Osisko Development Reports Third Quarter 2023 Results

Osisko Development Corp. is pleased to report its financial and operating results for the three months ended September 30, 2023.

Osisko Development Corp. is pleased to report its financial and operating results for the three months ended September 30, 2023.

“Our overall gold production increased 15% quarter-over-quarter while costs applicable to sales per ounce of gold declined by 13%, which led to a 38% increase in adjusted EBITDA,” said Mitchell J. Krebs, President and Chief Executive Officer. “This production growth was driven by an 87% increase at our Kensington gold operation in Alaska and a 16% increase in gold production at our Palmarejo gold-silver mine in northern Mexico.”

Darrell Rader, President & CEO of Minaurum, stated, “We are very pleased to have Ruben join the Board of Directors. Ruben is a top tier geologist and was highly regarded by his close friend and co-founder of Minaurum, David M. Jones. We look forward to applying his technical expertise to Minaurum’s exploration efforts in Mexico.”

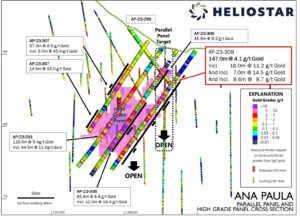

Heliostar CEO, Charles Funk, commented, “Ana Paula continues to outperform our expectations. The Company’s improved understanding of the gold mineralization led to the recent recognition of a new Parallel Panel only 50 metres north of the High Grade Panel. Today’s results are wide, with high-grade mineralization.”

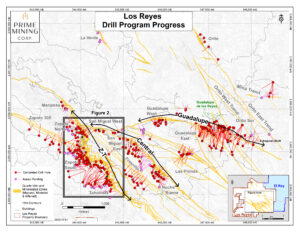

Prime Mining Corp. Chief Executive Officer Daniel Kunz commented, “The drill results released today continue to extend the high-grade plunge at the south-east end of the Z-T Area, known as Tahonitas. Today’s results, along with previously released holes in this area, have extended mineralization approximately 250m down-dip from the May 2023 resource pits. We are excited by how the mineralization in this area is developing and continue to drill Z-T as part of our success-based drill program.”

Jorge A. Ganoza, President and CEO, commented, “Fortuna has delivered record production and financial results for all its key metrics driven by the first full quarter contribution of our flagship Séguéla gold mine.” Mr. Ganoza continued, “Compared to the first half of the year, the reduction in our consolidated all-in sustaining cost to $1,312 is primarily the result of Séguéla’s industry leading AISC of $788 per ounce, abating inflation, optimization initiatives across the business, and higher gold production at the Yaramoko mine driven by new high grade zones.”

Mexico Mining Center © 2021 / All Rights Reserved