Mexico City, April 29, 2020 – Orbia Advance Corporation, S.A.B. de C.V. (BMV: ORBIA*) (“the Company” or “Orbia”) today released unaudited results for the first quarter of 2020.

Daniel Martinez-Valle, CEO of Orbia, remarked, “As we all face an unprecedented global pandemic and the uncertainty and volatility that comes with it, it is important that I first thank all those working around the clock and on the front lines to care for people around the world. I must also thank our more than 22,000 dedicated employees who are continuing to provide our customers with essential solutions. While the crisis at hand is challenging us as individuals and as an organization to execute under extraordinarily difficult circumstances, Orbia has emerged stronger from difficult circumstances before. I believe that by upholding our fundamental commitment to the health and safety of our employees and stakeholders, our legacy of executional excellence and our purpose to advance life around the world, we are well positioned to weather the storm, protect each other and continue to deliver for our customers and shareholders.”

Martinez-Valle continued, “In this context, the health and safety of our own and of those we touch through our work are our priorities. We have been monitoring the situation daily and implementing measures adherent with government guidelines to keep our employees, customers and the communities in which we operate safe as we conduct necessary operations for business continuity. While we have started to see some negative impacts in March, particularly in our building and infrastructure business due to temporary closures of non-essential sites and plants as well as a drop in demand in several of our markets, we remain confident in the strength of our businesses and in our financial resilience. We will continue to honor our purpose in our daily work, and will continue to respond with agility, responsibility and resilience to face the challenges ahead.”

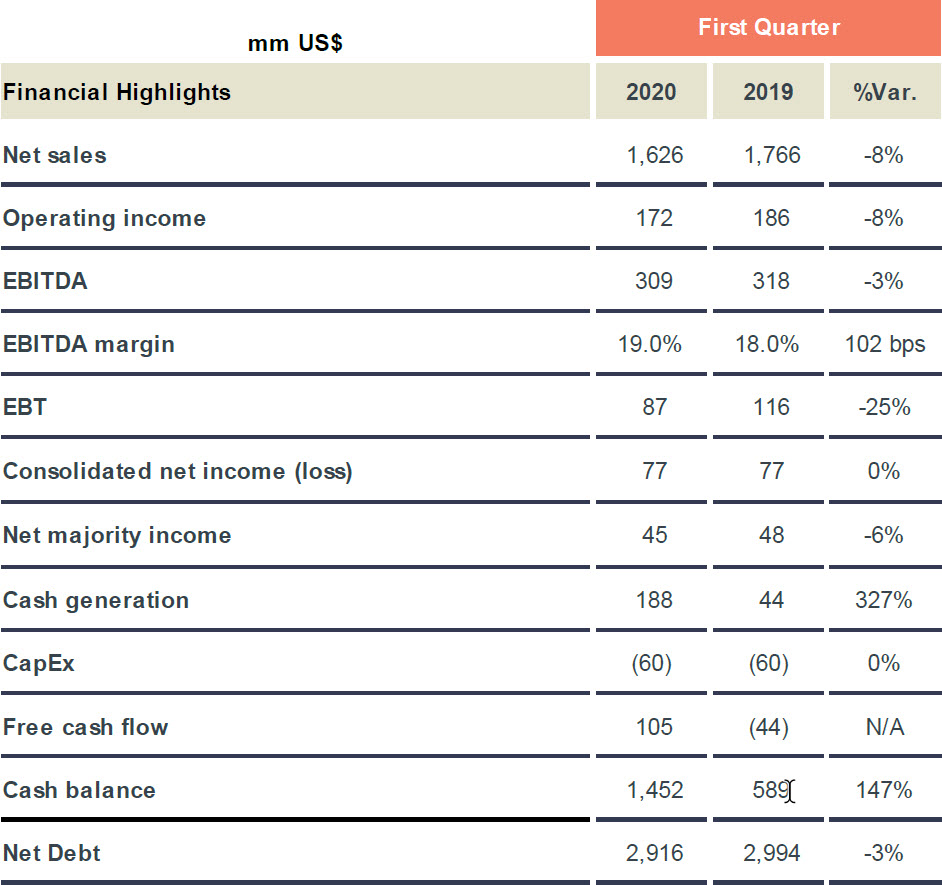

Q1 2020 Financial Highlights1

- Orbia’s reported EBITDA margin expanded to 19.0%, a 102 basis points improvement over Q1 2019. In spite of a challenging environment, EBITDA reached $309 million, a decrease of 3% compared to Q1 2019;

- Improvement in working capital for the third consecutive quarter drove free cash flow to $105 million, with a strong free cash flow conversion rate of 34% for this quarter;

- Strong performance in the Vestolit business led to an EBITDA increase of 19%, helped by higher volumes and efficiencies in our industrial value chain;

- Continued strong performance in the Dura-Line business led to an EBITDA increase of 7%, on top of its already solid comparison base from last year;

- During the quarter there were major impacts in Koura from illegal imports of refrigerant gases into Europe and in Wavin Latin America from the coronavirus, which were partially compensated by lower raw material costs, higher productivity and currency depreciation.

- Orbia withdrew $1 billion from its revolving line of credit as a precautionary measure to ensure strong liquidity and provide financial flexibility through the coronavirus pandemic.

Q1 2020 Financial Overview

Coronavirus (COVID-19) Response

As the human and economic impacts of the coronavirus pandemic escalate, Orbia believes it is important to keep customers, stakeholders and the public informed as to how this affects the Company and what measures are being taken to adapt to this quickly-changing situation.

Orbia has assembled a global task force of internal and external leaders responsible for assessing the situation daily and implementing measures, guidelines and best practices compliant with regional regulations to navigate responsibly and swiftly.

Team Health and Safety

Orbia’s fundamental reason for being is to advance life around the world. The health and safety of people and stakeholders come first. The Company has put in place the following measures to protect its employees, customers and the communities in which it operates while continuing essential business activities.

Among other measures, to reduce risk of transmission, to support employees who are or may be infected and to help employees manage stress and boost morale, Orbia has:

- Made teleworking mandatory for all employees who can effectively work from home across all appropriate locations, in adherence with regional guidance.

- Instituted enhanced health monitoring practices, sanitation guidelines and shift management protocols to support social distancing, hygiene best practices and employee health and safety in essential operating plants, facilities and sites.

- Introduced an employee self-quarantine policy based on travel history and health status.

- Established a physician network to provide access to health care services and support for employees.

- Issued frequent internal communications around business impacts and actions taken.

- Prepared a return to work protocol.

Orbia has also created regional councils with Health, Safety and Environment representatives and business group leaders to ensure compliance with regulatory requirements across all of its operations.

Business Strength

To maintain operational continuity, Orbia is presently keeping most of its manufacturing plants, facilities and sites running while continuing to closely monitor policy orders in each country. The Company has also put in place robust continuity plans for all its facilities and sites, inclusive of the aforementioned health and safety protocols and is maintaining close contact with customers and suppliers to ensure that needs today and tomorrow are met. Among other measures, Orbia has:

- Reached out to customers proactively to understand their needs and communicate the Company’s plans for operations and solutions delivery.

- Augmented communication frequency between the Company’s supply chain teams and suppliers and logistics partners to manage ahead of any potential disruptions.

Financial Resilience

Given market volatility, Orbia is reassessing all capital expenditures for 2020 in order to safeguard free cash flow. The Company is prioritizing critical maintenance projects as well as staying focused on key long-term strategic projects that will position the business for sustained growth in the future. At this point in time, the Company’s CAPEX expectations for the rest of the year will be in line with the investments made in 2019.

There are several initiatives across the organization to ensure costs and expenses containment which are showing a positive impact in the Company’s Cost of Goods Sold and SG&A. Orbia is taking all measures needed across several variables to streamline operations around the world.

Orbia will continue to maintain its discipline and efficiency in managing working capital across operations to allow cash flow resiliency. This is the Company’s third consecutive quarter with an improvement in working capital to enable a positive cash flow.

In light of ongoing economic uncertainty due to the continued global economic downturn as well as potential effects on global financial and capital markets resulting from the coronavirus outbreak, Orbia withdrew $1 billion from its revolving line of credit on March 27, 2020 as a precautionary measure to strengthen its liquidity and financial flexibility. It is important to highlight that the Company has an average life of debt of 12 years, and its next relevant debt maturity will not occur until 2022.

2020 Financial Outlook

Given the uncertainty regarding the duration and severity

of the current pandemic, it is very difficult at this point in time to provide

accurate guidance for the remainder of 2020. However, the Company remains

confident in its long-term strategy and ability to adapt to market conditions.

Consolidated Financial Information

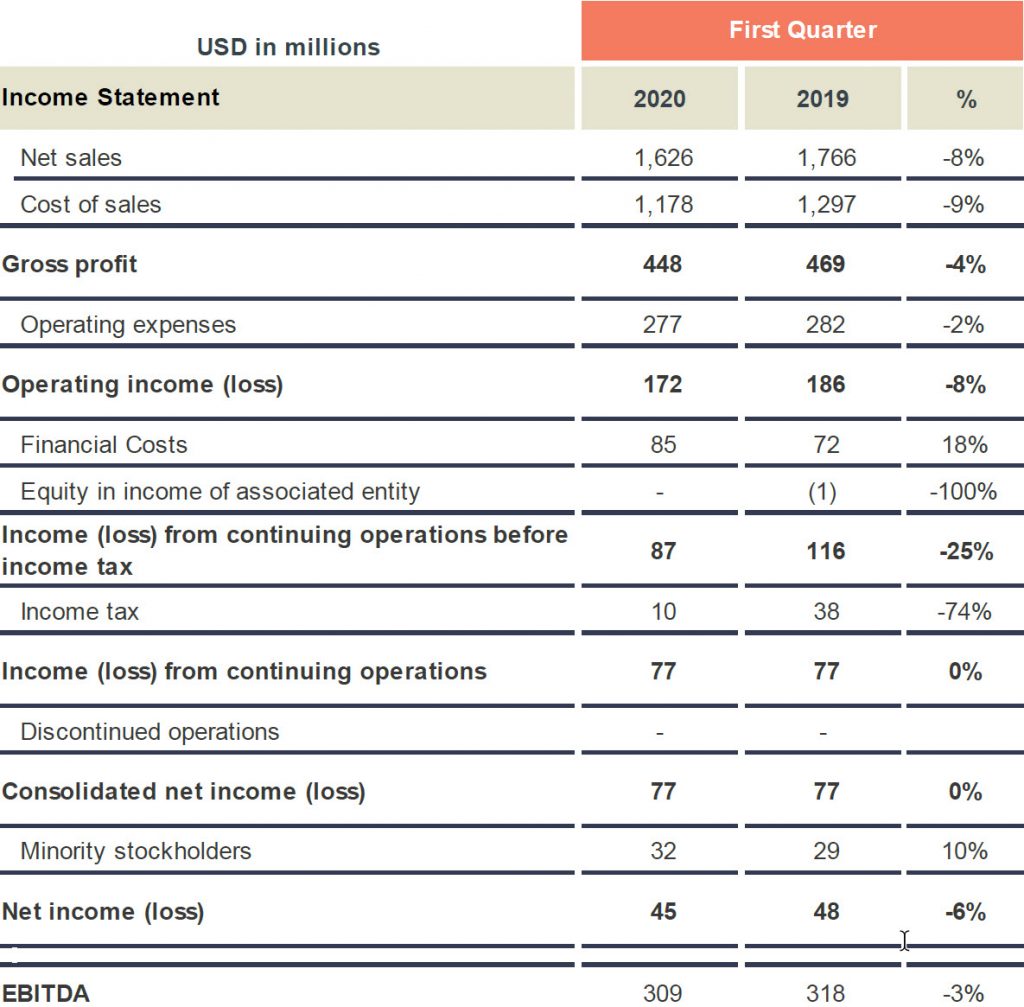

Revenues

For Q1 2020, revenues totaled $1.6 billion, down $140 million, or 8% from Q1 2019, mainly driven by lower sales in the Netafim, Wavin Latin America (LatAm) and Koura businesses.

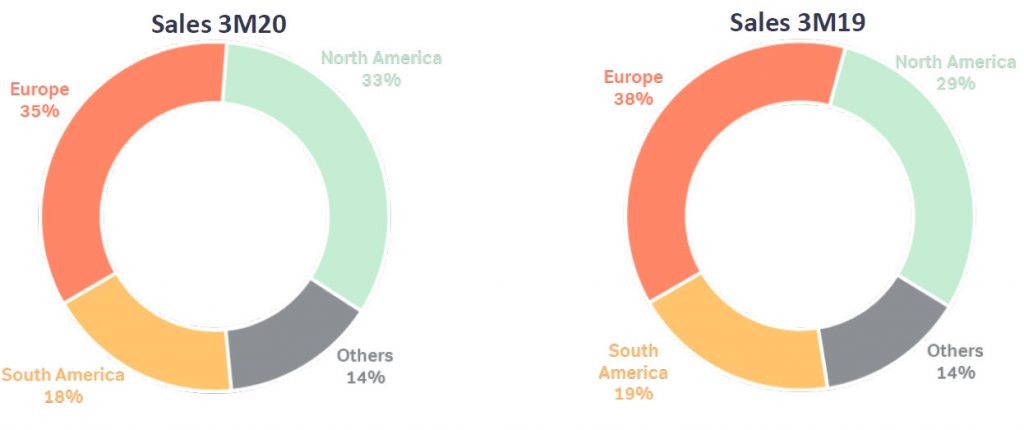

Sales by region (3M 2020) compared to (3M 2019):

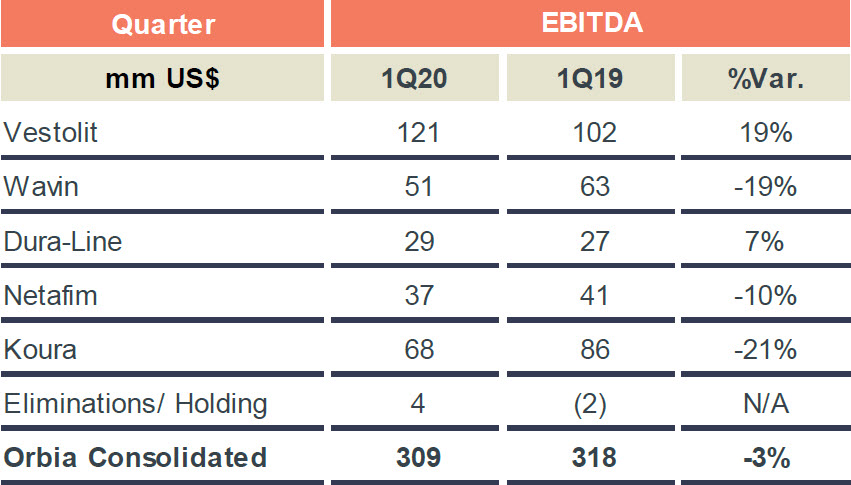

EBITDA

EBITDA for the quarter expanded 102 basis points with a margin of 19.0%, driven by margin expansions in the Vestolit and Dura-Line businesses. In Q1 2020, consolidated reported EBITDA was $309 million, down 3% from the $318 million reported in Q1 2019. This decline was mainly due to the continued impact of the illegal import of refrigerant gases into the European Union, which in turn constrained Koura’s “downstream” business as this negative effect was not reflected in the same period of last year. In addition, Wavin’s LatAm business was hit by supply and demand negative impacts in March.

Financial Costs

In Q1 2020, financial costs increased by $13 million to $85 million or 18%, as compared to Q1 2019. This increase was mainly due to higher exchange rate loss of $17 million associated with the liability positions in US dollars of entities which have the Mexican peso and Brazilian real as their functional currencies in a context of significant depreciation of these currencies. Several of these positions are intercompany loans or payables within our operations. These impacts were partially offset by a decrease in net interest expenses as a result of lower interest rates and bank commissions.

Taxes

In Q1 2020, income tax charges decreased 74% to $10 million, down from $38 million in Q1 2019 largely driven by the impact of the depreciation of the Mexican peso against the US dollar on Mexican entities with foreign currency debt, which in turn resulted in tax losses.

Consolidated Net Majority Income (Loss)

Mainly as a result of the above factors, net majority income in Q1 2020 decreased 6% to $45 million, down from $48 million in Q1 2019. The earnings per share2 (EPS) for Q1 2020 was $0.02, remaining flat as compared to the same period of last year.

2 Earnings per share

is calculated excluding the shares that Orbia has in the share buy-back

program, as of March 31st of 2020, we had 2,024,199,891 shares

outstanding.

Financial Performance by Business Group

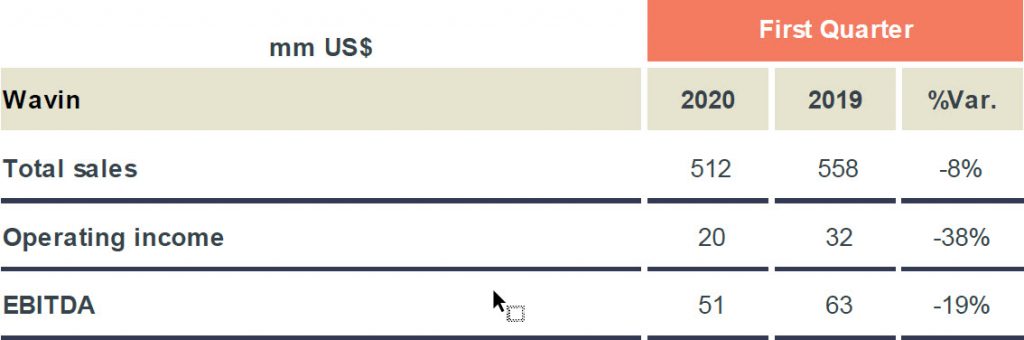

Wavin (Building & Infrastructure) Business Group:

In Q1 2020, Wavin posted revenues of $512 million, down 8% as compared to Q1 2019. The decline was mainly due to sluggish sales in Latin America (LatAm), as a result of lower sales volume in the Andean region and Central America, while sales in Brazil were negatively impacted by the depreciation of the Brazilian real. These sales shortfalls were mainly driven by coronavirus-related disruptions and regional lockdown measures, and the corresponding slow-downs in economic activity during the month of March.

In Q1 2020, reported EBITDA for Wavin was $51 million, down 19% from $63 million in Q1 2019. The decline was mainly due to lower sales volume in LatAm, which was partially offset by strong performance in Europe. The EBITDA margin was 9.9% as compared to 11.3% in Q1 2019, with compression driven by FX devaluation due to coronavirus-related topline effects in most LatAm currencies.

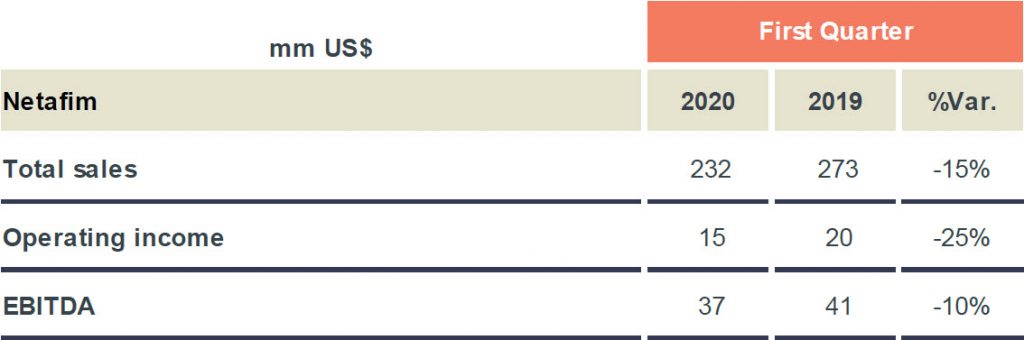

Netafim (Precision Agriculture) Business Group:

In Q1 2020 Netafim posted revenues of $232 million, down 15% as compared with Q1 2019. The decline was mainly due to the timing of deliveries on mega-projects. Sales also were slightly impacted by coronavirus- related factors in Asia, Europe and Latin America epicenters. However, the decline was largely offset by solid growth in North America, Turkey and India.

In Q1 2020, reported EBITDA

for Netafim was $37 million,

down 10% from $41 million

in Q1 2019. The decline was mainly due to lower revenues,

as noted previously. However, the EBITDA margin grew from 15.1% to 15.9%, due

to improved gross margins as a result of a better sales mix and lower raw

material costs.

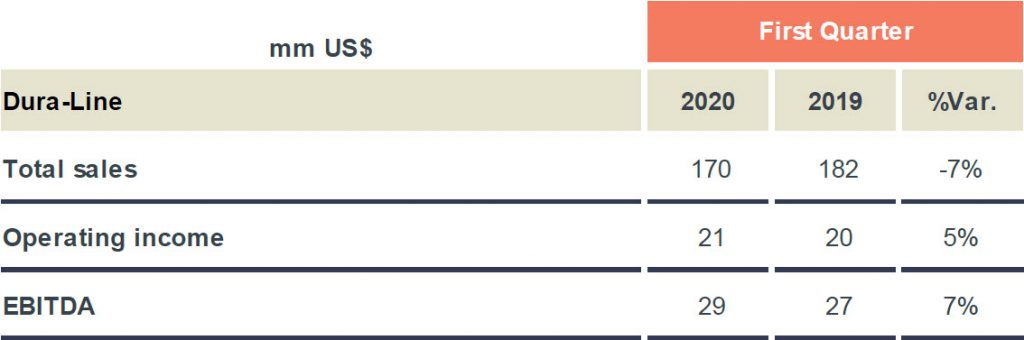

Dura-Line (Data Communications) Business Group:

In Q1 2020, Dura-Line posted revenues of $170 million, down 7% as compared to Q1 2019. The decline was mainly due to a large project undertaken in India for smart cities which ended in 2019. However, the decline was partially offset by higher sales volume in North America.

In Q1 2020, reported EBITDA for Dura-Line was $29 million, up 7% from $27 million in Q1 2019. The EBITDA margin was 17.0% as compared to 14.7% in Q1 2019, reflecting a margin expansion of 225 basis points, mainly driven by a significant increase of its high-end product mix combined with lower raw material costs.

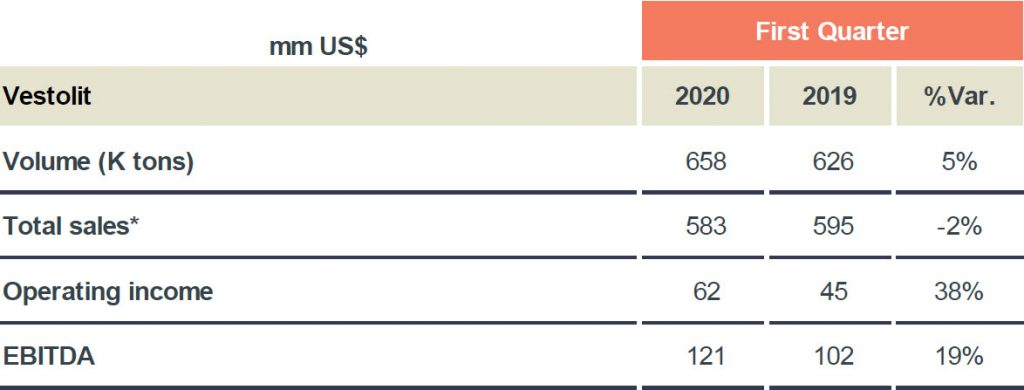

Vestolit (Polymer Solutions) Business Group:

In Q1 2020, Vestolit posted revenues of $583 million, down 2% as compared to Q1 2019. The decline was mainly due to lower average pricing, which was partially offset by higher sales volume.

In Q1 2020, reported EBITDA for Vestolit was $121

million, up 19% from $102 million in Q1 2019. This was mainly driven by cost

efficiencies, and the absence of two negative one-offs that had impacted Q1

2019 earnings. The EBITDA margin was 20.8% as compared to 17.1% in Q1 2019,

reflecting a margin expansion of 370 basis points.

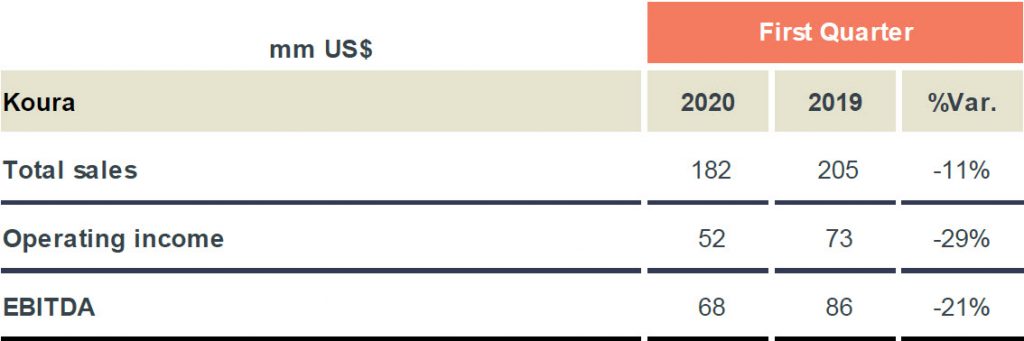

Koura (Fluor) Business Group:

In Q1 2020, Koura posted revenues of $182 million, down 11% as compared to Q1 2019. The decline was mainly due to lower sales in Koura’s “downstream” business per the continued impact of the illegal import of refrigerant gases into the European Union, which was not a factor in Q1 2019.

In Q1 2020, reported EBITDA for Koura was $68 million,

down 21% from $86 million in Q1 2009. This decline was mainly due to the

illegal imports of refrigerant gases in Europe, as noted above. The EBITDA

margin was 37.2% as compared to 42.0% in Q1 2019.

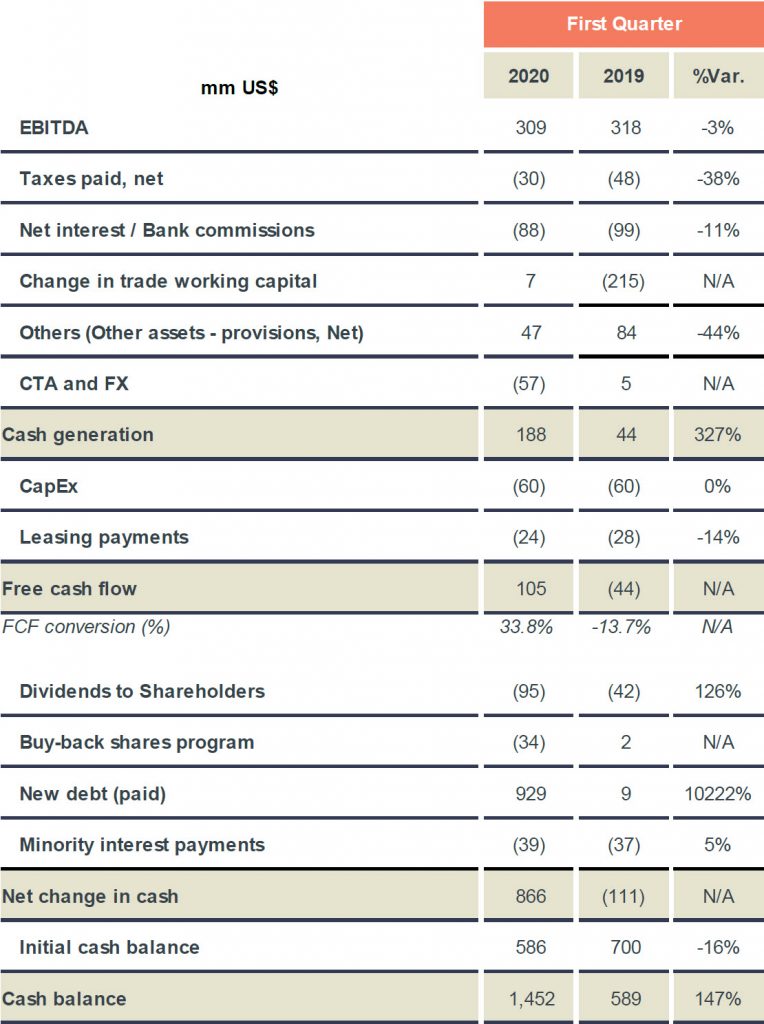

Operating Cash Flow

In Q1 2020, Orbia’s cash generation and free cash flow were $188 million and $105 million respectively, resulting in a strong free cash flow conversion rate of 33.8%. Cash generation was positively influenced by continued improvements in working capital management. Additionally, at the end of March, Orbia withdrew

$1 billion from its revolving line of credit as a

precautionary measure to strengthen the Company’s liquidity and financial

flexibility.

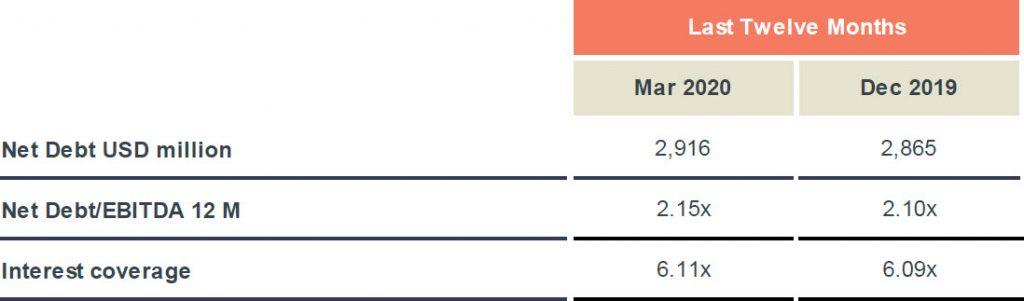

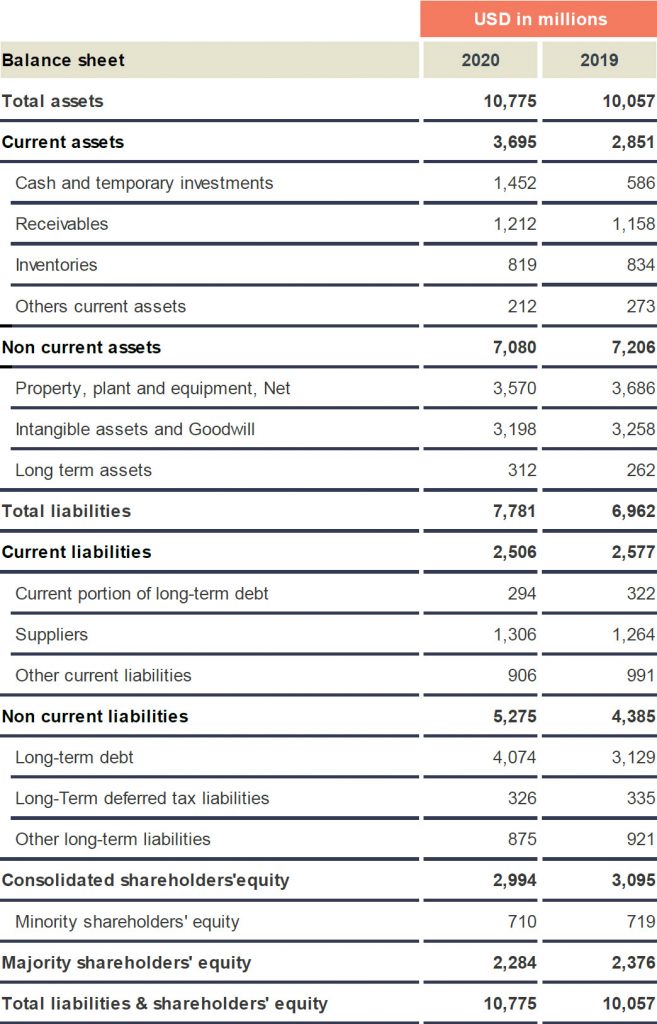

Financial Debt

As of March 31, 2020, Orbia’s net financial debt totaled $2.9 billion, from a total financial debt of $4.4 billion less cash and cash equivalents of $1.5 billion.

As of March 31, 2020, Orbia’s net debt/EBITDA ratio was 2.15x, while the Company’s interest coverage ratio (EBITDA/interest expense) was 6.11x as of that date.

Conference Call Details

Orbia will host a conference call to discuss Q1 2020 results on April 30th, 2020 at 10:00 am Central Time (CT; Mexico City)/11:00 am Eastern Time (ET; New York). To access the call, please dial 001-855-817-7630 (Mexico), 1-888-339-0721 (United States) or 1-412-317-5247 (International).

Participants may pre-register for the conference call here.

The live webcast can be accessed here.

A recording of the webcast will be posted several hours after the call is completed on Orbia’s website.

For all

company news, please visit Orbia’s newsroom.

Consolidated Income Statement

Consolidated Balance Sheet

Notes and Definitions

The results contained in this release have been prepared in accordance with International Financial Reporting Standards (“NIIF” or “IFRS”) having US Dollars as the functional and reporting currency. Figures are presented in millions, unless specified otherwise.

Since Q1 2019, Business Group EBITDAs are being reported inclusive of corporate charges; comparable prior year figures have been adjusted accordingly.

Reflective of Orbia’s continuous efforts to better inform the market and become a more customer-centric organization, beginning in Q1 2020, the Company is presenting the revenues, operating incomes and EBITDAs of each of its five businesses: Wavin (Building & Infrastructure), Dura-Line (Data Communications), Netafim (Precision Agriculture)—all of which previously were presented as Fluent (for reporting purposes only)— Vestolit (Polymer Solutions) and Koura (Fluor).

Figures and percentages have been rounded and may not add up.

About Orbia

Orbia is a community of businesses united by a shared purpose: to advance life around the world. The businesses that make up Orbia have a collective focus on ensuring food security, reducing water scarcity, reinventing the future of cities and homes, connecting communities to data infrastructure and expanding access to health and wellness with advanced materials. Orbia operates in the Precision Agriculture, Building and Infrastructure, Fluor, Polymer Solutions and Data Communications sectors. The company has commercial activities in more than 100 countries and operations in 44, with global headquarters in Mexico City, Boston, Amsterdam and Tel Aviv. To learn more, please visit orbia.com.

Prospective Information

In addition to historical information, this press release contains “forward-looking” statements that reflect management’s expectations for the future. The words “anticipate,” “believe,” “expect,” “hope,” “have the intention of,” “might,” “plan,” “should” and similar expressions generally indicate comments on expectations. The final results may be materially different from current expectations due to several factors, which include, but are not limited to, global and local changes in politics, the economy, business, competition, market and regulatory factors, cyclical trends in relevant sectors; as well as other factors that are highlighted under the title “Risk Factors” in the annual report submitted by Orbia to the Mexican National Banking and Securities Commission (CNBV). The forward-looking statements included herein represent Orbia’s views as of the date of this press release. Orbia undertakes no obligation to revise or update publicly any forward-looking statement for any reason unless required by law.”

Orbia has implemented a Code of Ethics that helps define our obligations to and relationships with our employees, clients, suppliers and others. Orbia’s Code of Ethics is available for consulting in the following link: http://www.Orbia.com/Codigo_de_etica.html. Additionally, according to the terms contained in the Mexican Securities Exchange Act No 42, the Orbia Audit Committee has established a “hotline” system permitting any person who is aware of a failure to adhere to applicable operational and accounting records guidelines, internal controls or the Code of Ethics, whether by the Company itself or any of its controlled subsidiaries to file a complaint (including anonymously). This system is operated by an independent third-party service provider. The system may be accessed via telephone in Mexico, the website at http://www.ethic-line.com/Orbia, or e-mail at [email protected]. Orbia’s Audit Committee has oversight responsibility for ensuring that all such complaints are appropriately investigated and resolved.

Original Article: https://www.orbia.com/499807/siteassets/5.-investor-relations/quarterly-earnings/2020/q1/pr-1q20-eng-fv.pdf