Gold $5,000 & Silver $100: Why the 2026 Milestone is Closer Than You Think

Advance Metals (ASX:AVM) – Further Ultra High Grade Antimony and Silver Results

Pinnacle Targets Multiple New Prospects at El Potrero & Outlines 2026 Plans | Pinnacle Silver & Gold

SILVER Has Broken Into ‘New Bull Era’ as Charts Go BALLISTIC

Fed Under Fire, Gold Explodes — The Bond Market Takes Over | Bill Fleckenstein

GOLD IS BREAKING: Why Miners Are Crushing the Metal

Silver Spruce Resources Inc. Announces Grant of Options

Pacifica Silver Announces Upsizing of Brokered Offering

Endeavour Silver Provides 2026 Guidance

Discovery Produces 66,718 Ounces of Gold in Fourth Quarter 2025

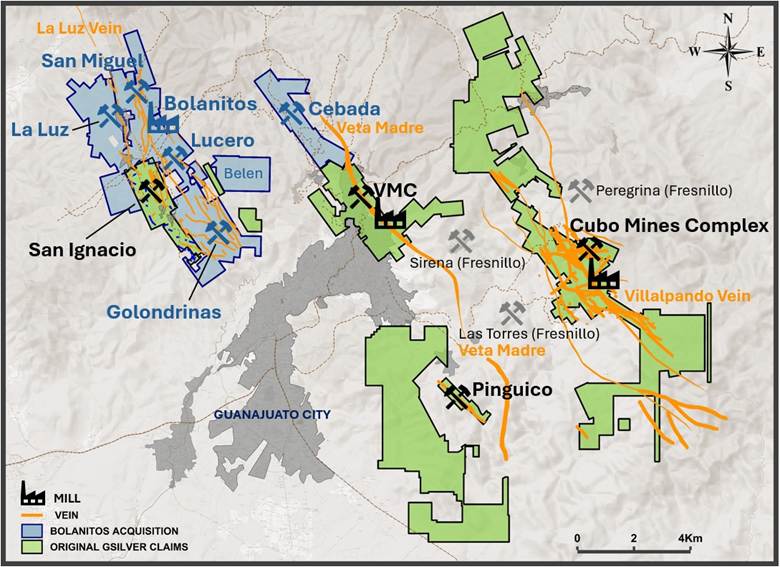

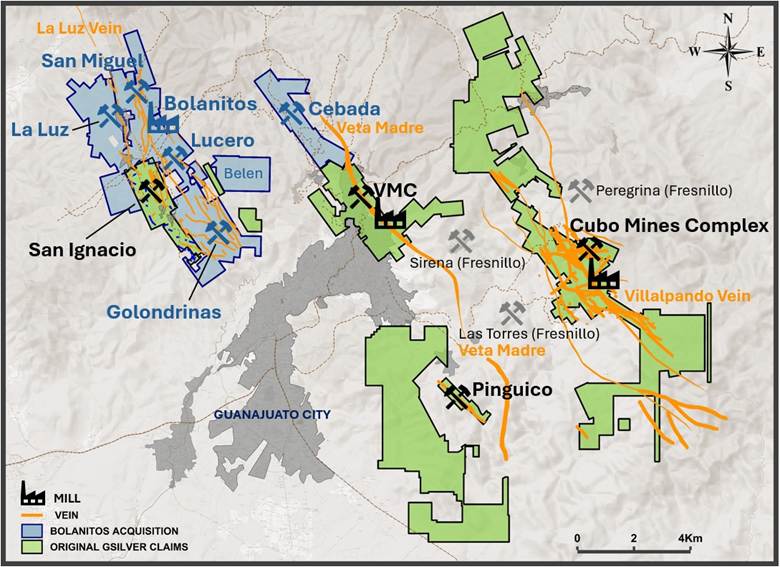

Guanajuato Silver Closes Acquisition of Bolanitos Gold-Silver Mine

Endeavour Silver Completes Sale of Bolañitos Mine

Pacifica Silver Announces $10 Million Brokered Financing

Guanajuato Silver Closes Acquisition of Bolanitos Gold-Silver Mine

Guanajuato Silver closed its acquisition of the Bolanitos gold-silver mine from Endeavour Silver on January 15, 2026, for up to US$50M (US$40M upfront + US$10M contingent). The mine, adjacent to GSilver’s San Ignacio, includes a 1,600 tpd plant and marks GSilver’s fifth producing asset in Mexico.

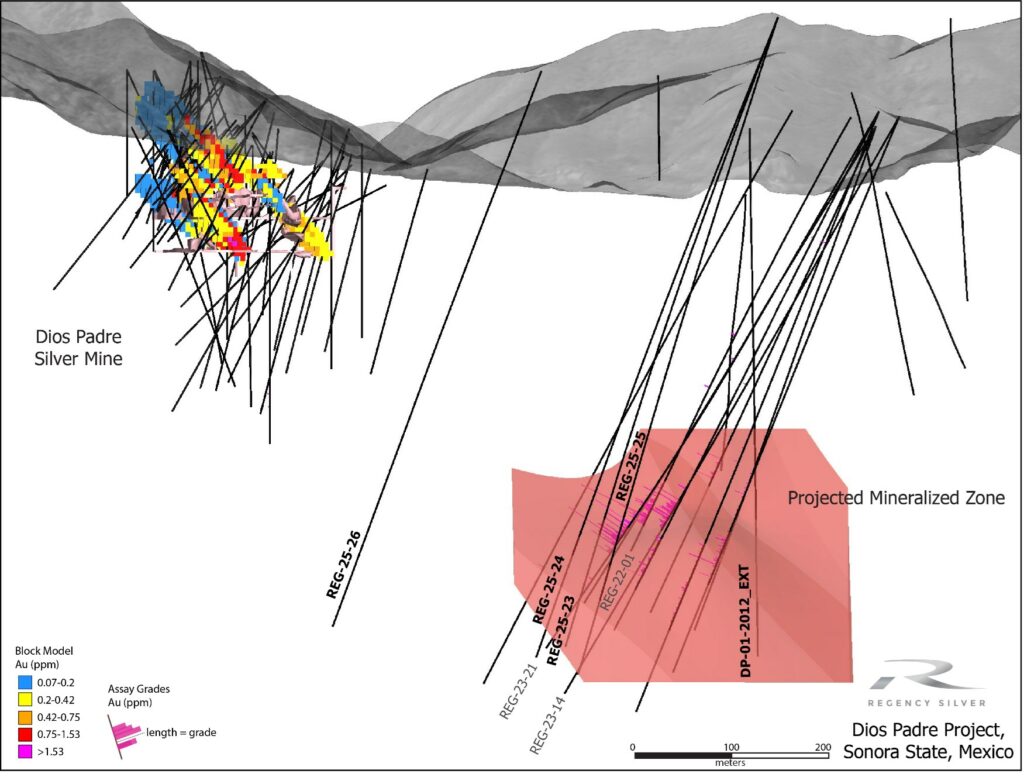

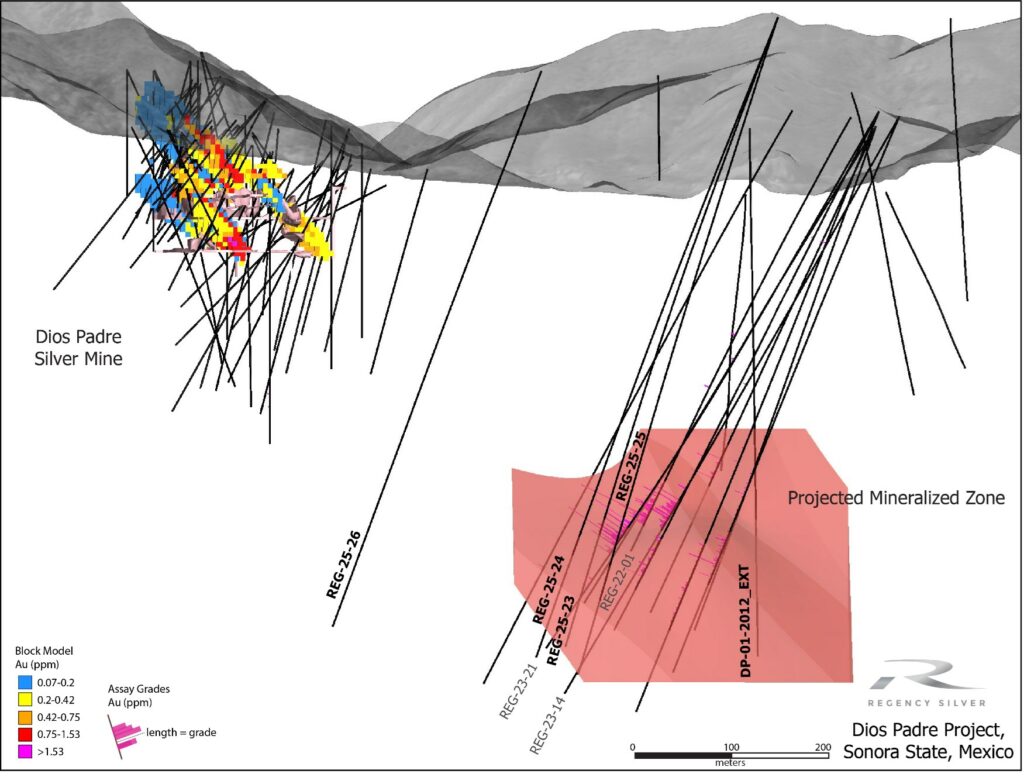

Regency Silver Commences 2026 Drill Program at Dios Padre Targeting Broad Zones of Sulphide-Specularite Bearing Breccia as Follow Up to Hole REG 25-26

Regency Silver Corp. (TSXV: RSMX, OTCQB: RSMXF) has commenced its 2026 drill program at the Dios Padre project in Sonora, Mexico. It targets broad sulphide-specularite bearing breccia zones as follow-up to hole REG-25-26 (~240m non-continuous mineralized interval, assays pending). Initial focus: minimum 4 holes (500-650m each) near REG-25-26, including REG-25-27 (50m above strongest zone), to test dip, strike, and expand the high-grade gold-copper-silver discovery.

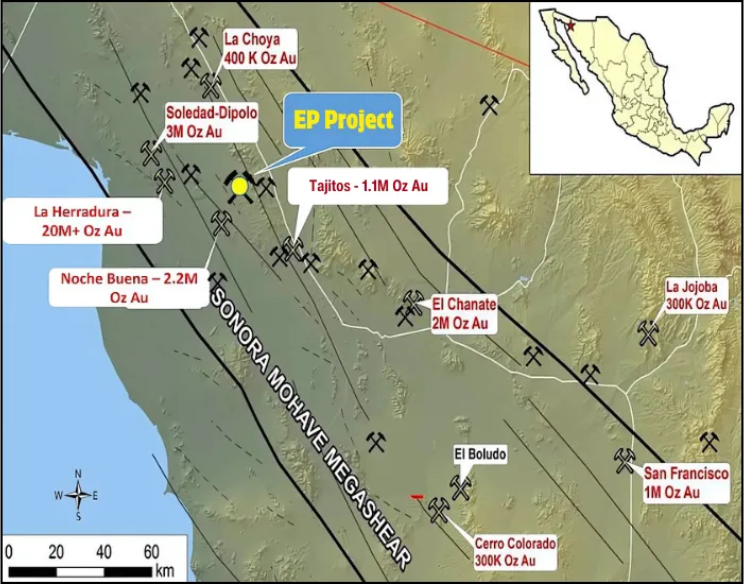

Colibri Resource Advances First-Pass Drill Program at San Perfecto and Priority Targets, EP Gold Project, Sonora, Mexico, Within a Region Hosting Projects Operated by Fresnillo plc, Agnico Eagle, Osisko Development, Minera Alamos, and Aztec Minerals

Colibri Resource Corporation (TSXV: CBI) resumed RC drilling at its EP Gold Project in Sonora, Mexico, completing 11 holes (906m) at San Perfecto and Banco de Oro targets. Assays expected early February 2026; additional 6-10 holes planned for priority targets in this prospective region.

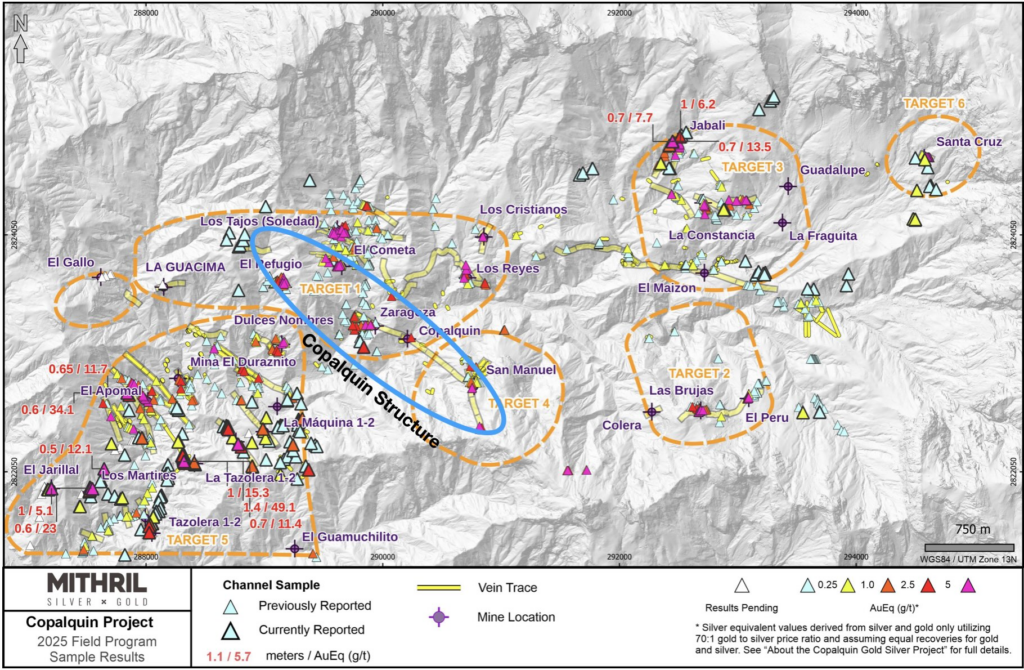

Mithril Silver & Gold Kicks Off Maiden Drill Programme At Target 3, In The Multi-Target Copalquin Gold-Silver District

Mithril Silver & Gold Limited has commenced its maiden 3,300-metre drill program at Target 3 in the Copalquin gold-silver district, Durango, Mexico. This forms part of a planned 25,000m district-wide campaign in H1 2026, testing mineralization continuity near high-grade El Jabali historic workings (up to 16 g/t Au and 1,275 g/t Ag).

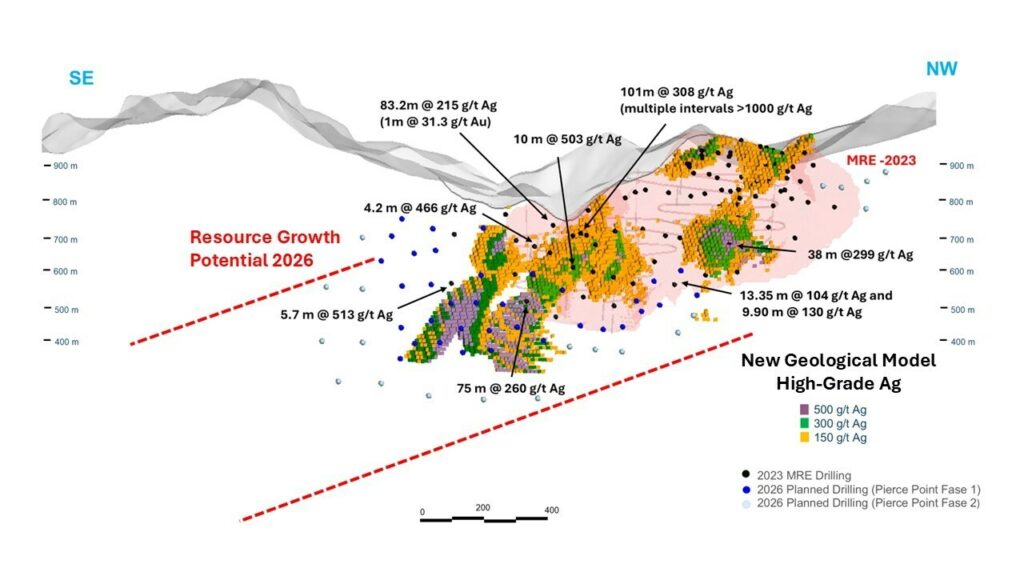

GR Silver Provides 2026 Guidance Including Drilling and Project Advancement Plans

GR Silver Mining outlined its 2026 plans to accelerate exploration, drilling, and project development at its San Marcial and Plomosas areas in Sinaloa, Mexico, targeting resource growth and advancement. The company aims to expand high-grade zones and progress key project milestones through systematic drilling, aiming to add value and move toward potential future development.

Algo Grande Engages AI-Metals to Advance AI-Driven Integration Across Adelita Data; Reinforces Target Framework from Prior Geophysical Programs

Algo Grande Copper Corp. has engaged AI-Metals for a 12-month AI-driven program to reprocess and integrate geological, geochemical, and geophysical data at its 100%-owned Adelita Copper-Gold-Silver Project in Sonora, Mexico. This reinforces a large skarn-porphyry system, supporting 32 high-priority targets and upcoming Phase 2 exploration in Q1-Q2 2026.

Silver Storm Commences 6,000 Metre Drilling Campaign at La Parrilla Silver Mine Complex

Silver Storm Mining Ltd. has begun a 6,000-metre underground drilling program at its 100% owned La Parrilla Silver Mine Complex in Durango, Mexico. The campaign targets step-out and infill drilling at Quebradillas, San Marcos, and Rosarios to grow resources and support development toward a potential restart of operations in 2026. Follow-up drilling and surface exploration are also planned.

Vizsla Silver Reports Additional HIgh Grade Intercepts at Copala with Geotechnical Drilling

Vizsla Silver announced additional high-grade intercepts from geotechnical drilling at the Copala area of the Panuco silver-gold project, Mexico. Key results include 1,800 g/t AgEq over 3.80m true width (incl. 3,833 g/t over 0.93m) and 840 g/t AgEq over 6.50m true width. These dual-purpose holes confirm strong mineral continuity and support upcoming engineering studies.

Questcorp and Riverside Make New Gold Discovery in Initial Drill Results from Luis Hill and Famosa Targets at Union Project, Sonora, Mexico

Questcorp Mining and Riverside Resources announce a new Carlin-like gold discovery at the Luis Hill target on the Union Project, Sonora, Mexico. Initial drilling hit 42.7m @ 0.286 g/t Au in black shales and carbonates. Famosa Mine area returned 1.85m @ 0.345 g/t Au. Phase I completed 12 holes (1,625m); assays pending for other targets. Follow-up drilling planned for 2026.

Mercado Minerals Announces Initiation of Inaugural Field Exploration Program at Copalito

Mercado Minerals Ltd. has begun its first field exploration at the Copalito Project in Sinaloa, Mexico, including mapping, prospecting, re-sampling historic core, re-logging, and refining drill targets. The company aims to start a ~3000 m Phase 1 diamond drill program in Q1 2026 and will verify historical data while advancing logistics for drilling.

Kingsmen Drills a New Discovery of High Grade Silver Mineralization: 3.15 Meters Grading 241 g/t Ag/Eq Including 525 g/t Ag/Eq with 0.185 g/t Gold over 1.15 Meters

Kingsmen Resources reported a new high-grade silver discovery at its Las Coloradas project in Chihuahua, Mexico. Drill hole LC-25-004 intersected 241 g/t silver equivalent over 3.15 m, including 525 g/t AgEq over 1.15 m, from a shallow depth (~70 m), with additional anomalous gold and strong mineralization suggesting further discovery potential and plans for more 2026 drilling.

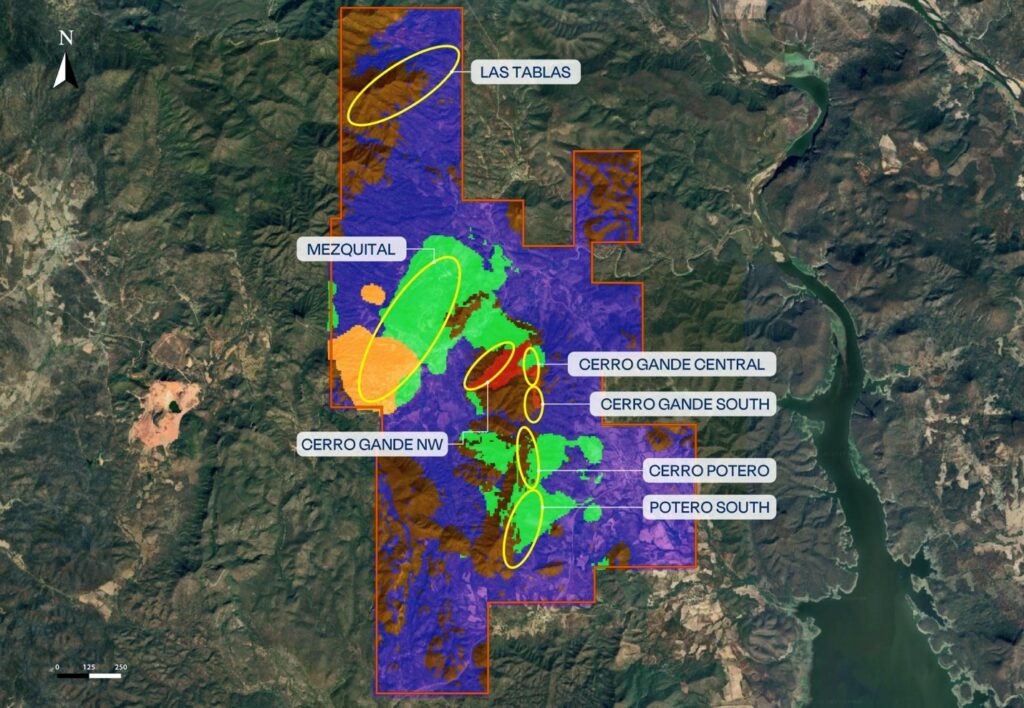

Pinnacle Provides Progress Update for El Potrero Gold-Silver Project

Pinnacle Silver and Gold reports strong progress at its El Potrero gold-silver project in Durango, Mexico after acquiring up to 100 % of the property. In 2025 it established a large, high-grade epithermal system, completed extensive sampling and geological work, advanced metallurgy and permitting, and now plans underground and surface drilling in 2026 to advance toward production.

Luca Drills 55.8 Metres of 5.90 g/t AuEq at Campo Morado – Confirms Near-Mine High-Grade Mineralization and Expands Exploration Program

Luca Mining Corp. reported strong drill results at Campo Morado, including 55.8 m of 5.90 g/t AuEq (with 7.7 m of 10.09 g/t) in hole CMRF25-15, confirming wider, higher-grade gold-rich mineralization near infrastructure. The company has expanded the program, adding a second rig and 10,000 m of drilling to test high-priority targets.

Silver Spruce Resources Inc. Announces Closing of $976,000 Non-Brokered Private Placement

Silver Spruce Resources Inc. closed a non-brokered private placement, issuing 976,000 units at $0.10 for $976,000 gross proceeds. Each unit includes one common share and one warrant exercisable at $0.15 for three years. The company also issued 224,400 finder warrants and will use net proceeds for exploration and working capital.

Silver Spruce Resources Inc. Announces Grant of Options

Silver Spruce Resources Inc. granted 2,100,000 stock options to directors, officers, employees, and consultants under its stock option plan. Each option lets the holder buy one common share at $0.30 for five years from the grant date, supporting long-term team alignment and company growth.

Pacifica Silver Announces Upsizing of Brokered Offering

Pacifica Silver Corp. increased its brokered private placement to raise up to C$20,010,000 by issuing 13.8 million common shares at C$1.45, with an agent option for an extra 15%. Net proceeds will support exploration and drilling at its Claudia Project in Durango, Mexico, plus working capital and general corporate purposes. The offering is expected to close around January 23, 2026.

Endeavour Silver Provides 2026 Guidance

Endeavour Silver issued 2026 guidance: 8.3–8.9M oz silver, 46–48K oz gold, 14.6–15.6M oz AgEq. Consolidated cash costs $12–$13/oz Ag (net), AISC $27–$28/oz. Total capex $157.8M; exploration $25.9M. Terronera drives strong gold output and low costs.

Discovery Produces 66,718 Ounces of Gold in Fourth Quarter 2025

Discovery Silver Corp. announced that its Porcupine operations produced 66,718 ounces of gold in Q4 2025, up 6% from the prior quarter due to higher grades and throughput. Post-acquisition (April 2025), total output reached 180,424 ounces, with full-year 2025 production at 234,702 ounces.

DynaResource Announces Preliminary Full Year 2025 Operating Results and 2026 Guidance

DynaResource reported preliminary 2025 results from its San Jose de Gracia Mine, producing 21,393 ounces of gold and completing processing plant optimizations with Falcon gravity units. For 2026 guidance, it forecasts 22,000–24,000 ounces of gold production with cash costs of $1,400–$1,600/oz and AISC of $2,400–$2,600/oz, plus planned $1M–$2M exploration.

Endeavour Silver Completes Sale of Bolañitos Mine

Endeavour Silver completed the sale of its Bolañitos silver-gold mine in Mexico to Guanajuato Silver on January 15, 2026, for US$40M upfront (US$30M cash + US$10M shares) plus up to US$10M contingent on production milestones. The move supports Endeavour’s focus on core silver assets.

Pacifica Silver Announces $10 Million Brokered Financing

Pacifica Silver Corp. entered a brokered private placement offering of 6.9 million common shares at C$1.45, aiming to raise about C$10 million (with a 15% agents’ option). The net proceeds will fund exploration and drilling at the Claudia Project in Durango, Mexico, and support general corporate and working capital needs. Closing is expected around January 23, 2026, subject to approvals.

Mobile View

Guanajuato Silver Closes Acquisition of Bolanitos Gold-Silver Mine

Guanajuato Silver closed its acquisition of the Bolanitos gold-silver mine from Endeavour Silver on January 15, 2026, for up to US$50M (US$40M upfront + US$10M contingent). The mine, adjacent to GSilver’s San Ignacio, includes a 1,600 tpd plant and marks GSilver’s fifth producing asset in Mexico.

Regency Silver Commences 2026 Drill Program at Dios Padre Targeting Broad Zones of Sulphide-Specularite Bearing Breccia as Follow Up to Hole REG 25-26

Regency Silver Corp. (TSXV: RSMX, OTCQB: RSMXF) has commenced its 2026 drill program at the Dios Padre project in Sonora, Mexico. It targets broad sulphide-specularite bearing breccia zones as follow-up to hole REG-25-26 (~240m non-continuous mineralized interval, assays pending). Initial focus: minimum 4 holes (500-650m each) near REG-25-26, including REG-25-27 (50m above strongest zone), to test dip, strike, and expand the high-grade gold-copper-silver discovery.

Colibri Resource Advances First-Pass Drill Program at San Perfecto and Priority Targets, EP Gold Project, Sonora, Mexico, Within a Region Hosting Projects Operated by Fresnillo plc, Agnico Eagle, Osisko Development, Minera Alamos, and Aztec Minerals

Colibri Resource Corporation (TSXV: CBI) resumed RC drilling at its EP Gold Project in Sonora, Mexico, completing 11 holes (906m) at San Perfecto and Banco de Oro targets. Assays expected early February 2026; additional 6-10 holes planned for priority targets in this prospective region.

Mithril Silver & Gold Kicks Off Maiden Drill Programme At Target 3, In The Multi-Target Copalquin Gold-Silver District

Mithril Silver & Gold Limited has commenced its maiden 3,300-metre drill program at Target 3 in the Copalquin gold-silver district, Durango, Mexico. This forms part of a planned 25,000m district-wide campaign in H1 2026, testing mineralization continuity near high-grade El Jabali historic workings (up to 16 g/t Au and 1,275 g/t Ag).

GR Silver Provides 2026 Guidance Including Drilling and Project Advancement Plans

GR Silver Mining outlined its 2026 plans to accelerate exploration, drilling, and project development at its San Marcial and Plomosas areas in Sinaloa, Mexico, targeting resource growth and advancement. The company aims to expand high-grade zones and progress key project milestones through systematic drilling, aiming to add value and move toward potential future development.

Algo Grande Engages AI-Metals to Advance AI-Driven Integration Across Adelita Data; Reinforces Target Framework from Prior Geophysical Programs

Algo Grande Copper Corp. has engaged AI-Metals for a 12-month AI-driven program to reprocess and integrate geological, geochemical, and geophysical data at its 100%-owned Adelita Copper-Gold-Silver Project in Sonora, Mexico. This reinforces a large skarn-porphyry system, supporting 32 high-priority targets and upcoming Phase 2 exploration in Q1-Q2 2026.

Silver Spruce Resources Inc. Announces Closing of $976,000 Non-Brokered Private Placement

Silver Spruce Resources Inc. closed a non-brokered private placement, issuing 976,000 units at $0.10 for $976,000 gross proceeds. Each unit includes one common share and one warrant exercisable at $0.15 for three years. The company also issued 224,400 finder warrants and will use net proceeds for exploration and working capital.

Silver Spruce Resources Inc. Announces Grant of Options

Silver Spruce Resources Inc. granted 2,100,000 stock options to directors, officers, employees, and consultants under its stock option plan. Each option lets the holder buy one common share at $0.30 for five years from the grant date, supporting long-term team alignment and company growth.

Pacifica Silver Announces Upsizing of Brokered Offering

Pacifica Silver Corp. increased its brokered private placement to raise up to C$20,010,000 by issuing 13.8 million common shares at C$1.45, with an agent option for an extra 15%. Net proceeds will support exploration and drilling at its Claudia Project in Durango, Mexico, plus working capital and general corporate purposes. The offering is expected to close around January 23, 2026.

Endeavour Silver Provides 2026 Guidance

Endeavour Silver issued 2026 guidance: 8.3–8.9M oz silver, 46–48K oz gold, 14.6–15.6M oz AgEq. Consolidated cash costs $12–$13/oz Ag (net), AISC $27–$28/oz. Total capex $157.8M; exploration $25.9M. Terronera drives strong gold output and low costs.

Gold $5,000 & Silver $100: Why the 2026 Milestone is Closer Than You Think

Advance Metals (ASX:AVM) – Further Ultra High Grade Antimony and Silver Results

Pinnacle Targets Multiple New Prospects at El Potrero & Outlines 2026 Plans | Pinnacle Silver & Gold

SILVER Has Broken Into ‘New Bull Era’ as Charts Go BALLISTIC

Fed Under Fire, Gold Explodes — The Bond Market Takes Over | Bill Fleckenstein

GOLD IS BREAKING: Why Miners Are Crushing the Metal

Our company BYLSA DRILLING provides drilling services in a variety of environments, ranging from typical exploration sites to extreme topographic conditions, always with the highest quality and safety standards.