Successful transition to expansion drilling at Silvertip with high-grade results in the Discovery zone; Promising oxide gold assays returned from new zones at Sterling and Crown;

Multiple high-grade discoveries made through expansion drilling at Kensington; and Palmarejo continuing to deliver positive results from Guadalupe and Independencia deposits

Chicago, Illinois – December 17, 2019 – Coeur Mining, Inc. (“Coeur” or the “Company”) (NYSE: CDE) today provided an update on its 2019 exploration activities, which focused primarily on resource expansion drilling. The Company reported encouraging results from expansion drilling at its Silvertip operation in British Columbia, its Sterling and Crown exploration projects in southern Nevada, and the Kensington mine in Alaska as well as positive results from the ongoing near-mine exploration program at the Palmarejo mine in Mexico. Drilling activities at the Rochester and Wharf operations began late in the year and are not highlighted in this update.

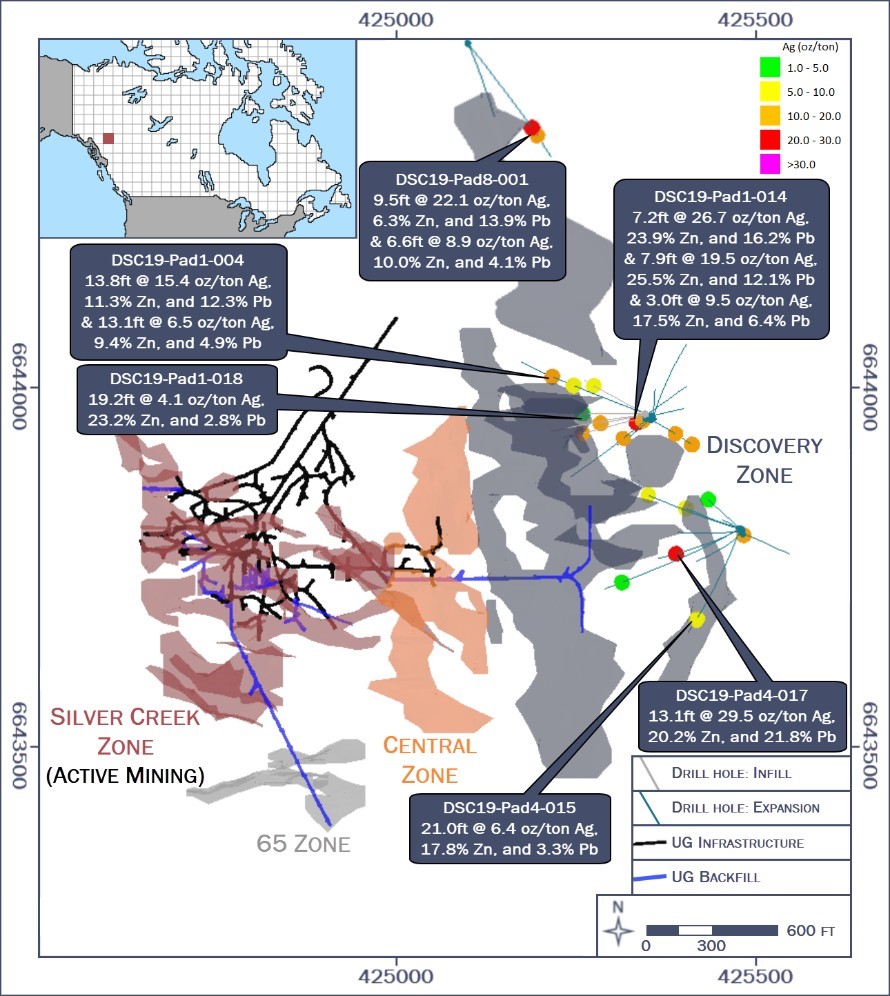

- Successful launch of expansion drilling program at Silvertip – Drilling within the Discovery zone intercepted multiple manto structures with high-grade assay results from step-out holes. Notable intervals include: 13.1 feet (4.0 meters) of 29.5 ounces per ton (“oz/t”) (1,011.9 grams per tonne (“g/t”)) silver, 20.2% zinc and 21.8% lead, and 19.2 feet (5.9 meters) of 4.1 oz/t (139.6 g/t) silver, 23.2% zinc and 2.8% lead.

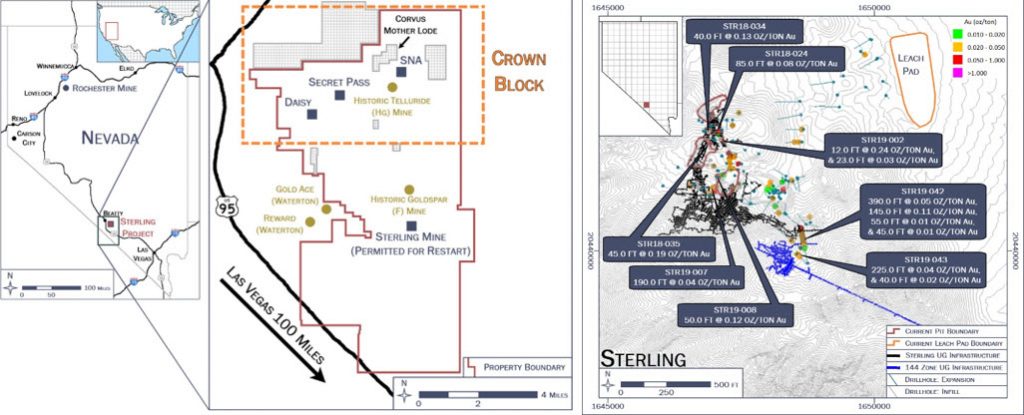

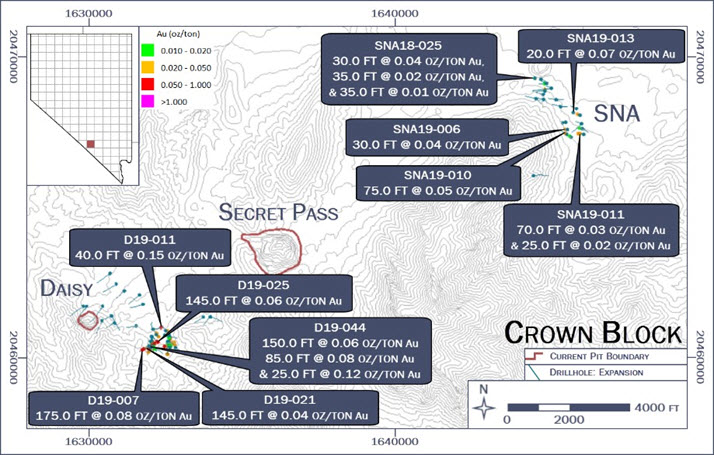

- Promising assay results from new areas at Sterling and Crown – Expansion drilling at Sterling and Crown returned several notable intervals from the historic Sterling and Daisy mining areas. A single hole drilled southeast of Sterling returned 390.0 feet (118.9 meters) of 0.05 oz/t (1.6 g/t) gold and 145.0 feet (44.2 meters) of 0.11 oz/t (3.8 g/t) gold, along with two additional intercepts of 55.0 feet (16.8 meters) of 0.01 oz/t (0.4 g/t) gold and 45.0 feet (13.7 meters) of 0.01 oz/t (0.4 g/t) gold. At Daisy, a single hole returned 150.0 feet (45.7 meters) of 0.06 oz/t (2.0 g/t) gold, 85.0 feet (25.9 meters) of 0.08 oz/t (2.6 g/t) gold and 25.0 feet (7.6 meters) of 0.12 oz/t (4.1 g/t) gold.

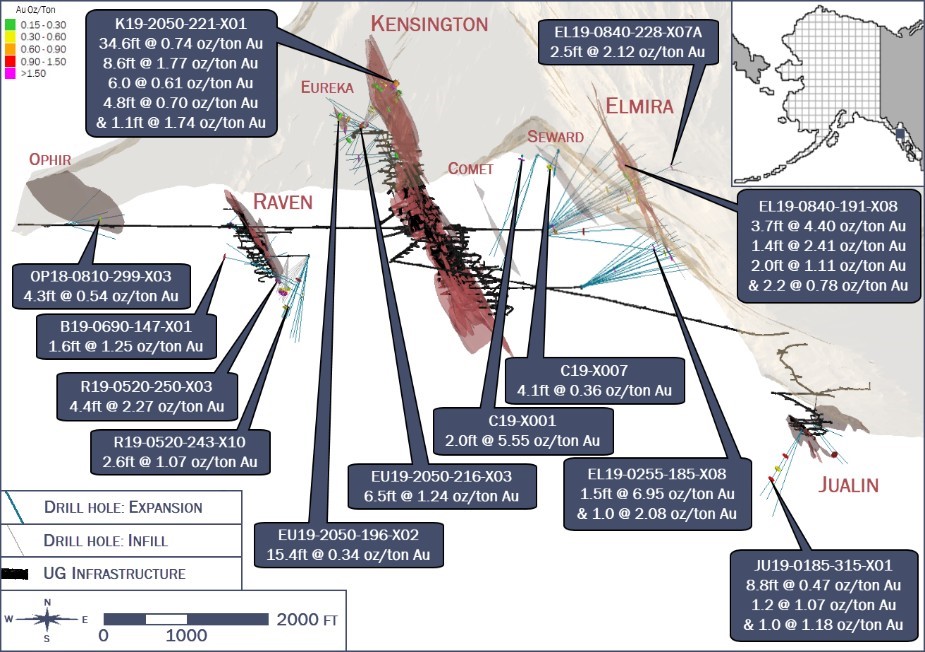

- Expansion drilling discovered multiple new high-grade targets at Kensington – Highlights include high-grade assays from Elmira, Eureka and Johnson, all located near existing infrastructure. Results at Elmira include 3.7 feet (1.1 meters) of 4.40 oz/t (150.7 g/t) gold, while assays at Eureka returned 15.4 feet (4.7 meters) of 0.34 oz/t (11.7 g/t) gold. Additionally, the first hole drilled at Johnson returned 2.5 feet (0.8 meters) of 2.12 oz/t (72.7 g/t) gold.

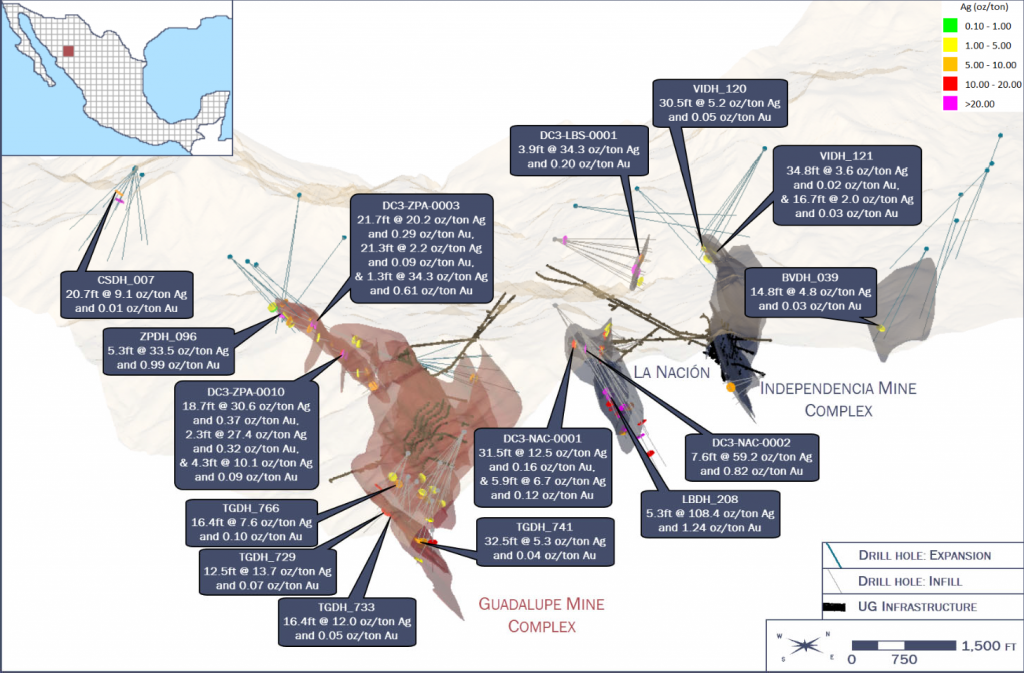

- Continued positive results from drilling at Palmarejo – Expansion drilling north of the Independencia mine complex returned 30.5 feet (9.3 meters) of 0.05 oz/t (1.5 g/t) gold and 5.2 oz/t (179.0 g/t) silver. Infill drilling in the northern portion of the Guadalupe mine complex returned several high-grade intercepts, including 21.7 feet (6.6 meters) of 0.29 oz/t (10.0 g/t) gold and 20.2 oz/t (690.9 g/t) silver, and 18.7 feet (5.7 meters) of 0.37 oz/t (12.8 g/t) gold and 30.6 oz/t (1,047.5 g/t) silver. Infill drilling at La Nación, located within the Independencia mine complex, returned 31.5 feet (9.6 meters) of 0.16 oz/t (5.4 g/t) gold and 12.5 oz/t (429.6 g/t) silver, and 5.3 feet (1.6 meters) of 1.24 oz/t (42.5 g/t) gold and 108.4 oz/t (3,714.9 g/t) silver.

Year-to-date through the end of the third quarter, Coeur’s investment in exploration totaled approximately

$21.0 million ($15.3 million expensed and $5.6 million capitalized). The Company expects to spend approximately $26-$34 million on exploration this year, including $18-$22 million and $8-$12 million of expensed and capitalized exploration, respectively1. Over 90%2 of the Company’s 2019 exploration budget has been allocated to near-mine drilling, which the Company believes offers lower risk and higher potential returns. In 2020, Coeur expects to increase its level of exploration investment with the objectives of (i) discovering new resources and (ii) converting existing resources to reserves in order to extend mine life.

“Despite overall lower levels of exploration investment, we successfully commenced several expansion drilling programs in 2019, with notable results at Silvertip, Sterling and Crown, and Kensington,” said Mitchell J. Krebs, Coeur’s President and Chief Executive Officer. “We focused our efforts on exploration targets within our current operating footprint and near existing infrastructure in the pursuit of potential mine life extensions and organic growth opportunities, which rank near the top of our capital allocation framework. Overall, we are very pleased with the results from our 2019 drilling campaign and are excited about the potential of the high-grade targets we identified during the year.”

For a complete table of all drill results, please refer to the following link: https://www.coeur.com/_resources/pdfs/2019-12-17-2019-Exploration-Update-Appendix-Final.pdf. Please see the “Cautionary Statements” section for additional information regarding drill results.

Silvertip

Coeur shifted its exploration focus at Silvertip from resource conversion to expansion drilling in 2019, targeting areas close to existing infrastructure. The Company focused on expanding areas east of the underground mine complex, including the Discovery zone (open in multiple directions), with up to three surface core rigs active during the year. A table of drill results and associated maps highlighting the initial success of the campaign were released in conjunction with the Silvertip analyst tour in July 20193 and were also included in the Company’s second quarter 2019 results4.

As of November 30, approximately 53,100 feet (16,200 meters) have been drilled at Silvertip during 2019, with over 60% of drillholes cutting manto mineralization above grade thickness cutoff. Highlights from the drilling campaign through July demonstrated significant thickness in the manto-style mineralization within the Discovery zone. Similar mineralization has been encountered throughout 2019, highlighting the success of the drill program at Silvertip this year.

Key highlights include:

- Hole DSC19-Pad8-001 returning

9.5 feet (2.9 meters) of 22.1 oz/t

(756.3 g/t) silver,

6.3% zinc and 13.9% lead, and 6.6 feet (2.0 meters) of 8.9 oz/t (303.7 g/t) silver, 10.0% zinc and 4.1% lead; and

- Hole DSC19-Pad1-014 returning 7.2 feet (2.2 meters) of 26.7 oz/t (913.7 g/t) silver, 23.9% zinc and 16.2% lead, 7.9 feet (2.4 meters) of 19.5 oz/t (668.6 g/t) silver, 25.5% zinc and 12.1% lead, and 3.0 feet (0.9 meters) of 9.5 oz/t (325.7 g/t) silver, 17.5% zinc and 6.4% lead.

Notably, both holes highlighted above fall outside the current resource boundary at Silvertip.

In parallel with drilling activities, Coeur commenced a regional exploration program at Silvertip in mid-2019 with several legacy geophysical and geochemical data sets available for interpretation. Analysis of this data helped the Company develop a targeted list of exploration priorities, with the highest being the Tiger Terrace zone (approximately three miles south of Silvertip’s mill).

In order to refine the drill targets at Tiger Terrace, Coeur completed ground electromagnetic and gravity surveys during 2019. Electromagnetic data shows a conductive zone running north-south over a two-mile trend, coincident with the mapped location of permissive limestone host rocks. Gravity data confirms that portions of the conductive horizon have excess density, indicative of a potential sulfide source. Soil sampling over the zone confirmed that the geophysical targets also have coincident silver, zinc and lead anomalies. First pass drilling is currently being permitted for mid- 2020.

The Company plans to begin drilling from underground stations at Silvertip in early 2020, focusing on infill drilling in the Central and Discovery zones. Surface expansion drilling at Silvertip, including greenfield exploration at Tiger Terrace, is expected to begin in mid-2020.

Sterling and Crown

At the recently acquired Sterling and Crown exploration projects located in southern Nevada, up to two reverse circulation rigs were active during the year and drilled approximately 88,300 feet (26,900 meters) through the end of November.

At Sterling, one reverse circulation rig focused on infill and expansion drilling early in the year. A second phase of expansion drilling was initiated in August with encouraging results discovered near the historic underground workings, located in the southern portion of the Sterling mining area. Similar to hole STR19- 042 (highlighted in the beginning of the release), hole STR19-043 was drilled southeast of Sterling and intercepted notable mineralization, returning 225.0 feet (68.6 meters) of 0.04 oz/t (1.2 g/t) gold and 40.0 feet (12.2 meters) of 0.02 oz/t (0.6 g/t) gold. Intercepts from these holes are interpreted to be the northern extension of higher-grade mineralization mined in the historic underground workings.

Coeur also drilled expansion targets at the Crown Block, located approximately 4.0 miles (6.4 kilometers) north of the Sterling project, initially focusing on the South Daisy and SNA deposits. Importantly, all of the Company’s drilling within the Crown Block has been contained on two separate five-acre disturbance drill permits: (i) Daisy-Secret Pass, and (ii) SNA. These permits limited the number of step-out holes that Coeur was able to drill in 2019; however, the Company is currently working on a larger 300-acre disturbance permit, which it expects to receive in the second quarter of 2020.

Within the Daisy-Secret Pass disturbance area, the Company targeted oxide heap-leachable gold hosted in Paleozoic sedimentary rocks, similar to those found in other gold trends in Nevada. Notable intercepts include:

- Hole D19-025 returning 145.0 feet (44.2 meters) of 0.06 oz/t (2.0 g/t) gold;

- Hole D19-011 returning 40.0 feet (12.2 meters) of 0.15 oz/t (5.1 g/t) gold; and

- Hole D19-007 returning 175.0 feet (53.3 meters) of 0.08 oz/t (2.6 g/t) gold.

Following its success at Daisy, the Company shifted its focus to expansion drilling at SNA during the fourth quarter. Results were encouraging, highlighted by:

- Hole SNA19-010 returning 75.0 feet (22.9 meters) of 0.05 oz/t (1.7 g/t) gold.

In parallel with ongoing drilling activities, Coeur began a regional target generation program, conducting surface geologic mapping, rock chip sampling and gravity surveys. Results from these studies have been integrated with prior airborne magnetic data to generate several new targets, helping to identify four specific target types (ranked below according to priority):

- Structurally controlled sediment-hosted oxide gold, similar

to the Daisy and SNA deposits;

- Structurally controlled sediment- and volcanic-hosted gold (oxide and sulfide), similar to the Secret Pass and nearby Mother Lode (owned by Corvus Gold Inc.) deposits;

- A larger, deep sediment-hosted gold target north of the Mother Lode deposit; and

- A deep, intrusive-type target that could be a potential source for gold mineralization in the area.

Coeur intends to focus on the top two priority target types at Crown for the near future. The Company has identified several potential oxide heap- leachable targets along a seven-mile, east-west trend in the Fluorspar Canyon, located to the north and west of the Daisy and Secret Pass deposits, respectively. Coeur plans to test the targets in this area upon receipt of the 300- acre disturbance drill permit. The deeper sulfidic gold targets are expected to be drilled opportunistically.

Coeur plans to continue resource expansion drilling at both Sterling and Crown in 2020, beginning the year with one reverse circulation drill at Sterling and two at Crown. One of the rigs at Crown is expected to conduct step-out drilling to the north of the Mother Lode deposit to test deeper targets identified in recent geophysical interpretations. The targets are believed to be an upthrown block of potential gold-host rocks, similar to other deposits in the area. Additionally, the Company plans to add a diamond core rig for part of the year to conduct resource infill drilling at both Sterling and Crown to provide samples for engineering and metallurgical testing.

Kensington

2019 represented a year of district-wide expansion at Kensington, resulting in the drilling and discovery of several high-grade targets. Three underground core rigs were active during the year and drilled approximately 123,000 feet (37,500 meters) through the end of November. Approximately 70% of Coeur’s exploration budget at Kensington was dedicated to expansion drilling, while the remaining 30% targeted resource conversion.

Infill drilling took place during the beginning of the year, primarily at Kensington, Zone 30 and Lower Raven. In the upper portion of Zone 30, hole K19-2050-221-X01 returned several intervals above grade thickness cutoff, including 34.6 feet (10.5 meters) of 0.74 oz/t (25.5 g/t) gold and 8.6 feet (2.6 meters) of

- oz/t (60.8 g/t) gold. The Company plans to continue drilling in this area during 2020.

Exploration activities then transitioned to expansion drilling, targeting Lower Raven, Eureka, Elmira, Jualin and Johnson. Results continue to be encouraging, particularly at Eureka, with consistent intervals above grade thickness cutoff as drilling continues down dip from the 1,400-foot level in the Kensington mine. Key highlights include:

- Jualin hole JU19-0185-315-X01 returning 8.8 feet (2.7 meters) of 0.47 oz/t (15.9 g/t) gold, 1.2 feet (0.4 meters)

of 1.07 oz/t (36.6 g/t) gold and 1.0 feet (0.3 meters)

of 1.18 oz/t (40.6 g/t) gold;

- Eureka hole EU19-2050-216-X03 returning 6.5 feet (2.0 meters) of 1.24 oz/t (42.4 g/t) gold; and

- Eureka hole EU19-2050-196-X02 returning 15.4 feet (4.7 meters) of 0.34 oz/t (11.5 g/t) gold.

One helicopter-supported drill rig tested the Comet and Seward veins for the first time from surface. Both veins are strategically located immediately above the main access tunnel. As part of Coeur’s 2018 and 2019 surface exploration program, the Company mapped and sampled both veins with visible gold occurring at both locations. Key highlights at Comet and Seward include:

- Hole C19-X007

returning 4.1 feet (1.2 meters)

of 0.36 oz/t (12.4 g/t) gold; and

- Hole C19-X001 returning 2.0 feet (0.6 meters) of 5.55 oz/t (190.1 g/t) gold.

Based on the successful 2019 program, Coeur’s top priorities for 2020 include: (i) drilling Elmira, Eureka, Johnson, Raven and Seward, and (ii) continuing the infill programs at the upper portion of Zone 30 and Jualin.

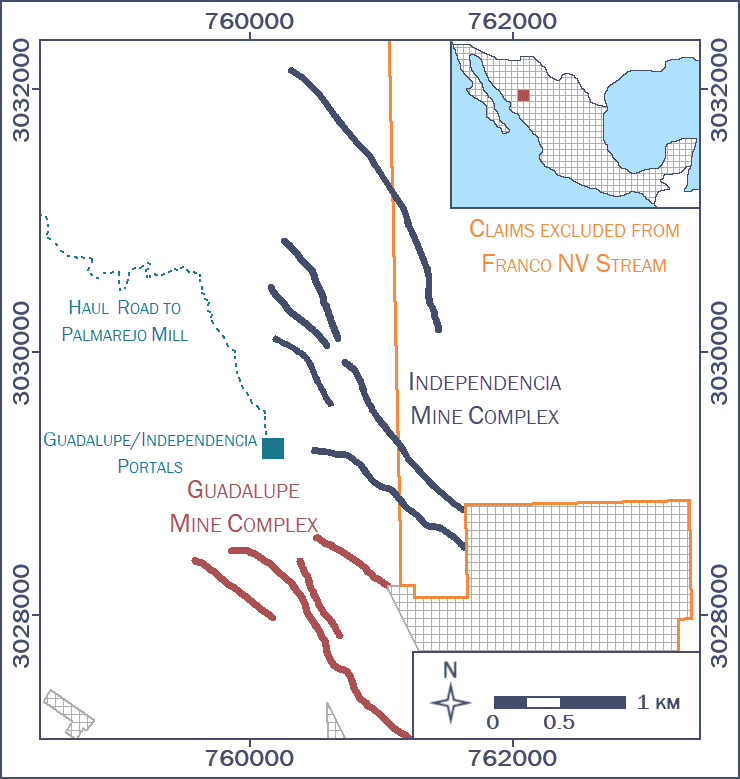

Palmarejo

Coeur’s top exploration priority at Palmarejo in 2019 was to continue locating thicker zones of mineralization near the Guadalupe and Independencia mine complexes with the goal of discovering new resources and extending mine life. Importantly, the Company focused on new veins that could potentially be mined utilizing existing infrastructure. A total of 200,000 feet (61,000 meters) were drilled through the end of November 2019, with up to ten core rigs active simultaneously.

Initial drilling activity was focused on infill and resource expansion around the Guadalupe mine complex. As the year progressed, the Company gradually migrated rigs to the Independencia mine complex where it focused on testing the extension of the veins to the north.

Highlights from the Company’s 2019 drilling campaign at Palmarejo include:

- Positive infill

results at the western and southern

portion of the Guadalupe mine complex, including hole DC3-ZPA-0010 returning 18.7 feet (5.7 meters) of 0.37 oz/t (12.8 g/t) gold and 30.6 oz/t (1,047.4 g/t) silver.

- New resource expansion intercepts from the northern portion of the Independencia mine complex, including hole VIDH_120 returning 30.5 feet (9.3 meters) of 0.05 oz/t (1.5 g/t) gold and 5.2 oz/t (179.0 g/t) silver.

- New resource expansion intercepts from the northeastern-most portion of the Independencia mine complex, including hole BVDH_039 returning 14.8 feet (4.5 meters) of 0.03 oz/t (1.1 g/t) gold and

4.8 oz/t (164.5 g/t) silver.

Coeur’s geologic team also expanded its footprint in the district by mapping and sampling exposures of new veins southwest and northeast of the two underground mining complexes as well as new veins west and east of the legacy open pit mine. Coeur expects to seek drill permits for several new areas in 2020 based on positive surface trace-element geochemistry and alteration results.

The Company plans to continue aggressively drilling resource expansion targets in several areas during 2020, including the southwest portion of the Guadalupe mine complex as well as the northern and northeastern portion of the Independencia mine complex, while stepping up exploration efforts across the remainder of the more than 66,700-acre (27,000-hectare) land package.

About Coeur

Coeur Mining, Inc. is a U.S.-based, well-diversified, growing precious metals producer with five wholly-owned operations: the Palmarejo gold-silver complex in Mexico, the Rochester silver-gold mine in Nevada, the Kensington gold mine in Alaska, the Wharf gold mine in South Dakota, and the Silvertip silver-zinc-lead mine in British Columbia. In addition, the Company has interests in several precious metals exploration projects throughout North America.

Cautionary Statements

This news release contains forward-looking statements within the meaning of securities legislation in the United States and Canada, including statements regarding exploration efforts and plans, exploration expenditures, timing of permitting, drill results, growth, extended mine lives, grade, thickness, investments, mine expansion and development plans, and resource delineation, expansion, and upgrade or conversion. Such forward-looking statements involve known and unknown risks, uncertainties and other factors which may cause Coeur’s actual results, performance or achievements to be materially different from any future results, performance or achievements expressed or implied by the forward-looking statements. Such factors include, among others, the risk that anticipated additions or upgrades to reserves and resources are not attained, the risk that planned drilling programs may be curtailed or canceled due to budget constraints or other reasons, the risks and hazards inherent in the mining business (including risks inherent in developing large-scale mining projects, environmental hazards, industrial accidents, weather or geologically related conditions), changes in the market prices of gold, silver, zinc and lead and a sustained lower price environment, the uncertainties inherent in Coeur’s production, exploratory and developmental activities, including risks relating to permitting and regulatory delays (including the impact of government shutdowns), ground conditions, grade variability, any future labor disputes or work stoppages, the uncertainties inherent in the estimation of mineral reserves, changes that could result from Coeur’s future acquisition of new mining properties or businesses, the loss of any third-party smelter to which Coeur markets its production, the effects of environmental and other governmental regulations, the risks inherent in the ownership or operation of or investment in mining properties or businesses in foreign countries, Coeur’s ability to raise additional financing necessary to conduct its business, make payments or refinance its debt, as well as other uncertainties and risk factors set out in filings made from time to time with the United States Securities and Exchange Commission, and the Canadian securities regulators, including, without limitation, Coeur’s most recent reports on Form 10-K or Form 10-Q. Actual results, developments and timetables could vary significantly from the estimates presented. Readers are cautioned not to put undue reliance on forward- looking statements. Coeur disclaims any intent or obligation to update publicly such forward-looking statements, whether as a result of new information, future events or otherwise. Additionally, Coeur undertakes no obligation to comment on analyses, expectations or statements made by third parties in respect of Coeur, its financial or operating results or its securities.

Christopher Pascoe, Coeur’s Director, Technical Services and a qualified person under Canadian National Instrument 43-101, approved the scientific and technical information concerning Coeur’s mineral projects in this news release. For a description of the key assumptions, parameters and methods used to estimate mineral reserves and resources, as well as data verification procedures and a general discussion of the extent to which the estimates may be affected by any known environmental, permitting, legal, title, taxation, socio-political, marketing or other relevant factors, Canadian investors should refer to the Technical Reports for each of Coeur’s properties as filed on SEDAR at www.sedar.com.

Notes

The potential quantity and grade for the deposits described herein are conceptual in nature. There is insufficient exploratory work to define a mineral resource and it is uncertain if further exploration will result in the applicable target being delineated as a mineral resource. Differences in drill thickness may result from rounding values.

- Guidance as published by Coeur on November 4, 2019.

- Based on the midpoint of guidance published by Coeur on November 4, 2019.

- https://www.coeur.com/_resources/presentations/2019-07-17-Silvertip-Site-Tour.pdf.

- https://www.coeur.com/_resources/presentations/2019-08-08-2QEarnings.pdf.

For Additional Information

Coeur Mining, Inc.

104 S. Michigan Avenue, Suite 900

Chicago, Illinois 60603

Attention: Paul DePartout, Director, Investor Relations

Phone: (312) 489-5800

www.coeur.com

Original Article: https://www.coeur.com/_resources/news/nr_20191217.pdf