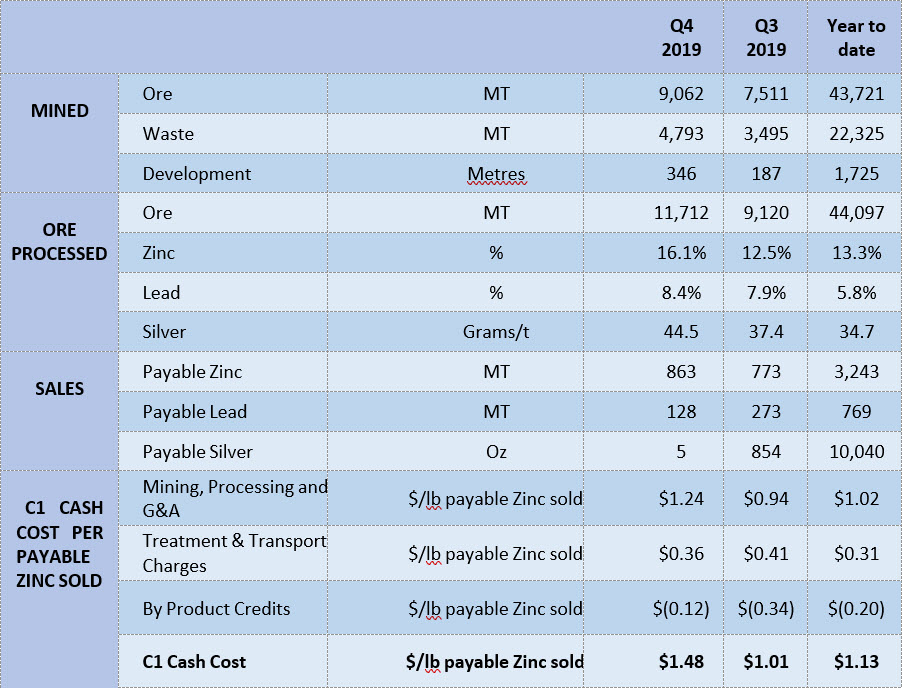

- 9,062 tonnes ore mined during the quarter grading 16.1% zinc and 8.4% lead, up from the September quarter demonstrating better than historical grades mined at Plomosas.

- 11,712 tonnes of ore processed at 16.1% zinc and 8.4% lead, up 31% from the September quarter as the debottlenecking starts to deliver increased plant performance.

- Payable metal sold of 863 tonnes of zinc and 128 tonnes of lead in concentrate, up from the September quarter.

- Inventory stockpiles at quarter end which will be realised in 2020.

- 1,621 tonnes of high-grade run-of-mine ore stockpiled for processing

- 69 tonnes of zinc concentrate, and 59 tonnes of lead concentrate stockpiled and available for sale

- Q4 2019 C1 cash cost of payable zinc sold $1.48/lb, primarily higher than the September quarter due to the reduced production with 7 days closure through the Christmas period, and disruption to the mining operations by terminating the mining contractor.

- Significant operational improvements at the Aldama concentrator, in December the plant operated for 19 days at an average of 185 tonnes per day, November 27 days at 155 tonnes per day, October 27 days at 152 tonnes per day.

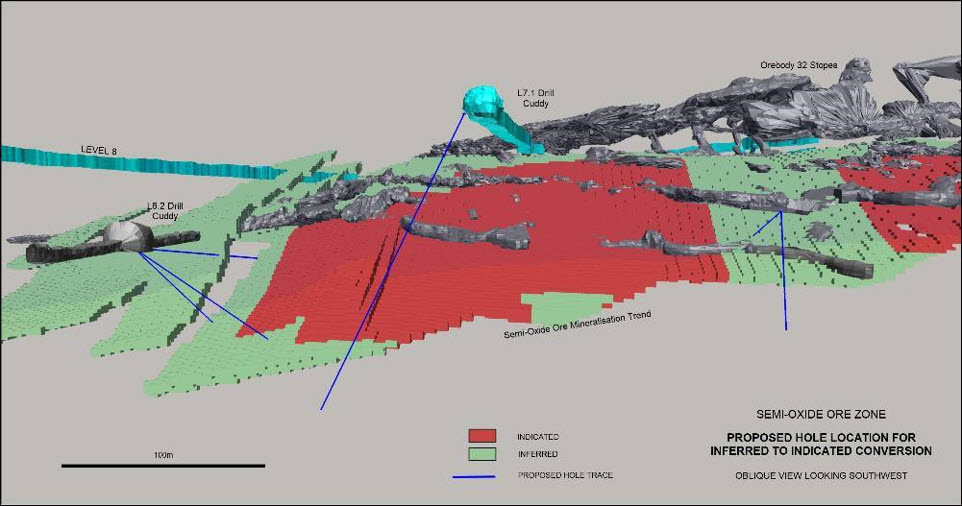

- Exploration drilling commenced with the programme to improve confidence on the Inferred SOX mineralisation located between levels 7 and Level 9.

- Gold mineralisation was confirmed from surface samples taken in the quarter, in the north west of the Plomosas concession holding. Assays up to 61.0 g/t Au and 27.5 g/t Au were returned after quarter end.

- Completed a fully underwritten non-renounceable Rights issue of 1 new share for every 6 shares held at A$ 0.011 per share to raise A$2.48 million (before costs).

- Cash balance at 31 December 2019 of US$0.556 million plus concentrate trade receivables of $0.617 million

Consolidated Zinc Limited (CZL:ASX or “the Company”) is pleased to present its December 2019 quarterly activities report.

All references in this report are to US$, unless otherwise stated.

OPERATIONS – PLOMOSAS MINE, CHIHUAHUA STATE, MEXICO (100% OWNED)

Health, Safety and Environment

There were no reportable environmental or safety incidents during the quarter.

Mining

During the quarter, 9,062 tonnes of ore were mined at Plomosas, which was higher than the previous quarter of 7,511 tonnes despite the decision to move to owner operated mining and terminate the mining contractor.

Stope mining of the semi -oxide ore (“SOX”) between Level 7 and Level 9 is well underway using room and pillar mining with gallery stopes developed where the ground support allows. The rises between sublevel 888mRL and sublevel 921m RL provide access into the stoping areas.

The mining contract was terminated and mining contractor demobilised from Plomosas during the last week of November 2019. Plomosas secured a rental underground loader and purchased 2 new haul trucks to commence owner operated mining. The equipment arrived during early December and was commissioned by the 16th December 2019. Staffing was built up and operations continued to improve with a near full compliment of staff at the end of the quarter.

The Company’s decision to terminate the mining contractor, was a result of an annual review of the contractors performance and productivity, and a review of their progress claims which identified significant overcharging and their underperformance at the Plomosas mine, completing approximately 60% of their contracted scope of works during the first 12 months of the contract.

Processing

During the quarter 11,712 tonnes of ore were processed at average milled grades of 16.1% zinc, 8.4% lead and 44.5 g/t silver.

The third party Aldama concentrator was shut down during the Christmas holiday period from the 23rd December to the 28th December 2019, with maintenance undertaken on the plant and some further modifications to the reagent dosing equipment. Further a disc filtration system to dry the zinc concentrates was installed and will be commissioned during the first quarter 2020.

Improvements in daily plant throughput continued during the quarter. In December the plant operated for 19 days at an average of 185 tonnes per day, November 27 days at 155 tonnes per day, October 27 days at 152 tonnes per day.

The processing throughput increased in parallel with the improved recovery for the quarter of 64.5% of zinc recovered to zinc concentrates, while lead recoveries dropped from 30% to 24.9% of lead recovered to lead concentrates. The recovery improvements are a reflection of the ongoing work with the University of Chihuahua and the implementation of the findings by the MLAZ plant management team during the quarter.

At the end of the quarter inventory stockpiles were 1,621 tonnes of ROM ore available for processing and 69 tonnes of zinc concentrate and 59 tonnes of lead concentrate as detailed below:

- Run of Mine stockpile at Plomosas: 1,215 tonnes

- Plant feed stockpile at Aldama: 304 tonnes

- Plant crushed stockpile at Aldama: 102 tonnes

- Zinc Concentrate stockpile: 69 tonnes

- Lead Concentrate stockpile: 59 tonnes

Operating Costs

December quarter C1 operating costs of $1.48 per payable pound of payable zinc were higher than the September quarter ($1.01/lb), due to the following factors:

- Mining was reduced with the transition of contract mining to owner operated and run of mine stockpiles were depleted. Consequently, the unit cost of ore mining during the quarter was higher due to largely fixed overheads including dewatering, employee and equipment hire costs.

- Plant production days was limited to 73 days in 91 days, 80% availability; and

- The operating costs include invoiced amounts from the mining contractor which the Company has disputed as material overcharges. Should the Company be successful in its disputed amounts, there is potential for a material cost reduction to be reflected on settlement of the disputed amounts with the mining contractor.

TABLE 1. QUARTER ENDED 31 DECEMBER 2019 PRODUCTION STATISTICS

The Board of CZL are closely monitoring the macroeconomic conditions for any further changes as the decline in zinc price and significant increase in concentrate treatment charges have eroded margins across the industry. The recent Coronavirus outbreak has resulted in a 10% downturn in zinc prices that further stresses the profitability of the Plomosas mine. The average zinc price realised in 2019 was US$1.15/lb, CZL has implemented strategies to reduce operating costs through 2020.

Concentrate Sales

In total 1,881 tonnes and 301 tonnes of zinc and lead concentrates respectively, were sold in the quarter.

At the end of the quarter, 69 tonnes of zinc concentrate, and 59 tonnes of lead concentrate were stockpiled and scheduled for sale in in 2020.

EXPLORATION

During the quarter $0.195 million of exploration expenditure was incurred on the following projects detailed below.

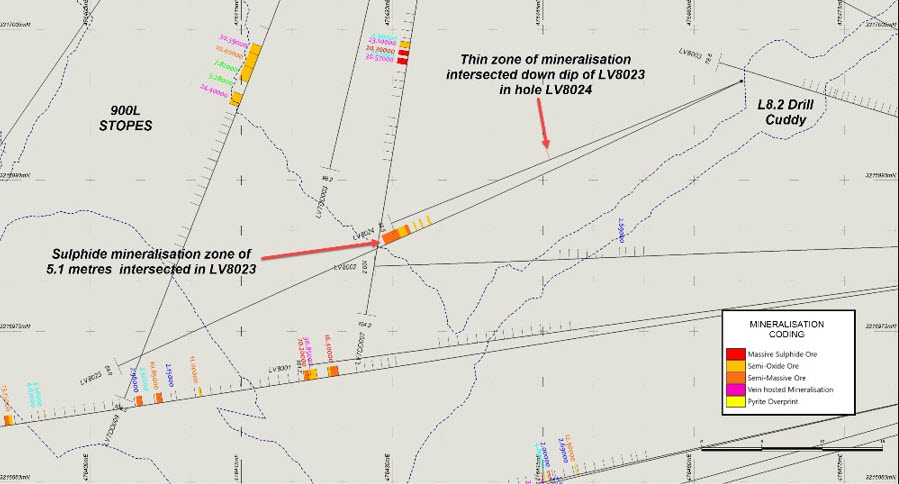

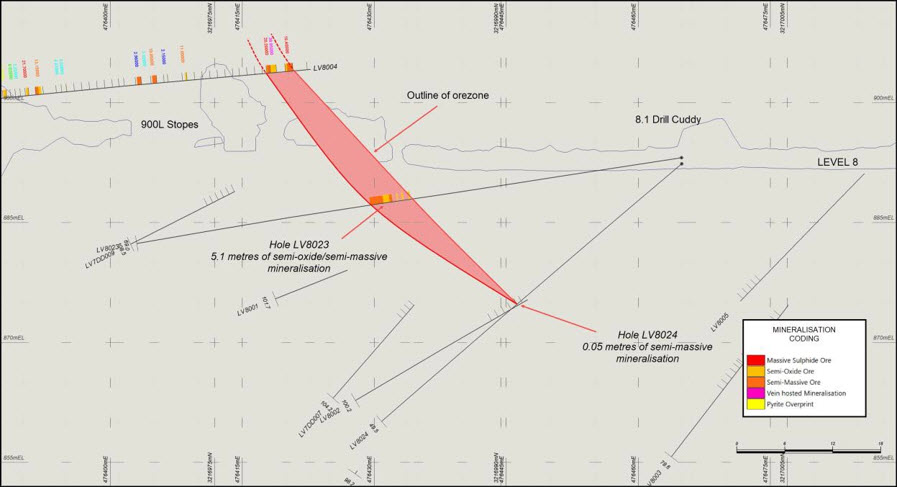

SOX Extensional Drilling – Level 7

Underground drilling and development commenced in Level 7 during the quarter. A total of two drill holes, LV8023 and LV8024 were completed for 118.50 metres. A total of 47 samples were collected for assaying.

Drill hole LV8023 encountered massive sulphide mineralisation along with semi-massive and semi-oxide ore. Interfingering of the ore is noted in the upper contact of the main zone, with massive sulphide and oxidised ore occurring in the lower zones.

Drill hole LV8024 which was drilled down-dip, intersected a thinner zone of mineralisation, confirming the pinching nature of the ore.

Assay results are pending for the drilling completed during the quarter.

The drilling to date continues to demonstrate that high-grade mineralisation extends to the south of current mining activities. This provides additional confidence for the ongoing underground mining activities in the sub-levels of 975L, 900L and down to 875L.

There are an additional six hole in the program, which will be completed mid-January.

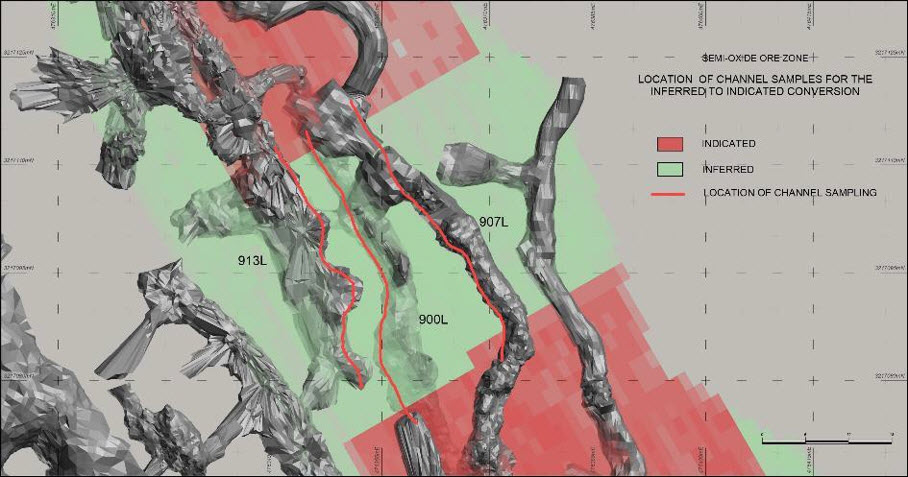

Resource Sampling

As mining has progressed, some older drives have been uncovered, allowing access to mineralised exposures, hence removing the need to drill areas required for category upgrade.

Three levels allowed access to the central zone of the orebody, 913L, 907L and the 900L, which were used to channel sample the ore zone, as shown in figure 5.

A total of 114 samples were collected and submitted for assays. Assay results are pending.

REGIONAL EXPLORATION

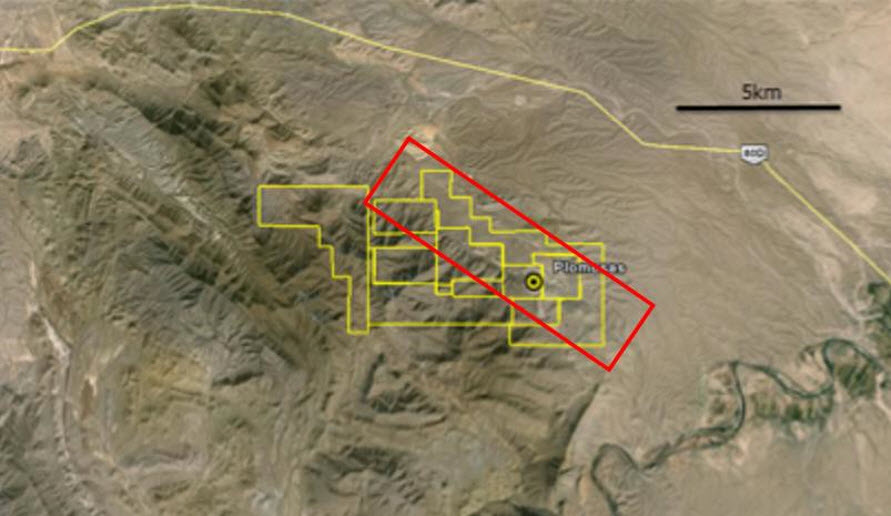

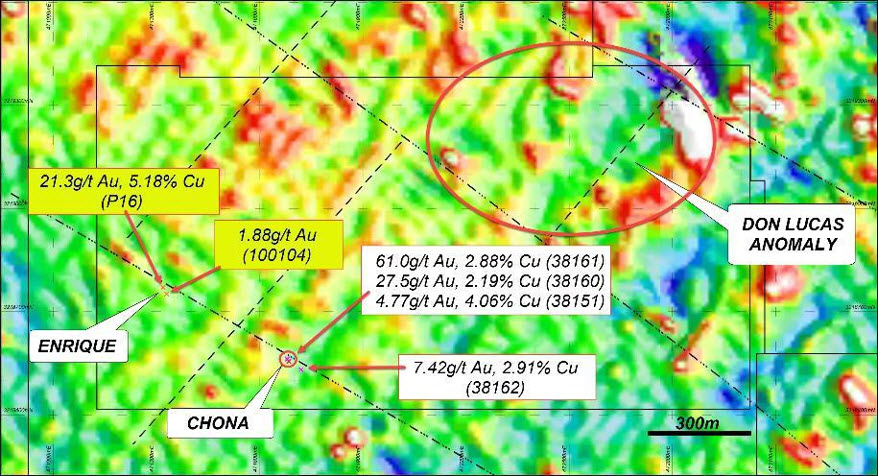

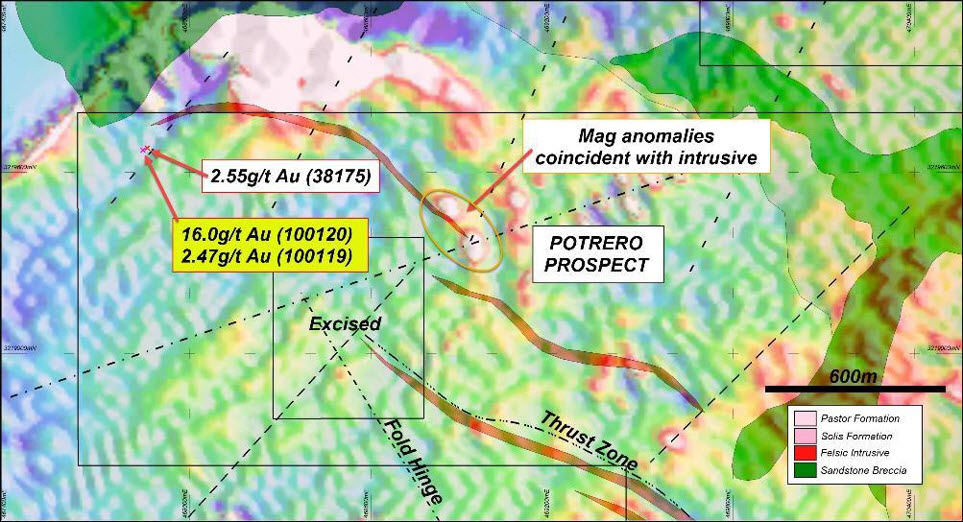

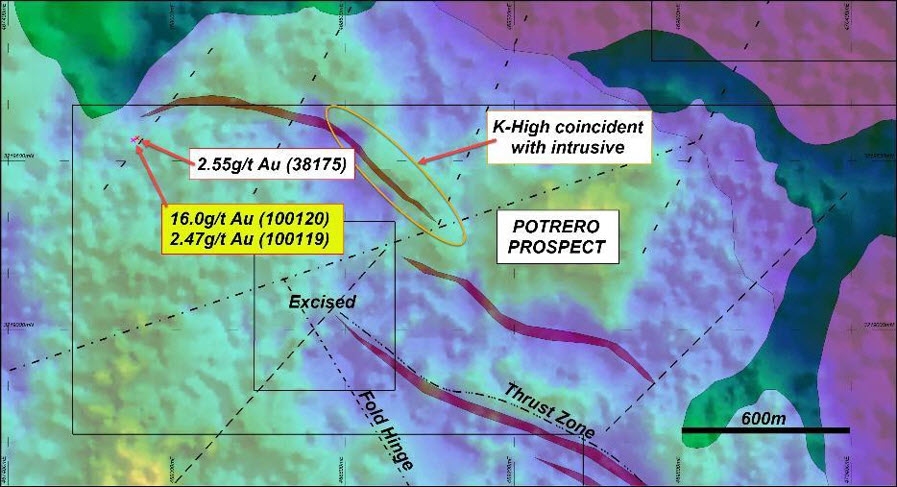

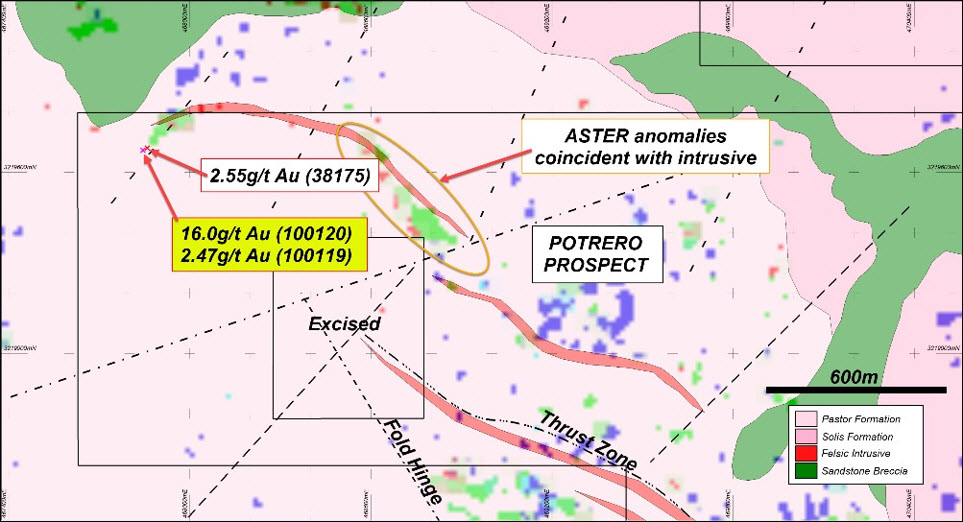

During the quarter, preliminary work was completed to investigate areas of interest that had either displayed previous work, historic mining or areas that show anomalism through interpretation of images and data. This data includes the airborne geophysics, radiometrics, ASTER images and gravity survey, completed in 2017.

The gravity surveys were confined to an area as highlighted as red in Figure 6, while the airborne magnetic survey covered the entire tenement holdings as highlighted in yellow in Figure 6. The magnetic survey, in combination with the gravity, ASTER and radiometric surveys, highlight prospective sequences and structural anomalies that highlight certain areas as targets for on-going regional exploration.

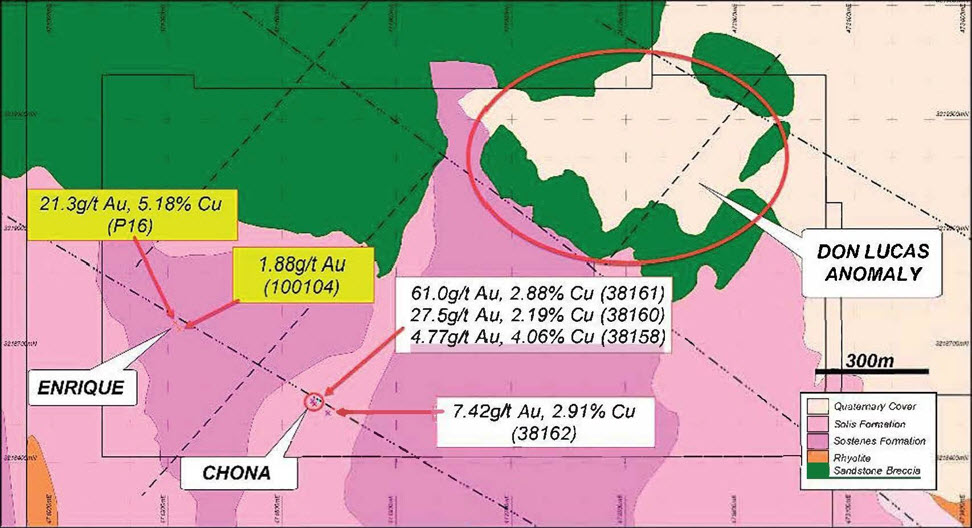

Preliminary Results Gold Exploration

A reconnaissance program was made during the quarter to test areas of interest with the results of the sampling received after quarter end shown in Table 2. Three areas of interest were outlined, Chona-Enrique veins, Potrero and Don Lucas Anomaly.

TABLE 2. HIGHLIGHTS OF ANOMALOUS GOLD AND COPPER ROCK CHIP SAMPLING

Refer to the ASX announcement dated 30 January 2020 for full details of all rock chip assays.

Chona-Enrique Gold Veins

Located approximately 5km to the west-northwest of Plomosas mine and inside the Don Lucas concession, the Chona and Enrique veins are interpreted to be mesothermal in origin. Veins in the Chona area are typically around 20-30cm in width with a visual strike extent of around 100 metres with a dip and dip direction of 45O at 055O. Veins are granular, containing quartz, carbonate and haematite as gangue to malachite at around 3%.

MLAZ samples collected from Chona returned values of 61.0g/t Au, 6.9g/t Ag, 2.88% Cu (sample 38161), 27.5g/t Au, 4.1g/t Ag, 2.19% Cu (sample 38160), 7.42g/t Au, 4.2g/t Ag, 2.91% Cu (sample 38162), 4.77g/t Au, 3.8g/t Ag, 4.06% Cu (sample 38158).

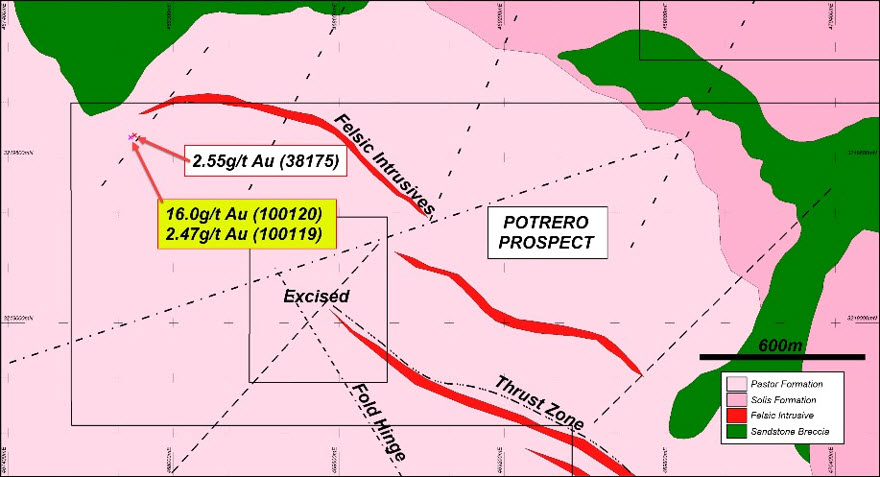

Potrero Project

This project is located in the north-western corner of Don Sebastian Concession and has had previous mining activities from small adits, accessing mineralised breccia associated with a large felsic intrusive.

Potrero geology is complex, comprising thrusts zones and kilometre scale folding. Late stage faulting is also noted, displacing layered sequences.

Historic

assays returned values of 8.20g/t

Au (sample 177059),

2.47g/t Au (sample

100119), 1.56g/t Au (sample 100118) and 1.24g/t Au (sample

177055). Samples 177059 and 100119 are assumed to have come from a mullock pile.

Samples 100126, 100118 and 177055 were

sampled from outcrop accessed by adits.

MLAZ has only taken one sample from this area which returned a grade of 2.55g/t Au (sample 38175) as announced in the ASX release dated 30 January 2020, however the sample was from the same mullock pile as the historic sampling. Additional work is warranted to follow up on high grade areas.

Don Lucas Anomaly

Large coincident ASTER and K-radiometric anomaly, coupled with magnetic signatures, particularly one magnetic high located at 472843.8mE; 3219259.7mE, in the north-eastern corner of the concession. This magnetic high complement the K-radiometric high, which appears to be an alteration zone response to the magnetics. Refer to figure 8.

CORPORATE

Board Succession

The Company announced on 16 December 2019, Mr Andrew Richards replaced Mr Stephen Copulos as non- executive Chairman from 1 January 2020.

Mr Richards is a long-standing Executive Director of the Company and brings his long distinguished 35-year career initially as a geologist and subsequent mining corporate executive to the Chairmanship.

Placement and Rights Issue

During the quarter, the Company completed a fully underwritten non-renounceable rights issue of 1 new share for every 6 shares held at an issue price of A$0.011per share to raise A$2.48 million (before costs) (the “Rights Issue”). The Rights Issue closed on 4th October 2019.

Cash

The Company’s closing cash at the end of the quarter was US$0.556 million (prior quarter $0.297 million).

Trade receivables

The Company’s trade receivables due from the sale of zinc and lead concentrates was $0.617 million (prior quarter $0.340 million) and VAT refundable of $1.281 million (prior quarter $1.05 million).

The VAT refunds are in the process of being recovered through a combination of cash refunds and credits offsetting future VAT payable on the sale of concentrates in each calendar month.

Convertible Notes

The closing balance of convertible notes on issue at the end of the quarter was A$1.220 million inclusive of capitalised interest.

The convertible notes on issue have a principal value of A$1.052 million, with:

- A$0.900 million with a maturity 30 June 2020 at a conversion price of A$ 1.0 cent per share;

- A$0.152 million with a maturity date of 27 August 2020 at a conversion price of A$ 1.5 cent per share; and

- All convertible notes on issue are held by the Company’s major shareholder the Copulos Group.

Unsecured borrowings

The Company has A$800,000 unsecured loan facilities fully drawn (prior quarter A$800,000) from entities related to the Mr Stephen Copulos (former non-executive Chairman) and Mr Andrew Richards (non- executive Chairman), with a maturity date of 30 June 2020. The terms of the unsecured facilities are a 10% interest rate maturing on 30 June 2020.

This announcement was authorised for issue to the ASX by the Directors of the Company. For further information please contact:

Brad Marwood

Managing Director

08 9322 3406

ABOUT CONSOLIDATED ZINC

Consolidated Zinc Limited (ASX: CZL) owns 100% of the historic Plomosas Mine, located 120km from Chihuahua City, Chihuahua State. Chihuahua State has a strong mining sector with other large base and precious metal projects in operation within the state. Historical mining at Plomosas between 1945 and 1974 extracted over 2 million tonnes of ore grading 22% Zn+Pb and over 80g/t Ag. Only small- scale mining continued to the present day and the mineralised zones remain open at depth and along strike.

The company has recommenced mining at Plomosas and is committed to exploit the potential of the high-grade Zinc, Lead and Silver Mineral Resource through the identification, exploration and exploitation of new zones of mineralisation within and adjacent to the known mineralisation with a view to identify new mineral resources that are exploitable.

Caution Regarding Forward Looking Statements and Forward-Looking Information:

This report contains forward looking statements and forward-looking information, which are based on assumptions and judgments of management regarding future events and results. Such forward-looking statements and forward-looking information involve known and unknown risks, uncertainties, and other factors which may cause the actual results, performance or achievements of the Company to be materially different from any anticipated future results, performance or achievements expressed or implied by such forward-looking statements. Such factors include, among others, the actual market prices of zinc and lead, the actual results of current exploration, the availability of debt and equity financing, the volatility in global financial markets, the actual results of future mining, processing and development activities, receipt of regulatory approvals as and when required and changes in project parameters as plans continue to be evaluated.

Except as required by law or regulation (including the ASX Listing Rules), Consolidated Zinc undertakes no obligation to provide any additional or updated information whether as a result of new information, future events or results or otherwise. Indications of, and guidance or outlook on, future earnings or financial position or performance are also forward-looking statements.

Production Targets:

Production targets referred to in this report are underpinned by estimated Mineral Resources which have been prepared by competent persons in accordance with the requirements of the JORC Code. The production targets in this report are sourced from both Indicated and Inferred Mineral Resources and it should be noted that there is a low geological confidence associated with Inferred Mineral Resources and there is no certainty that further exploration work will result in the determination of Indicated Mineral Resources or that the production target will be realised.

There is a low level of geological confidence associated with Inferred Mineral Resources and there is no certainty that further exploration work will result in the determination of indicated mineral resources or that the production target itself will be realised. The stated production target is based on the Company’s current expectations of future results or events and should not be solely relied upon by investors when making investment decisions. Further evaluation work and appropriate studies are required to establish sufficient confidence that this target will be met.

Competent Person Statement:

The information in this report that relates to exploration results, data collection and geological interpretation is based on information compiled by Mr Steve Boda BSc (Hons), MAIG, MGSA, MSEG. Mr Boda is a Member of Australian Institute of Geoscientists (AIG).

Mr Boda has sufficient experience that is relevant to the style of mineralisation and type of deposit under consideration and to the activity that is being undertaken to qualify as Competent Person as defined in the 2012 edition of the ‘Australasian Code for Reporting of Exploration Results, Minerals Resources and Ore Reserves’ (JORC Code). Mr Boda consents to the inclusion in this report of the matters based on their information in the form and context in which it appears.

The information in this report that relates to Mineral Resources is based on, and fairly represents information and supporting documentation prepared by Mr Steven Boda, a Competent Person who is a Member of Australian Institute of Geoscientists (AIG). Mr. Boda has sufficient experience that is relevant to the style of mineralisation and type of deposit under consideration and to the activity being undertaken to qualify as a Competent Person as defined in the 2012 Edition of the “Australasian Code for Reporting of Exploration Results, Mineral Resources and Ore Reserves”. Mr Boda has approved the Statement as a whole and consents to its inclusion in this report in the form and context in which it appears.

The information in this report that relates to the Mineral Resources were first reported by the Company in compliance with JORC 2012 in market release dated 30 April 2018.

The Company confirms that it is not aware of any new information or data that materially affects the information included in the market announcements referred to above and further confirms that all material assumptions and technical parameters underpinning the ore reserve and mineral resource estimates contained in those market releases continue to apply and have not materially changed.

Original Article: https://www.consolidatedzinc.com.au/wp-content/uploads/2020/02/20200201-CZL-2019-Dec-Qtr-Report-FINAL-ASX-LODGEMENT.pdf