodity price volatility; uncertainty of exploration and development; uncertainty in the estimation of Mineral Reserves and Mineral Resources; permitting risk; mineral and surface rights; statements with respect to estimated production and mine life of the various mineral projects of Argonaut; the benefits of the development potential of the properties of Argonaut; the future price of gold, copper, and silver; the realization of mineral reserve estimates; the timing and amount of estimated future production; costs of production; success of exploration activities; and currency exchange rate fluctuations. Except for statements of historical fact relating to Argonaut, certain information contained herein constitutes forward-looking statements. Forward-looking statements are frequently characterized by words such as “plan,” “expect,” “project,” “intend,” “believe,” “anticipate”, “estimate” and other similar words, or statements that certain events or conditions “may” or “will” occur. Forward-looking statements are based on the opinions and estimates of management at the date the statements are made, and are based on a number of assumptions and subject to a variety of risks and uncertainties and other factors that could cause actual events or results to differ materially from those projected in the forward-looking statements. Many of these assumptions are based on factors and events that are not within the control of Argonaut and there is no assurance they will prove to be correct.

Factors that could cause actual results to vary materially from results anticipated by such forward-looking statements include changes in market conditions; the ability to obtain regulatory approvals and the conditions therefor; the timing and ability to successfully complete elements of the Qualifying Transaction, including regulatory approvals, shareholder approvals and capital raisings; variations in ore grade or recovery rates; risks relating to international operations; fluctuating metal prices and currency exchange rates; possible exposure to undisclosed risks of liabilities arising in relation to recent transactions; changes in project parameters; the possibility of project cost overruns or unanticipated costs and expenses; labour disputes and other risks of the mining industry; failure of plant, equipment or processes to operate as anticipated. Although Argonaut has attempted to identify important factors that could cause actual actions, events or results to differ materially from those described in forward-looking statements, there may be other factors that cause actions, events or results not to be anticipated, estimated or intended. There can be no assurance that forward-looking statements will prove to be accurate, as actual results and future events could differ materially from those anticipated in such statements. Argonaut undertakes no obligation to update forward-looking statements if circumstances or management’s estimates or opinions should change except as required by applicable securities laws. The reader is cautioned not to place undue reliance on forward-looking statements. Statements concerning mineral reserve and resource estimates may also be deemed to constitute forward-looking statements to the extent they involve estimates of the mineralization that will be encountered if the property is developed. Comparative market information is as of a date prior to the date of this document.

About Argonaut Gold

Argonaut Gold is a Canadian gold company engaged in exploration, mine development and production. Its primary assets are the El Castillo mine and San Agustin mine, which together form the El Castillo Complex in Durango, Mexico, the La Colorada mine in Sonora, Mexico and the Florida Canyon mine in Nevada, USA. Advanced exploration projects include the Magino project in Ontario, Canada, the Cerro del Gallo project in Guanajuato, Mexico and the Ana Paula project in Guerrero, Mexico. The Company holds several other exploration stage projects, all of which are located in North America.

For more information, contact:

Argonaut Gold Inc.

Dan Symons

Vice President, Investor Relations

Phone: 416-915-3107

Email: dan.symons@argonautgold.com

1252201 BC Ltd.

Bruce Bragagnolo

CEO

Phone: 604-417-9517

Email: brucebrag@gmail.com

Source: Argonaut Gold Inc.

Original Article: https://www.argonautgold.com/English/news-and-events/news-releases/news-releases-details/2020/Argonaut-Gold-Enters-into-Agreement-to-Sell-Ana-Paula-Project-for-US30-Million-plus-a-C10-Million-Contingent-Payment-Upside-to-Ana-Paula-Project-Retained-Through-9.9-Equity-in-Acquiring-Company-and-1-Net-Smelter-Returns-Royalty/default.aspx