Southern Silver Exploration Corp. (TSX.V: SSV) (“Southern Silver”) reported today that the company continues to de-risk the Cerro Las Minitas project with the completion of the latest round of metallurgical test work. Results confirmed a sequential process flowsheet able to produce marketable copper, lead and zinc concentrates from a representative composite of the Skarn Front deposit, significantly increasing the marketability and projected value of the resulting lead and zinc concentrates compared to earlier batch testing.

These results are highlighted by a 94.7% zinc recovery grading 54.0% Zn in the zinc concentrate and grades of 5,504g/t Ag and 65.1% Pb in the lead concentrate. Silver strongly partitions into the lead and copper concentrates for a combined 83.8% Ag recovery into concentrates that traditionally receive favourable payable terms.

This round of test work utilized a more robust protocol than the earlier reported batch testing (see NR-10-18; September 19, 2018), resulting in significant upgrades of both the lead and zinc concentrates and greater confidence in the recovery and grade projections. Further variability test work on the Skarn Front deposit continues in order to determine the broader parameters for metallurgical recoveries and concentrate values. Results from this additional test work are still pending.

President, Lawrence Page Q.C. stated “The results of this most recent test work demonstrate a process to derive increased value from silver, lead and zinc, the prevalent metals identified in the CLM deposit. This is a significant milestone in that we have advanced a viable Cu-Pb-Zn processing flowsheet with no fatal flaws and increased the overall value of the resulting concentrates compared to the earlier batch test work.”

Test Work Details

The test work was conducted on behalf of Southern Silver by Blue Coast Research of Parksville, British Columbia, and improves on earlier batch testing (see NR-06-18, May 14, 2018 and NR-10-18, September 19, 2018) that generated high-grade lead and zinc concentrates from the Blind-El Sol deposits and high-grade lead, zinc and copper concentrates from the Skarn Front deposit.

The current test work program comprises:

- locked-cycle and batch testing of the Cu-Pb-Zn flowsheet of the Skarn Front composite which has now been completed; and

- batch testing of subset composites to better understand the implications of grade variability within the deposit

Eight different samples were collected for variability test work. These ranged from high grade to low grade with varying precious and base-metal ratios designed to reflect a range of potential ore compositions throughout the Skarn Front deposit. A total of 210.8kg of mineralized material from 17 different drill holes was collected for the test work.

Aliquots from seven of the variability samples were blended into a homogenized Master Composite totalling 91.8kg and grading 111g/t Ag, 0.24% Cu, 1.3% Pb and 5.8% Zn. A locked-cycle test was conducted that was based on an open circuit flowsheet established in the earlier batch test work. The locked cycle test produced a robust assessment of final lead and zinc concentrates. Owing to the lower copper content of the Master Composite, a larger scale batch cleaner test was conducted to establish the copper metallurgy. Results from the locked-cycle test were combined with the copper cleaner test work to create an overall metallurgical projection for the Skarn Front composite.

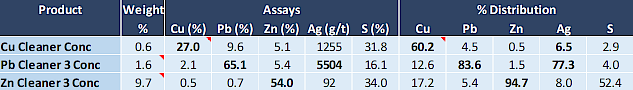

Projected recoveries and grades from the Skarn Front composite are:

- 83.6% Pb and 77.3% Ag into the lead concentrate which assays 65.1% Pb and 5,504g/t Ag respectively after three stage of cleaning; and

- 94.7% Zn and 8.0% Ag into the zinc concentrate which assays 54.0% Zn and 92g/t Ag respectively after three stages of cleaning.

- 60.2% Cu and 6.5% Ag recovered into the copper concentrate which assays 27.0% Cu and 1255g/t Ag respectively after three stages of cleaning;

Table 1: Projected Metallurgy for the Cerro Las Minitas Skarn Front Master Composite

Cerro Las Minitas Project

The Cerro Las Minitas project is an advanced exploration stage polymetallic Ag-Pb-Zn-Cu Skarn/CRD project located in southern Durango, Mexico.

The CLM project as of May 9th, 2019 contains an estimated Indicated Resource, at a 175g/t AgEq cut-off, of 37.5Mozs silver, 40Mlbs copper, 303Mlbs lead and 897Mlbs zinc (134Mozs AgEq) and an estimated Inferred Resource of 45.7Mozs silver, 76Mlbs copper, 253Mlbs lead and 796Mlbs zinc (138Mozs AgEq).(1)

A total of 133 drill holes for 59,000 metres have now been completed on the Cerro Las Minitas project with exploration expenditures of approximately US$18.5 million equating to exploration discovery costs of approximately $0.07 per AgEq ounce to the end of 2019.

The Cerro Las Minitas project operates on a joint venture basis by Southern Silver at a 40% interest and Electrum Global Holdings LP at a 60% interest. Southern Silver is operator of the project.

About Southern Silver Exploration Corp.

Southern Silver Exploration Corp. is a precious metal exploration and development company with a focus on the discovery of world-class mineral deposits in north-central Mexico and the southern USA. Our specific emphasis is the Cerro Las Minitas silver-lead-zinc project located in the heart of Mexico’s Faja de Plata, which hosts multiple world-class mineral deposits such as Penasquito, San Martin and Los Gatos. We have assembled a team of highly experienced technical, operational and transactional professionals to support our exploration efforts with the objective of developing, along with our partner, Electrum Global Holdings LP, the Cerro Las Minitas project into a premier, silver-lead-zinc mine.

The Company engages in the acquisition, exploration and development either directly or through joint-venture relationships in mineral properties in major jurisdictions. Our property portfolio also includes the Oro porphyry copper-gold project located in southern New Mexico, USA. The Oro property consists of patented land, State leases and BLM located mineral claims which cover a highly prospective quartz-sericite-pyrite alteration zone, interpreted to overlie an unexposed porphyry centre and distal sediment-hosted, oxide-gold target.

- The 2019 Cerro Las Minitas Resource Estimate was prepared following CIM definitions for classification of Mineral Resources. Resources are constrained using mainly geological constraints and approximate 10g/t AgEq grade shells. The block models are comprised of an array of blocks measuring 10m x 2m x 10m, with grades for Au, Ag, Cu, Pb, Zn values interpolated using ID3 weighting. Silver and zinc equivalent values were subsequently calculated from the interpolated block grades. The model is identified at a 175g/t AgEq cut-off, with an indicated resource of 11,102,000 tonnes averaging 105g/t Ag, 0.10g/t Au, 1.2% Pb, 3.7% Zn and 0.16% Cu and an inferred resource of 12,844,000 tonnes averaging 111g/t Ag, 0.07g/t Au, 0.9% Pb, 2.8% Zn and 0.27% Cu. AgEq cut-off values were calculated using average long-term prices of $16.6/oz. silver, $1,275/oz. gold, $2.75/lb. copper, $1.0/lb. lead and $1.25/lb. zinc. Metal recoveries for the Blind, El Sol and Las Victorias deposits of 91% silver, 25% gold, 92% lead, 82% zinc and 80% copper and for the Skarn Front deposit of 85% silver, 18% gold, 89% lead, 92% zinc and 84% copper were used to define the cut-off grades. Base case cut-off grade assumed $75/tonne operating, smelting and sustaining costs. All prices are stated in $USD. Silver Equivalents were calculated from the interpolated block values using relative recoveries and prices between the component metals and silver to determine a final AgEq value. The same methodology was used to calculate the ZnEq value. Mineral resources are not mineral reserves until they have demonstrated economic viability. Mineral resource estimates do not account for a resource’s mineability, selectivity, mining loss, or dilution. The current Resource Estimate was prepared by Garth Kirkham, P.Geo. of Kirkham Geosciences Ltd. who is the Independent Qualified Person responsible for presentation and review of the Mineral Resource Estimate. All figures are rounded to reflect the relative accuracy of the estimate and therefore numbers may not appear to add precisely.

Robert Macdonald, MSc. P.Geo, is a Qualified Person as defined by National Instrument 43-101 and responsible for the supervision of the exploration on the Cerro Las Minitas Project and for the preparation of the technical information in this disclosure.

On behalf of the Board of Directors

“Lawrence Page”

Lawrence Page, Q.C.

President & Director, Southern Silver Exploration Corp.

For further information, please visit Southern Silver’s website at southernsilverexploration.com or contact us at 604.641.2759 or by email at ir@mnxltd.com.

Neither TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

This news release may contain forward-looking statements. Forward-looking statements address future events and conditions and therefore involve inherent risks and uncertainties. Actual results may differ materially from those currently anticipated in such statements. Factors that could cause actual results to differ materially from those in forward looking statements include the timing and receipt of government and regulatory approvals, and continued availability of capital and financing and general economic, market or business conditions. Southern Silver Exploration Corp. does not assume any obligation to update or revise its forward-looking statements, whether as a result of new information, future events or otherwise, except to the extent required by applicable law.

Original Article: https://www.southernsilverexploration.com/news/2020-18/southern-silver-increases-value-of-concentrates-in-locked-cycle-test-work/